Summary

Is India’s bull run balancing on a tightrope? With earnings yield near historic lows and valuations priced for perfection, the risk of disappointment is high. Discover why global peers may offer better risk reward setups and what this means for your portfolio in our latest Netra.

‘Earnings yield’ is a simple yet powerful valuation metric.

As the inverse of the P/E (Price-to-Earnings) ratio, it tells you how much a company (or even an entire index) earns relative to its market price. In other words, it reflects the returns generated for every unit of currency you invest.

Right now, India’s earnings yield (taking the NSE 500 universe as the reference) is around 4.1%. To put that in perspective, this places it in the 96th percentile of historical observations (excluding the unusual COVID years). And this suggests that Indian equities are trading at valuations far above their long-term averages.

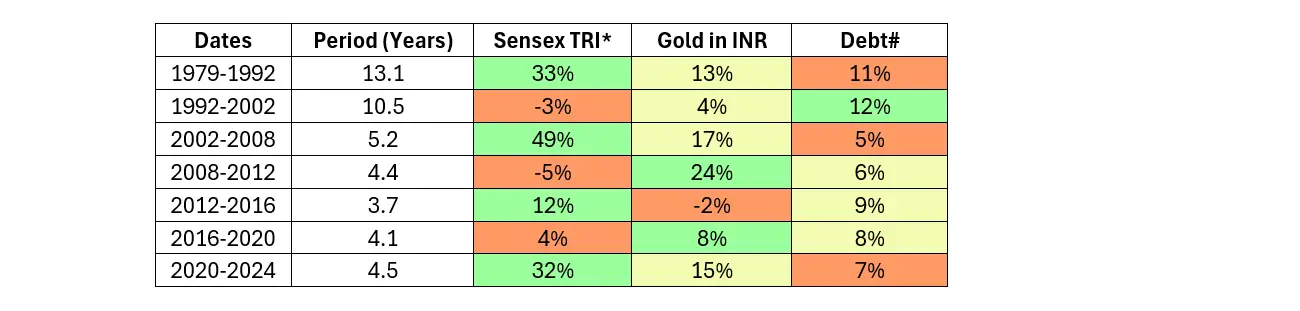

(Source: Bloomberg, DSP. Data as of July 2025. Green highlights indicate when the current P/E is below the 20-year average.)*

Supporters of these high valuations might point to India’s relatively strong return on equity (ROE). At present, India’s ROE is roughly 15%, which is certainly robust. Nevertheless, the combination of a low earnings yield and premium valuations probably means the market is already pricing in a lot of optimism.

So investors should keep in mind that if earnings growth slows down even modestly, valuations could revert to more reasonable levels.

For context, valuations are about expectations. A low earnings yield suggests that investors are paying a high price for each rupee of earnings, which is often justified when growth prospects are exceptional. But the higher the price you pay, the more vulnerable you are to disappointment.

Interestingly, as the above table indicates, several global markets today (such as Mexico, Vietnam, and Brazil) offer a more balanced profile: strong ROEs alongside more reasonable valuations. These present potentially better risk–reward opportunities than India’s current setup.

While this need not mean that Indian equities are doomed to underperform, it does mean that Indian investors need to tread carefully and focus on high-quality businesses.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of June 2025 and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment