Summary

What if the numbers aren’t telling the story you think? Indian companies look profitable, yet their returns are oddly muted. The rupee sits at record lows, flashing silent warnings. And while global IT rides hype, India’s tech giants may be the overlooked opportunity. Netra September unpacks the signals investors can’t afford to miss.

Welcome to the September 2025 edition of Netra, where we present data-driven market insights that can inform your investing decisions.

This month, we’ll talk about Indian companies’ low ROE, why a weaker rupee should be taken seriously, and how Indian IT giants might be an emerging opportunity.

India’s ROE puzzle

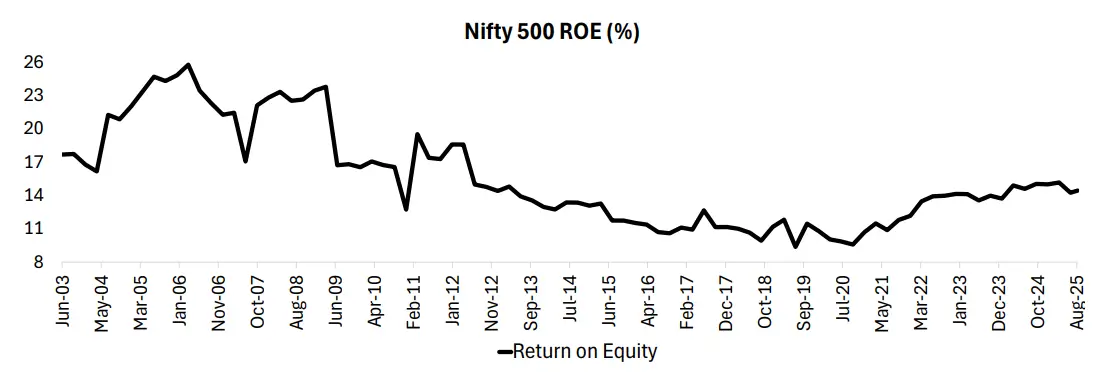

Back in 2003–07, Indian companies were on fire: they consistently delivered 20-25% ROE (return on equity). Post-Covid, we’ve seen a similar boom with strong topline growth, peak margins, and rising profits.

But here’s the puzzle: if the environment looks just as good, why is the ROE stuck at ~15% instead of 20%+?

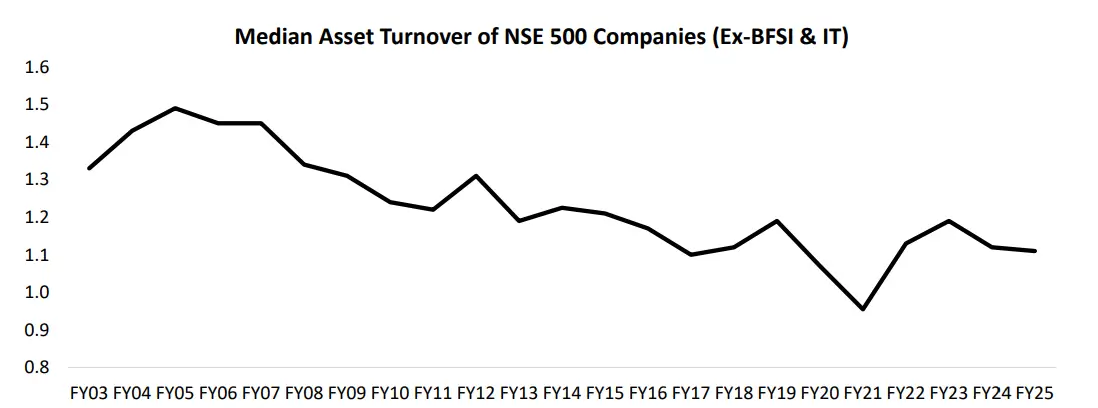

One reason is that the asset turnover, a measure of how efficiently a company uses its assets to generate sales, has declined.

In the earlier upcycle, every ₹100 of assets generated about ₹150 of sales. Today, that’s down to just ₹120–130, as you can see below.

Source: Capitaline, DSP, Data as of Aug 2025. Nifty 500 current constituents used.

At the same time, companies are running with lower debt, which inflates the equity base and drags down ROE. Add to that slower nominal growth and tougher competition, and profitability feels harder to sustain.

So while 15% ROE sounds healthy, it’s clearly below the highs of the past. For returns to rise, companies will need stronger demand growth, which will give them the confidence to take on more leverage. Unless that happens, this cycle might not deliver the same punch.

India’s FX Reserves: A Proxy For External Troubles?

If you’re an equities investor, your mistakes can remain hidden for a while: overpay for equities and an irrational market might still float you up. Even in bonds, if you buy the wrong duration, you can still hold to maturity and collect coupons.

So errors in stocks and bonds can often be managed by staying conservative.

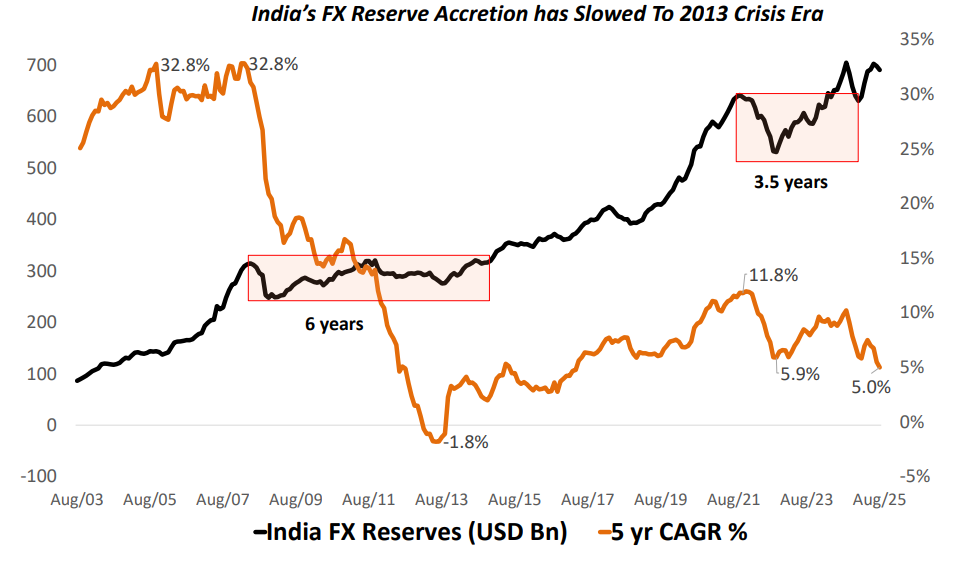

Currencies are different. Ignoring a lifetime low is a serious mistake.

Why? Because when a currency hits a new lifetime low, it does so despite the relevant central bank’s efforts to prevent this. That’s a red flag.

Today, the rupee is at record lows against the dollar, even though the US Dollar Index itself isn’t that strong. India’s FX reserve accretion has also slowed down, as can be seen below. That’s a signal: stay alert, as a spillover effect could hit bonds and stocks too.

Source: CMIE, DSP. Data as of August 2025

Large-Cap IT: An Emerging Relative Opportunity?

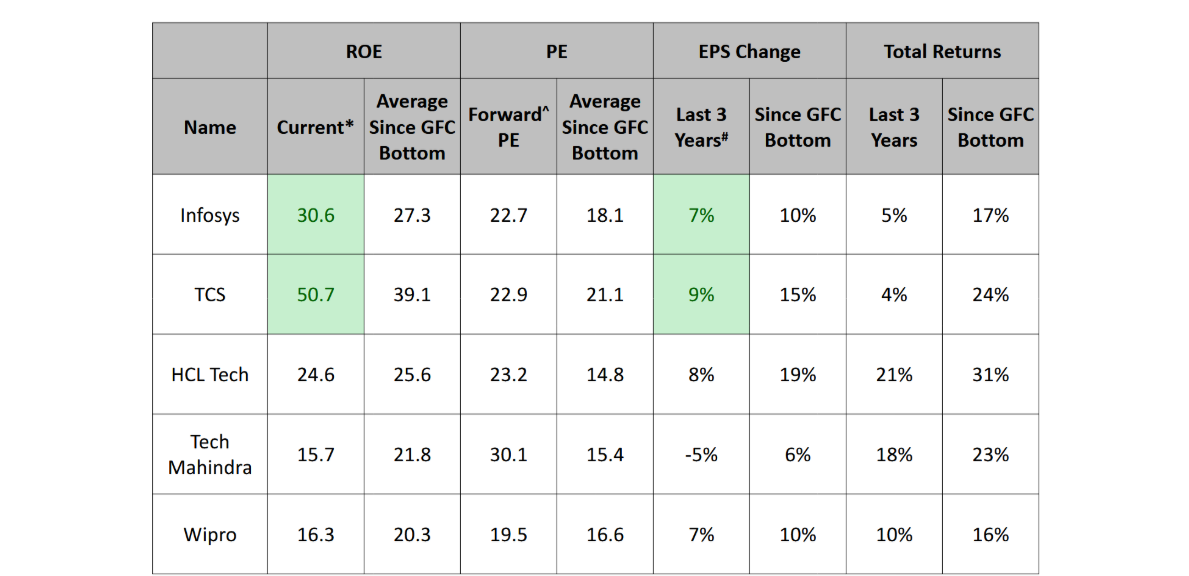

Global IT looks overheated, but Indian IT firms seem to be in a better spot. Over the past three years, large-cap IT stocks like Infosys and TCS have corrected meaningfully, even as their fundamentals have remained solid. The current ROEs for many of these companies are at or above long-term averages, and valuations have returned closer to historical norms.

Interestingly, the earnings growth for industry leaders has outpaced shareholder returns, showing a clear de-rating.

Source: Capitaline, DSP, Data as on Aug 2025. GFC Bottom is considered as March 2009. Green highlight is where Current ROE is higher than Average since GFC Bottom. ^1 Year Forward PE Considered. #Green highlight means EPS growth was higher than Total returns of that Stock. Total returns includes Dividends.*

The main reason for this disconnect is the absence of “AI froth” in Indian IT giants. Unlike their global peers, these giants haven’t ridden the hype wave; instead, they’ve focused on enabling Generative AI and maintaining strong Total Contract Value (TCV) pipelines.

At current levels, IT is a relative play. But if prices fall further, it could become an absolute one.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of June 2025 and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment