Summary

This blog talks about India’s heavy reliance on crude oil imports makes it vulnerable to global oil price surges, especially amid declining foreign institutional investment (FII) in equities. With FIIs reaching a 12-year low, foreign flows are crucial for economic stability, underscoring FIIs’ importance beyond market impact as key macroeconomic supports.

India is an oil-guzzler: in 2023, it was the third-biggest importer of crude oil (after China and the US). And this dependence on imported crude oil has long been a problem for India.

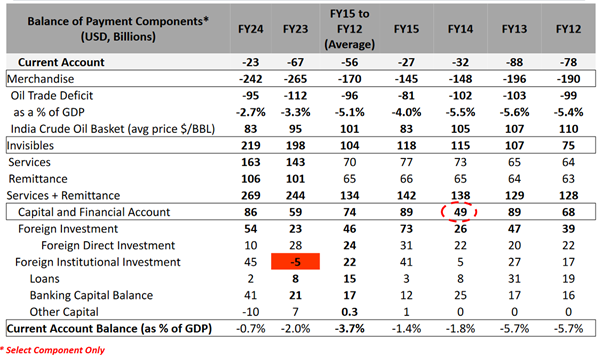

Whenever crude oil prices rise past $100, the money India spends on importing oil causes its merchandise trade deficit to balloon. However, over the last decade, a stellar rise in net flows from services and remittances has made this ‘oil problem’ more manageable. As can be seen in the table below, even with crude oil at $100 per barrel, services and remittances are mostly able to cover India’s merchandise deficit.

Source: DSP. Data as of Oct 2024

This, however, does not eliminate India’s vulnerability as far as the Balance of Payments (BOP) is concerned. In those years when India has faced an oil shock, foreign inflows have typically come to its aid. Whether it was the $34 billion FCNR (Foreign Currency Non-Resident) deposit scheme in September 2013 or large loan raises in FY13, FY18, and FY19, foreign capital has often played a crucial role in helping India manage potential BOP crises.

The flip side of this is that in those years when India’s financial and capital accounts (which record international capital transfers and asset flows) are unable to cover the deficit in its current account (which records the inflow and outflow of goods and services), a currency threat looms over the country, and the RBI has to step in.

What this means is that if a sharp increase in oil prices were to happen at the same time as large-scale FII sell-offs, then India’s BOP could deteriorate rapidly. In light of this, foreign flows, especially the more volatile FII equity flows, should be viewed not merely as drivers of stock prices but also as key supports for macroeconomic stability.

A major FII sell-off is currently underway, with FII ownership of Indian equities recently hitting a 12-year low. In addition, India’s dependence on crude oil imports rose marginally in 2023-24 (87.7%, up from 87.4% in the previous year). Thus, any unexpected global oil disruptions at this point could have especially painful consequences for the Indian economy.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of July 2024 (unless otherwise specified) and are subject to change without notice. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment