Summary

Oil once ruled the world. Now, AI is the new liquid gold. Billions are pouring in at breakneck speed, rivaling history’s wildest booms. But is this progress? Or a bubble waiting to burst? Discover what today’s AI capex frenzy means for investors below.

Around ten years ago, the global economy was obsessed with oil.

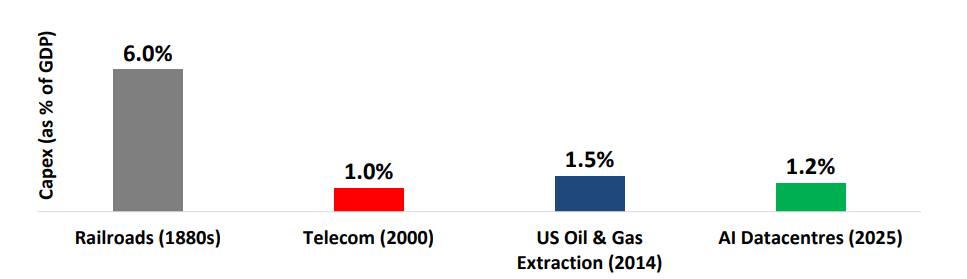

In 2014, capital expenditure (capex) on oil and gas infrastructure was nearly 1% of the world's GDP. In the US alone, oil and gas extraction reached 1.5% of GDP: a spending frenzy that rivaled the dot-com boom.

Today, that obsession has shifted dramatically to AI. We're witnessing an unprecedented wave of investment in that sector, with tech giants at the forefront.

This AI-related capex already exceeds the peak of the dot-com telecom bubble. At around 1.2% of GDP**, this spending is now equivalent to 20% of the 19th-century railroad investment frenzy, one of the most extreme buildouts in history. And the pace of this new wave is breathtaking.

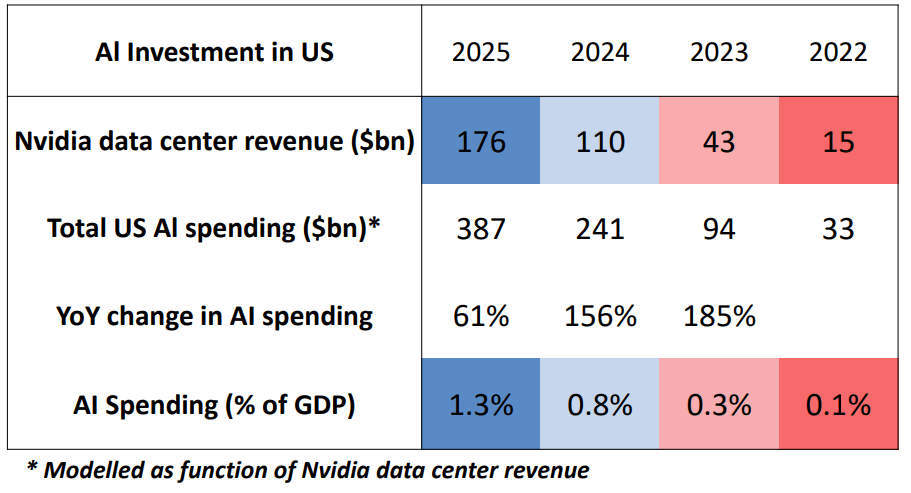

Consider this: Nvidia, a key player in this buildout, has seen its revenue skyrocket fivefold in just three years to $150 billion1. Such growth represents a staggering 70% CAGR.

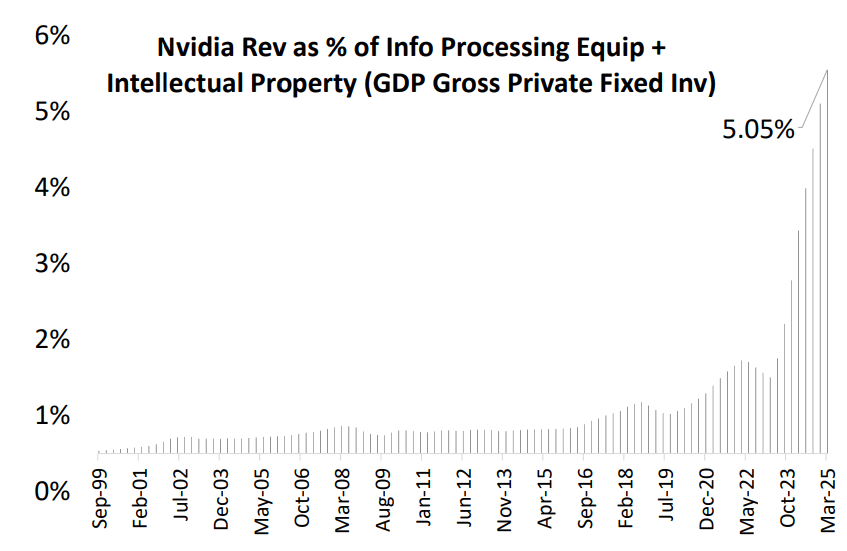

Nvidia alone now accounts for 5% of all US information-processing equipment and IP investment1. This is an incredible achievement: even the likes of Cisco couldn’t boast of something so impressive at the peak of the dot-com boom in 2000.

This is also a clear sign that this is more than just hype; instead, it's a massive, concentrated reallocation of capital.

While the long-term impacts of AI are still unfolding, this capex wave is unique. Unlike previous booms driven by broad-based economic returns, this boom is fueled by a handful of ultra-profitable firms.

And thus, the scale and concentration of this capex warrant a healthy dose of caution.

Why? Because even in the most promising technological revolutions, the biggest risks often emerge from the highest valuations.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

** Source: Bloomberg, Paul Kedrosky, Jens Nordvig, DSP. Data as of July 2025.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of June 2025 and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment