Summary

Think equities always win in the long run? History says otherwise. From 2008 to 2012, debt and even gold outshone stocks. The culprit: high valuations and blind optimism. Read our latest Netra to uncover why timing matters more than you think and how to avoid painful investing mistakes.

Large and quick profits.... are sufficient to dull the public’s critical faculty, just as they sharpen its acquisitive instinct.

Market upcycles are followed by downcycles.

History repeatedly vindicates this claim, and perhaps you think it’s an obvious truth.

And yet, when you're right in the middle of a ferocious bull run, it's easy to fall prey to the “This-Time-Is-Different” syndrome, which convinces you that somehow, this time, the ticker will simply keep going up indefinitely.

Such wishful thinking often leads investors to buy most heavily during the most expensive phase of the cycle.

Sure, over the long term, equities can appear attractive due to the underlying growth potential of businesses. But the reality is that many investors end up earning returns that are lower than those of other asset classes, or fail to beat inflation.

In fact, even achieving mid-single-digit real returns over the long run is more difficult than commonly assumed. We tend to forget this in every bull cycle, only to get a rude reminder during a downcycle.

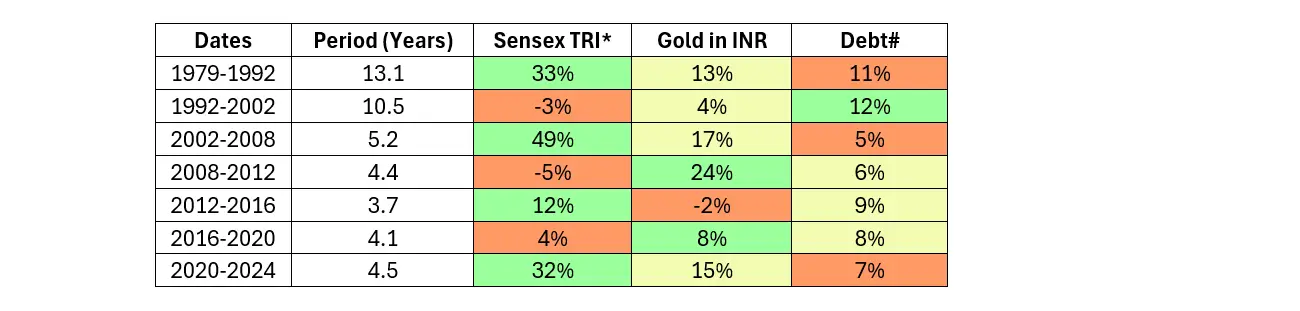

Consider the table below:

Source: Bloomberg, National Savings Institute, DSP. Data as of July 2025.

- Prior to 1996 Sensex TRI is calculated assuming 1.5% dividend yield. #For Debt since 2002 Crisil Composite bond Index is considered and prior to that 5 year national savings rate is considered.

Notice that somebody who invested in a Sensex-tracking index in 2008 would’ve faced four rather painful years in the red (with an absolute return of -5%). During that period, even debt would’ve delivered much better returns (6% absolute returns), to say nothing of gold (24% absolute returns).

Indeed, the table above makes it clear that equities can underperform for extended periods, and that entry timing significantly affects outcomes.

And this flies in the face of a common belief: that timing doesn’t matter because equities always outperform in the long run.

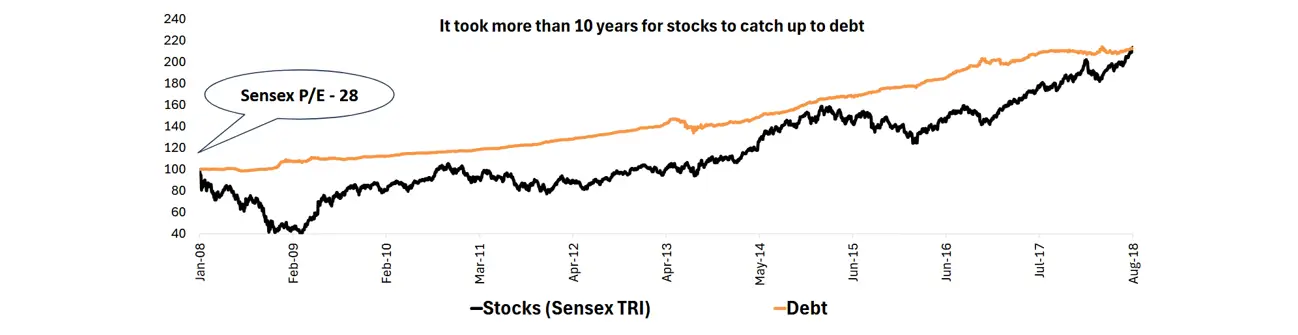

While Indian equities have indeed beaten debt over the very long term, returns have varied widely based on when you invested. There have been several prolonged phases, like the early 1990s and 2008–18 (shown below), where equities lagged behind debt.

Source: Bloomberg, National Savings Institute, DSP. Data as of July 2025. For Debt since 2002 Crisil Composite bond Index is considered.

The common thread among such phases? High starting valuations and excessive optimism.

When stocks are priced for perfection, even slight disappointments can lead to sharp corrections, making other asset classes the better performer.

And now that you’re aware of these blind spots, you have a better chance of avoiding them in your own investing journey.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of June 2025 and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment