Summary

Subtle shifts in asset roles, growth dynamics, and expectations suggest a closer look may be warranted. This month, we examine three areas where familiar narratives meet historical data: gold’s role across rolling periods, the realities of long-term economic growth, and the gap between index targets and eventual market outcomes. Together, these snapshots help frame how assumptions shift over time, often away from headline moves.

Gold: Familiar comfort, uneven outcomes

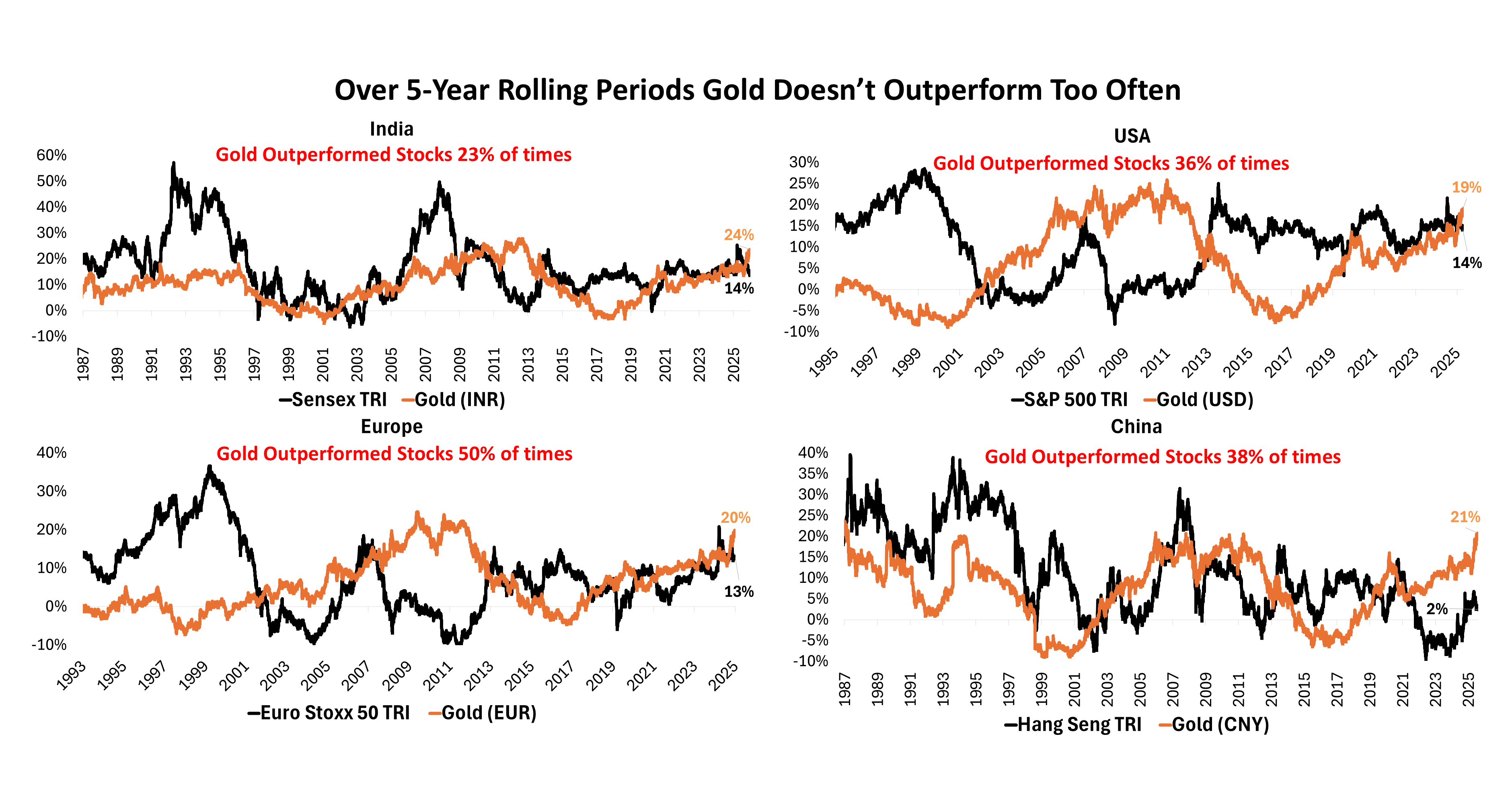

Gold has long occupied a familiar place in investor portfolios. It is often viewed as a hedge: something that balances risk when markets become uncertain. But when we step back and look at longer holding periods, the picture becomes more mixed.

Across rolling five-year periods, gold has not consistently outperformed equities. In India, gold has delivered higher returns than equities in less than a quarter of such periods. Even in developed markets, where gold is often seen as a more established diversifier, the outcome has varied meaningfully across cycles.

This does not diminish gold’s role in a portfolio. Instead, it reframes it. Gold behaves differently depending on timeframes and market conditions. For investors, especially those early in their journey, the insight is simple: diversification is about balance, not guarantees. For more experienced investors, it is a reminder that long-term outcomes are shaped as much by patience as by asset choice.

Source: Bloomberg, DSP. Data as of Dec 2025. Prior to 1996 Sensex TRI is calculated assuming 1.5% dividend yield. Prior to 2004 Hang Seng TRI is calculated assuming 3% dividend yield

From assets to ambition: how growth really compounds

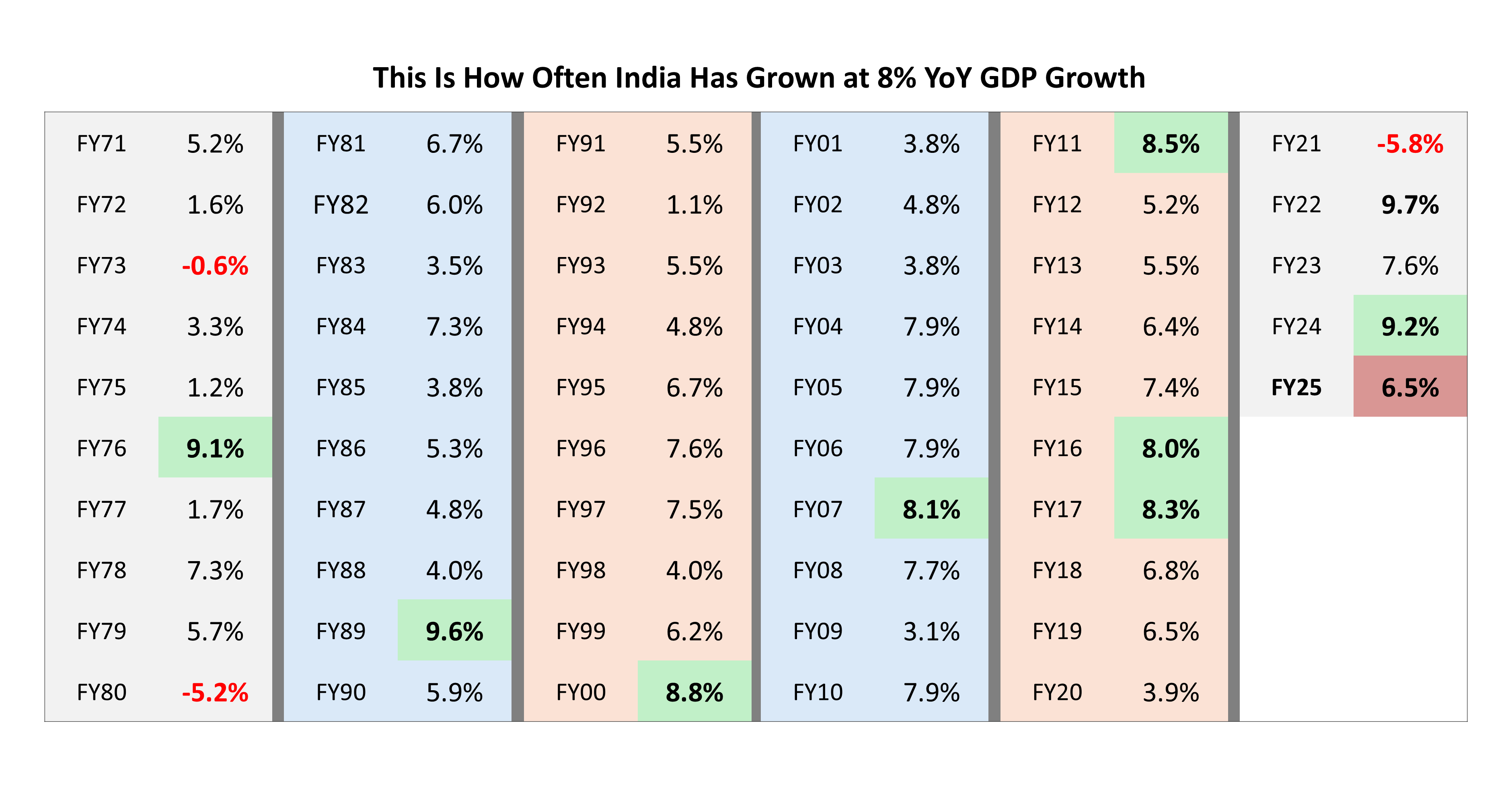

If asset behaviour reminds us that outcomes are uneven, economic growth tells a similar story.

India’s long-term growth ambition is often discussed in round numbers and distant milestones. But historical data shows that sustaining high nominal GDP growth over long periods has been the exception rather than the rule. Growth has moved in phases - periods of acceleration followed by moderation, rather than along a smooth upward path.

This matters because long-term projections are highly sensitive to assumptions. Small changes in growth rates, when compounded over decades, can materially alter outcomes. For investors, the takeaway is not about questioning ambition, but about recognising variability. Economic progress unfolds over time, shaped by cycles, policy, and global conditions and not in straight lines.

Understanding this variability helps ground expectations, particularly when markets attempt to price in long-term narratives too quickly.

Source: CMIE, DSP; Data as on Dec 2025

Targets and reality: a moving reference point

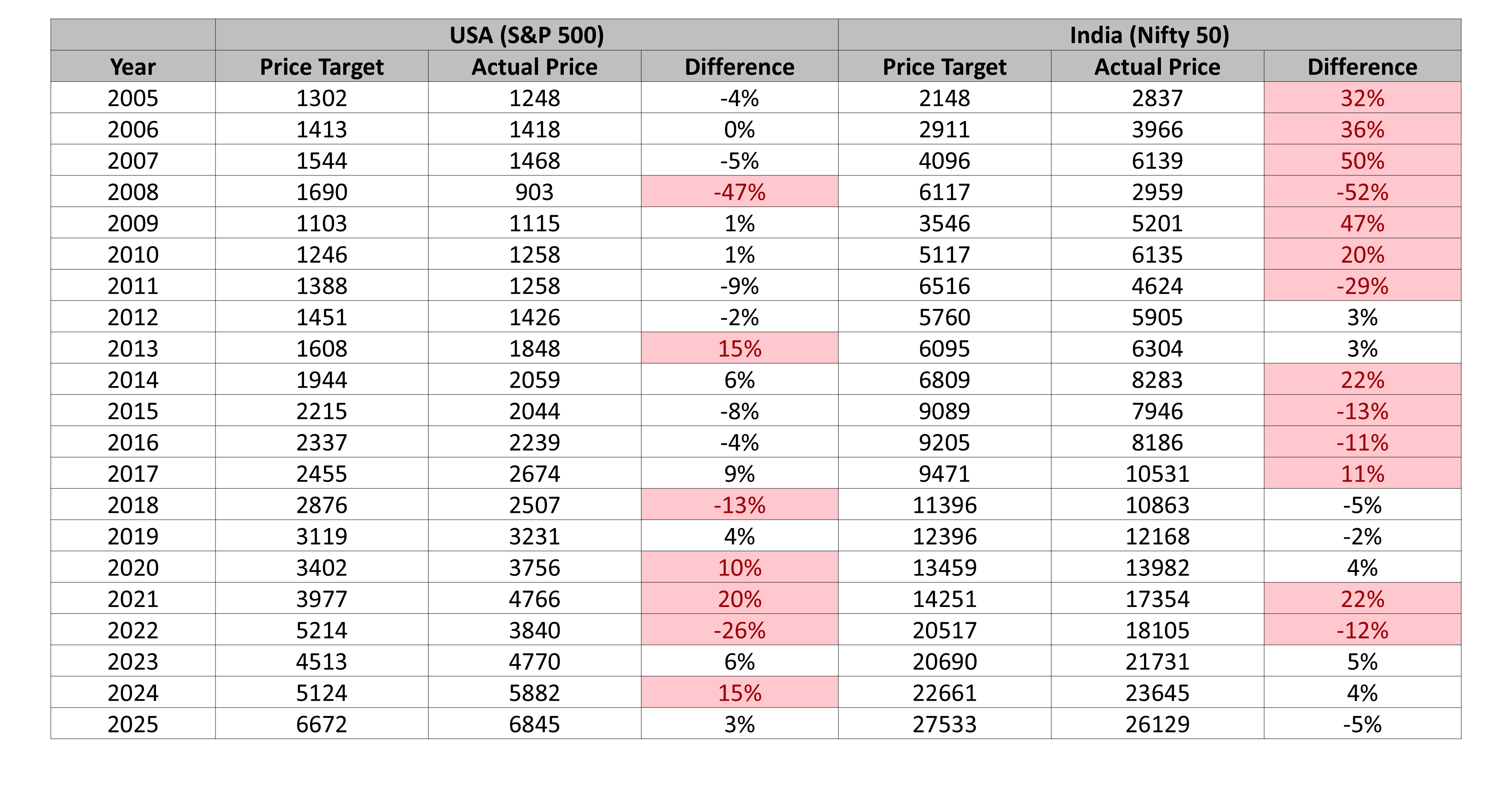

Market targets are often treated as signposts for the year ahead. Yet history suggests they shift far more frequently than markets themselves.

Over the past two decades, both Indian and global equity indices have often ended the year meaningfully above or below where forecasts began. These changes reflect evolving data, policy shifts, and market surprises: factors that cannot be fully anticipated at the start of the year.

The lesson here is not that targets lack value, but that they are reference points, not roadmaps. For newer investors, this reinforces the importance of staying invested rather than anchored to a number. For seasoned investors, it underscores why discipline and process tend to matter more than forecast accuracy.

Markets adjust continuously. Expectations, by necessity, follow.

Source: Bloomberg, DSP. Data as of Dec 2025. Price Targets are Bloomberg Estimated Price Target for that year. Red Highlight are where the difference between Price Target and Actual Price is more than +/- 10%

Taken together, these three views point to a common theme - not acceleration, but adjustment. Asset roles evolve, growth unfolds unevenly, and expectations recalibrate over time.

As 2026 approaches, the more useful question may not be where markets go next, but whether the narratives investors rely on are keeping pace with how conditions are changing.

In a market shaped by gradual shifts rather than abrupt turns, staying thoughtful about assumptions may prove just as important as responding to outcomes.

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Write a comment