Summary

If you saw four performance records, you’d pick the best one. Except they all belong to Warren Buffett. Past performance seduces us into false confidence. This blog unpacks why chasing recent winners rarely works and how to choose funds with a process, not luck.

Let’s say you are planning to invest your money with a professional money manager. You have four options to choose from and the following are their performance compared to benchmark.

- A underperformed by 15% in the last 1 year

- B underperformed by 25% in the last 3 years

- C outperformed by 14% in the last 5 years

- D underperformed in 33% of the years since 1980

Which of them would you choose?

At first glance, most of us would probably choose option C.

But here’s the twist.

All four are the same person – and the money manager is Warren E. Buffett

Why do most of us prefer option C?

Because we humans are wired to extrapolate. We look for patterns and use them to predict the future. And while doing so, we tend to give more weight to recent events.

If it had been sunny for a few days, we believe it will stay sunny.

If a restaurant served bad food the last time, we believe it will be bad again.

If a coin lands on heads six times in a row, we subconsciously expect a seventh.

We apply the same thinking in investing as well. The combination of extrapolation and recency bias makes us chase funds that have done exceedingly well in the recent past, hoping the trend will continue.

But does this approach work?

Let’s put it to test.

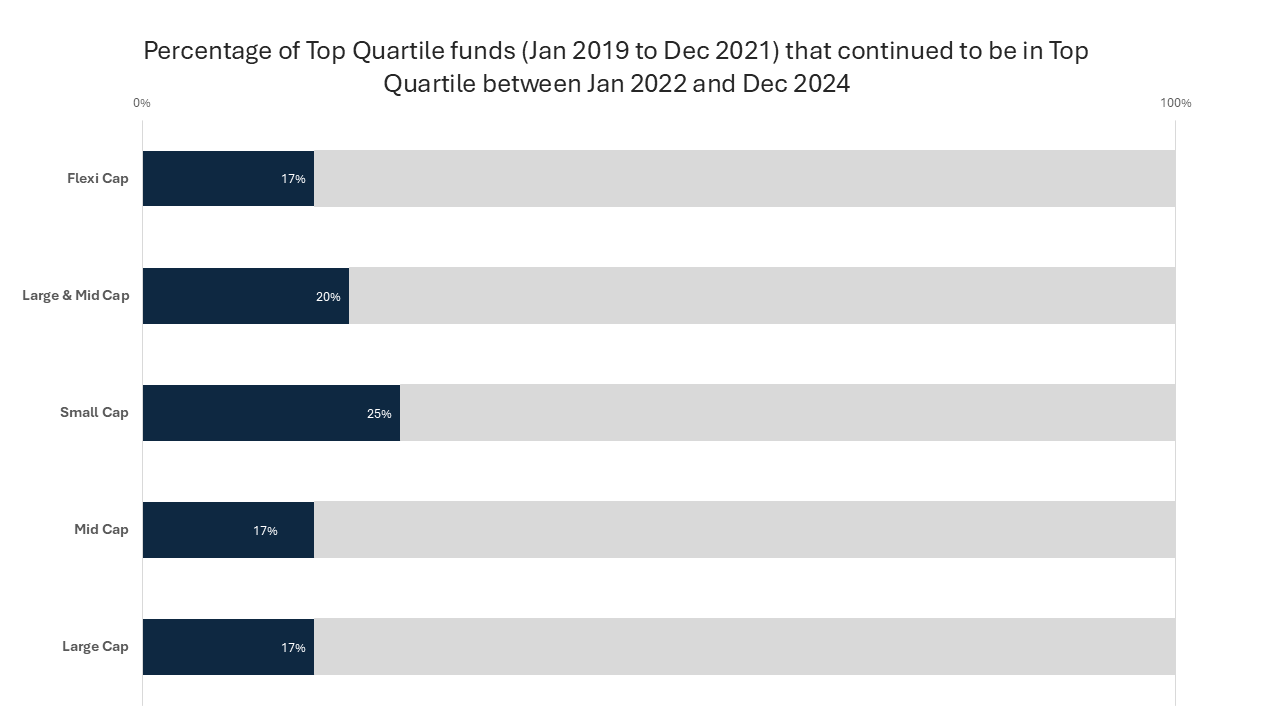

Consider the top quartile funds (i.e. funds featuring in the top 25%) during the period Jan 2019 to Dec 2021. How many of them remained in the top quartile in the next 3 years (i.e. from Jan 2022 to Dec 2024)?

Conventional wisdom would suggest that most top performers should have continued in top quartile.

But in reality, barely 15-25% of the schemes remained in the top quartile.

Source: DSP MF. NAV data sourced from MFI Explorer.

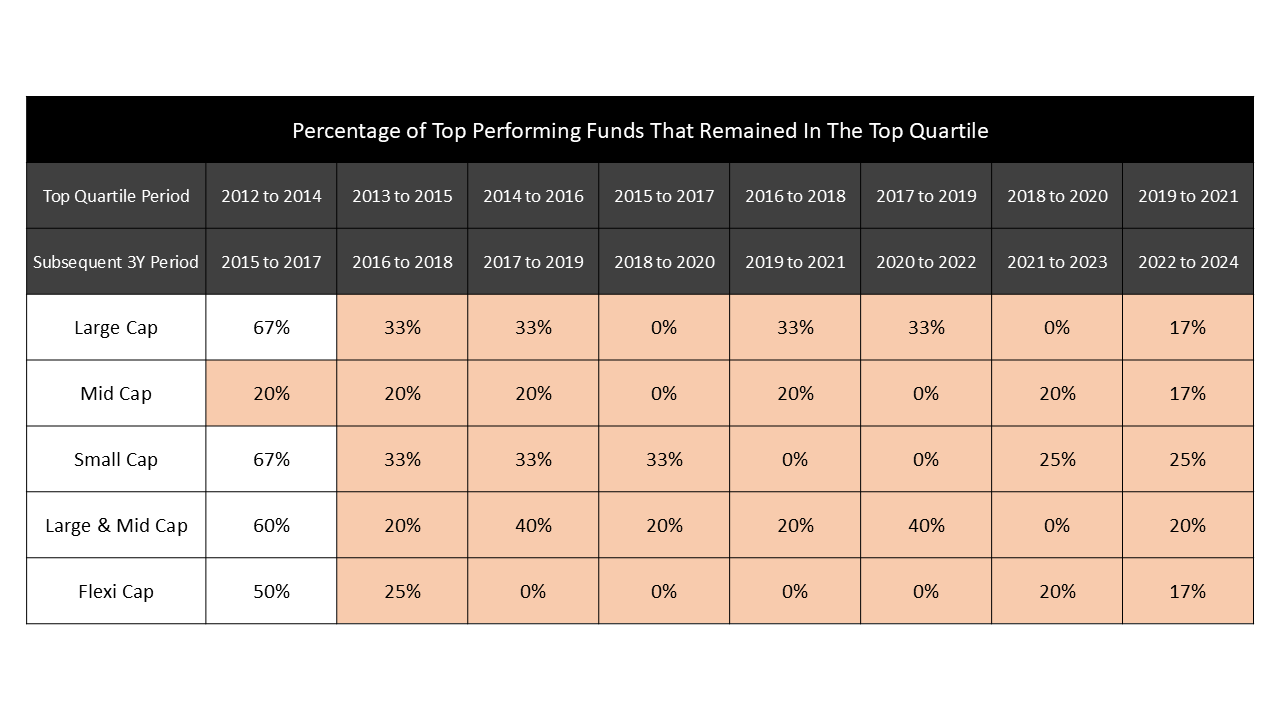

And this isn’t an anomaly. The results are similar when this exercise is extended to different 3 year periods over the last decade.

Source: DSP MF. NAV data sourced from MFI Explorer. Cells highlighted in light red indicate phases where majority of the funds slipped in the quartile rankings.

How to read the table? 67% (first data point on top left) of the top quartile large cap funds (based on 3 year returns) continued to remain in the top quartile in the next 3 years.

Top performing funds have largely struggled to retain the top spot.

Our odds of successfully picking a future top performer based on past performance can be as low as 0%.

Does this mean past performance should not be considered at all?

Absolutely not.

Past performance is a useful metric. However, it needs to be used with the understanding that all funds / fund managers (including us) go through performance cycles. Periods of outperformance are almost always followed by periods of underperformance. This is true even for legendary investors such as Warren Buffett (as seen above).

Let’s understand why this happens.

Equity market returns are predominantly driven by three different factors:

- Earnings Growth

- Change in Valuation (P/E)

- Dividend Yield

In the long run, equity returns tend to follow earnings growth. But businesses go through cycles affecting margins and profits. Valuations tend to mean revert. Dividends, being a function of profit and profit growth, can also get affected when times are tough. Short-term news flow, market sentiment, liquidity changes can also add to distortions.

Given this, investment styles and sectors keep moving in and out of favour. And predicting them with accuracy is next to impossible.

Underperformance, especially in the short term, is inevitable. And this can sometimes last months and even years.

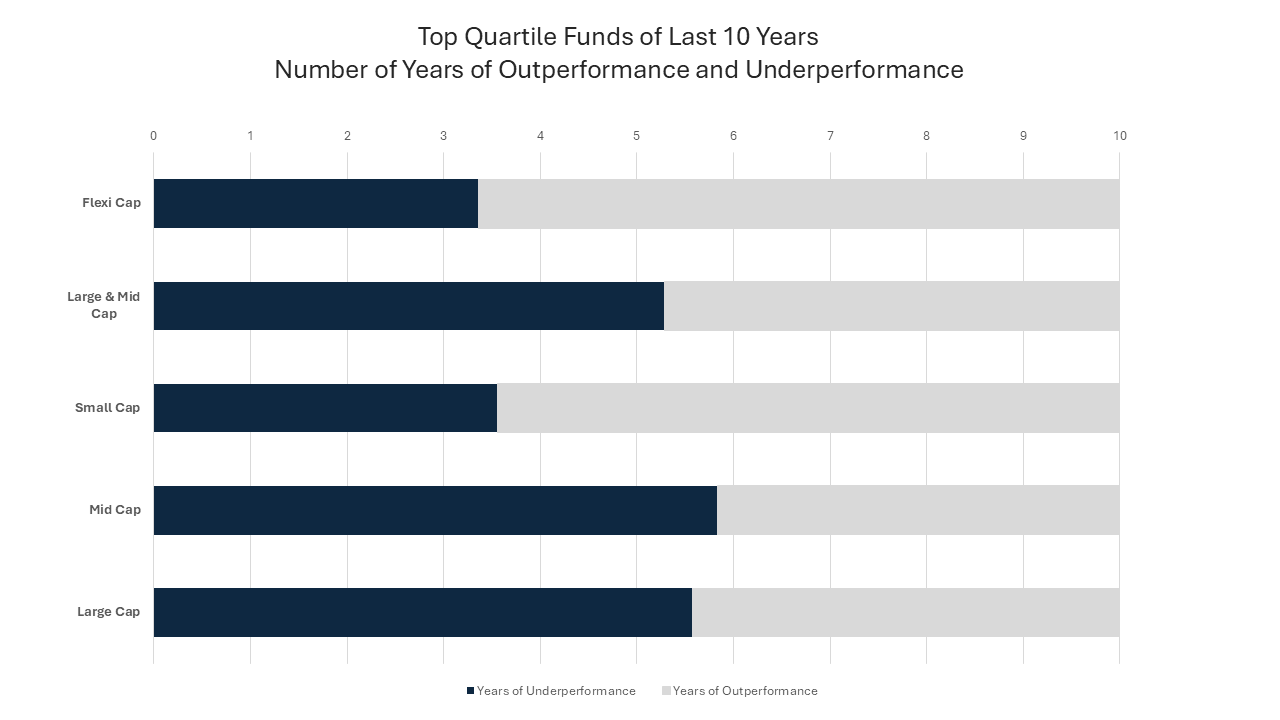

Here is some data to put this in perspective. The top performing funds of last 10 years have underperformed their benchmark in at least 3 to 5 years on average.

Source: DSP MF. NAV data sourced from MFI Explorer. Average number of years of underperformance / outperformance of top quartile funds are shown above.

Hence the need for a sound fund selection process that looks beyond past performance.

So, how should one go about choosing funds?

As predicting future top performers is next to impossible, the goal should be to build a reasonable checklist which can improve our chances of selecting better funds.

A sample checklist can be as follows

- Investment Style & Strategy – Is there a robust, logical, repeatable investment process with a stated investment policy? Is it being consistently applied even when the investment style is not in favour?

- Performance Consistency vs Benchmark – Has the fund consistently beaten the benchmark over different rolling periods (especially when the investment style is in favour)?

- Performance Consistency vs Peers – Has it consistently been in the top two quartiles (especially compared to funds following a similar style)

- Downside Protection – Has it fallen lesser than the benchmark / peers during market corrections?

- Past track record of the fund manager – Especially relevant if he/she has been managing the fund for less than 5-7 years

- Other Checks

- Portfolio Turnover – Extremely High churn may signal lack of conviction

- Liquidity – Can holdings be liquidated without incurring price impact?

- Active Share – Low value may mean that the fund is mimicking the benchmark

- AUM – Both too low and too high values come with their own challenges

- Expense Ratio – Lower the better

- AMC Strength – Prefer fund houses with experienced team and transparent practices

Beware of setting unrealistic return expectations

As discussed earlier, valuation changes cannot be relied upon to deliver +ve impact over long term.

Therefore, as a base case, our return expectation should always be kept in line with earnings growth expectation from the underlying businesses. Superior stock selection coupled with luck may add alpha to this.

Parting Thoughts

Past performance is a fact, but the best time to benefit from it is already in the past.

Fund selection should be based on a comprehensive set of returns, risk and other qualitative metrics. If this feels overwhelming, the alternative would be to take the help of an advisor who can evaluate these for us or opt for simple, plain vanilla index fund.

Subscribe to DSPIM #InvestForGood Blog

Investment Insights, Evidence & Stories that matter

Read over 600,000 times

Written by

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment