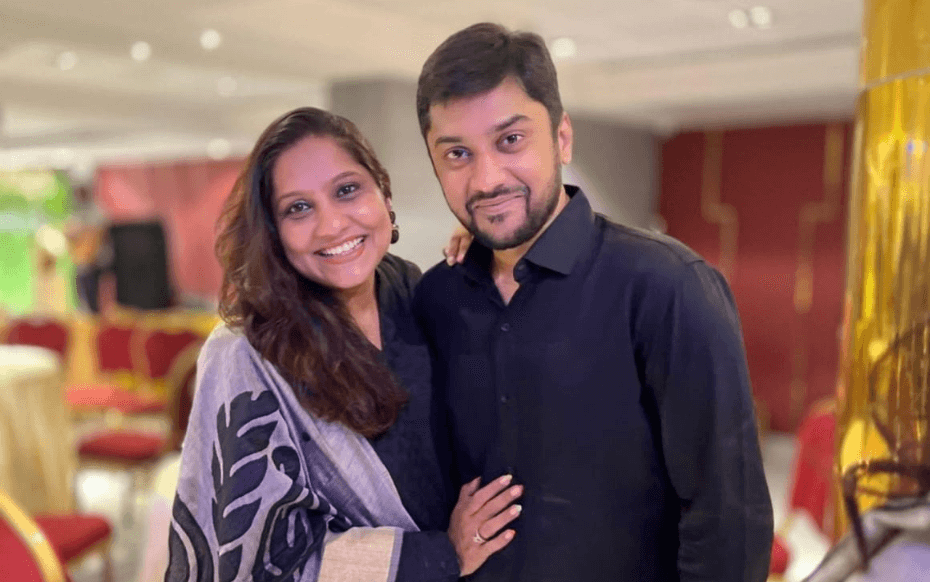

Summary

Welcome to the latest installment of Investor Stories, a blog series that lifts the curtain on how real people handle their finances. We aim to showcase journeys that highlight the mindset, habits, and strategies you need to achieve financial satisfaction, all without any jargon or complicated formulas!

Money management is much more than just numbers on a spreadsheet: it’s a reflection of the life you want to build and the people you want to protect.

I was just 21 when I started out in the world of entrepreneurship. No fancy funding, no big investors, no backup plan. Just me, and the support of my family, who were counting on me. Every rupee mattered. Every decision carried weight.

Over time, I built something I’m proud of: a business that not only survived, but thrived. In the early years, it gave me returns as high as 18%. It gave me things I couldn’t have imagined when I was younger: a home in Malabar Hill, a strong sense of confidence, and the satisfaction of knowing I’d done it all on my own.

Back then, my business wasn’t just my livelihood: it was my identity. I never thought about diversifying. Why would I? My own hard work was giving me better returns than any mutual fund could.

When Life Made Me Rethink

But life changes you. Marriage, fatherhood… they shift your perspective in ways you don’t expect.

My wife works in the mutual fund industry, and she would often nudge me to think beyond the business. I didn’t take this idea very seriously, to be honest.

Until one afternoon during the COVID lockdown. Over a casual cup of tea, she asked me:

“What if something happens to you? The business is just you. Will it really take care of us if you’re not around?”

These words hit me hard. Not because I was scared of death, but because I hadn’t thought about continuity. About legacy. About what would happen if I wasn’t there to keep the machine running.

That conversation changed me. It wasn’t about chasing higher returns anymore. It was about creating peace of mind.

From Business-Only to Balanced

I still love my business, and still give it my all. But now, I make sure my money is working outside of it too.

Here’s how my portfolio looks today:

- Bonds for steady low-risk returns

- Mutual funds for long-term compounding

- A Sukanya Samriddhi Account for my daughter’s future

- And a simple emergency fund, because life is unpredictable.

I’m not the kind of person who obsesses over market timing. I don’t read stock tips all day.

My rule is simple:

“If you have a surplus, just invest. Don’t overthink it. Don’t delay. Just let it grow.”

As a businessman, I don’t always find SIPs easy. Cash flows go up and down, and priorities shift. But whenever the business does well, I make it a point to put something aside. Not for today, not even for a specific goal, but just for the future in general.

Sometimes, that money might go towards my daughter’s education. Sometimes, towards my retirement. Or maybe even another dream down the line. The exact purpose may differ, but the direction is set.

What I’d Ask You

If you’re reading this, I’d ask you to think about this honestly: are you relying on just one engine to power your financial plans? Have you had that uncomfortable but necessary conversation with your family?

For me, diversification wasn’t about chasing higher returns. It was about maturity. About balance. About letting go of the need to control everything.

Smart investing, I’ve learned, isn’t only about money. It’s about the people you love, and the future you want to create for them.

From one bet to many… that’s when real wealth begins.

We hope the stories in this series help you reflect on your financial journey, and give you the confidence to chart your own course, one decision at a time.

We’d also love to hear what parts of Pinal Shah’s journey resonated with you: let us know in the comments!

Also Read:

Money Isn’t the Goal. Freedom Is.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India. The asset allocation shared is for informational purposes only and not to be construed as investment advice. Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. The investment approach / framework/ strategy mentioned herein are currently followed by the scheme and the same may change in future depending on market conditions and other factors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment