Summary

Most people invest what feels comfortable, not what their future truly needs. This piece helps you flip that script starting with your life goals, calculating your real SIP needs, and adjusting your spending accordingly. Think of it as pricing your dreams monthly, because your future deserves more than leftovers.

Hey,

Let’s have a heart-to-heart about something we often dodge: how much should you actually be investing every month? Not the number that feels cozy. Not the number that lets you still splurge on Swiggy every weekend or keep all your OTT subscriptions running at once.

I’m talking about your Magic SIP Number—the one that aligns with where you want your life to be 10, 20 years from now.

Most of us do this backward. We look at our paycheck, subtract what we need to live, keep a little buffer, and then go, “Okay, I can invest ₹5,000 comfortably.” But here’s the catch: comfort today shouldn’t come at the cost of discomfort tomorrow.

Let’s walk through how to flip that approach, without needing to turn into a spreadsheet wizard.

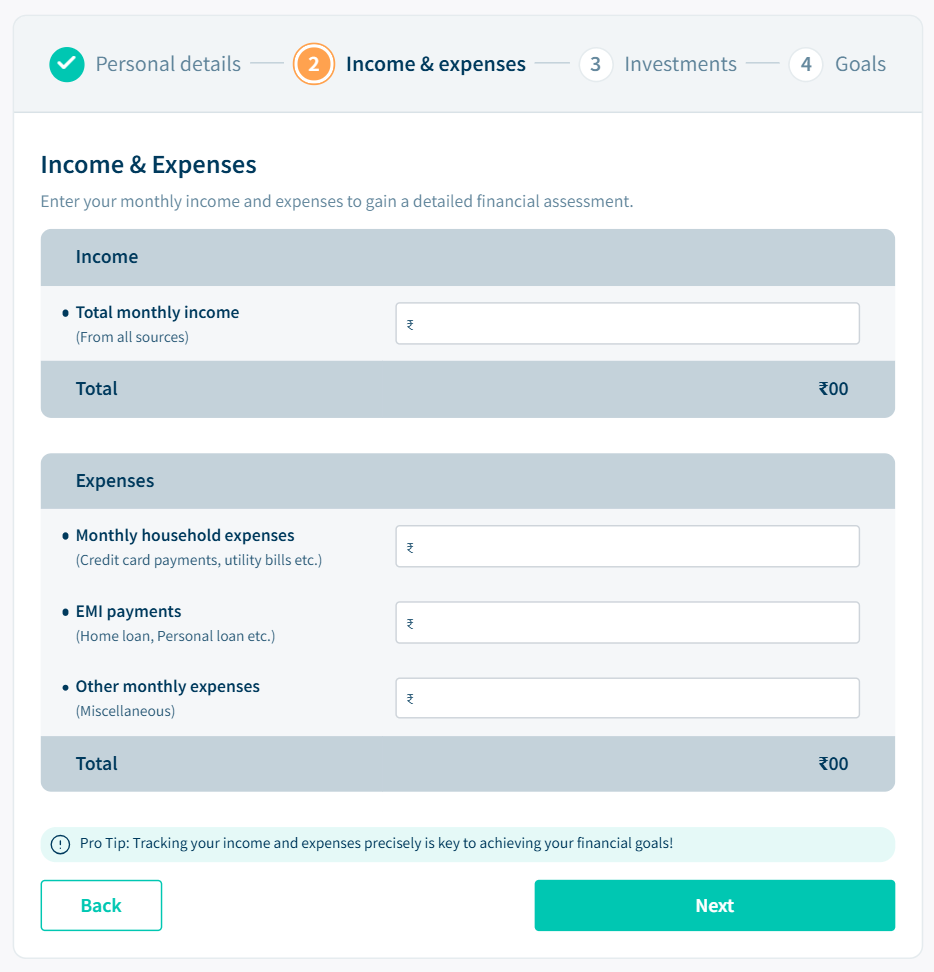

Step 1: Know Your Numbers (Like, Really Know Them)

First things first, figure out your monthly income. That’s you’re in-hand salary after taxes. Got it?

Now go over your monthly expenses with brutal honesty—yes, that includes your Friday night Zomato orders, your Amazon impulse buys, and that gym membership you’ve “been meaning to use.”

List out everything. Rent, EMIs, utilities, groceries, subscriptions, transport, leisure. The works.

Once you do this, something magical happens you realize exactly where your money is actually going. That clarity? It’s gold.

Step 2: Find Your Real Investment Potential

Now comes the eye-opener.

Investable Surplus = Income – Expenses

This is the real amount you could invest monthly, if you chose to. Think of it as your opportunity fund.

If that number is zero or close to it, don’t panic. It just means you need to go back to your expenses and see what’s optional vs. essential. Because your future deserves a line item in your monthly budget too.

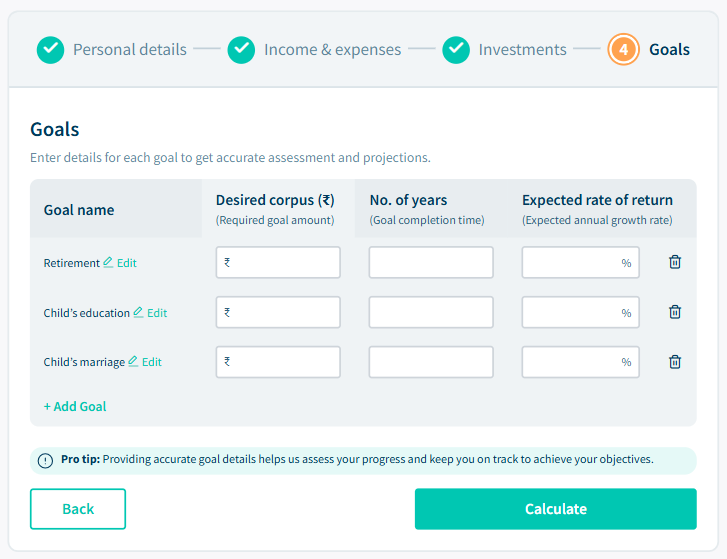

Step 3: Let Your Goals Talk

Here’s where things get real. Ask yourself:

- When do I want to retire?

- Do I want to send my kid abroad for college?

- Planning to buy a home in the next 5-10 years?

- Dreaming of a big wedding for your child?

Take each of these big life goals and use a goal-based SIP calculator-like the one DSP offers-to figure out how much you should be investing for each goal. Not what you can spare. What you actually need.

Trust me, this step is a game-changer.

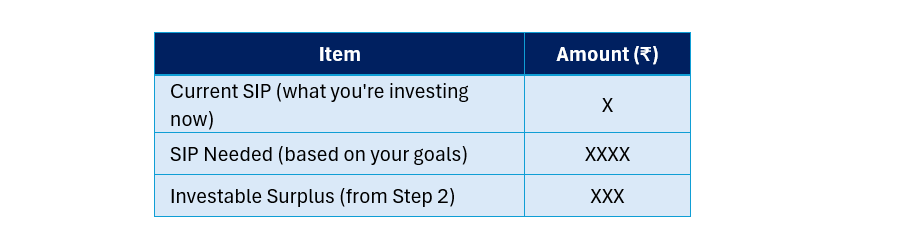

Step 4: Compare, Confront, and Course Correct

Now create a simple table like this:

Now ask yourself:

• Am I under-investing for what I actually want in life?

• Is my current SIP playing it too safe?

• Can I stretch a bit more without hurting my lifestyle?

Ideally, your SIP amount should land between the “SIP Needed” and your “Investable Surplus.” That’s your sweet spot.

If your surplus is less than what your goals require—guess what? That’s your wake-up call. You either increase your income, trim the fluff, or push your timelines (least favourite option).

Tool Tip: Use a SIP Optimizer to do the above activity effectively

Wanna double-check if you’re under-investing? Use the DSP SIP Optimizer.

It gives you actionable suggestions for your optimal SIP amount to make sure you are not underinvesting

And if you’re a mutual fund distributor? This tool helps you serve your clients with insights they didn’t even know they needed.

The DSP SIP Optimizer helps you:

• Provide personalized, optimal SIP amount recommendations

• Build trust by showing clients exactly what they’re missing, and help them avoid underinvesting

• Align client investment amount with real life goals

Flip Your Formula

Don’t do:

Income → Lifestyle → Essentials → Leftover for Investing

Do this instead:

Income → Essentials → Investments → Lifestyle

Put your future first. Your older self will be eternally grateful.

Price Your Dreams Monthly

A SIP isn’t just an investment-it’s the monthly EMIs of your dreams.

So grab a pen, pull up that calculator, and do the math. Your future isn’t waiting around, and honestly? It deserves better than a guess.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

All Mutual fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF & procedure to lodge/ redress any complaints visit dspim.com/IEID.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Comments

Total 1

Anonymous

30-05-2025

Very well written.

Write a comment