Summary

AI is swallowing capital faster than oil once did. Trillions are pouring into data centers, but are the returns real, or a mirage? History warns revolutions enrich nations, not always investors. The market has prepaid for AI’s future. Question is: will reality deliver?

In 2010s, a barrel of oil decided the fate of economies. Governments fell, fortunes rose, and investors obsessed over every uptick in Brent crude.

Fast forward today, and it isn’t oil fields that are swallowing capital it’s data centers.

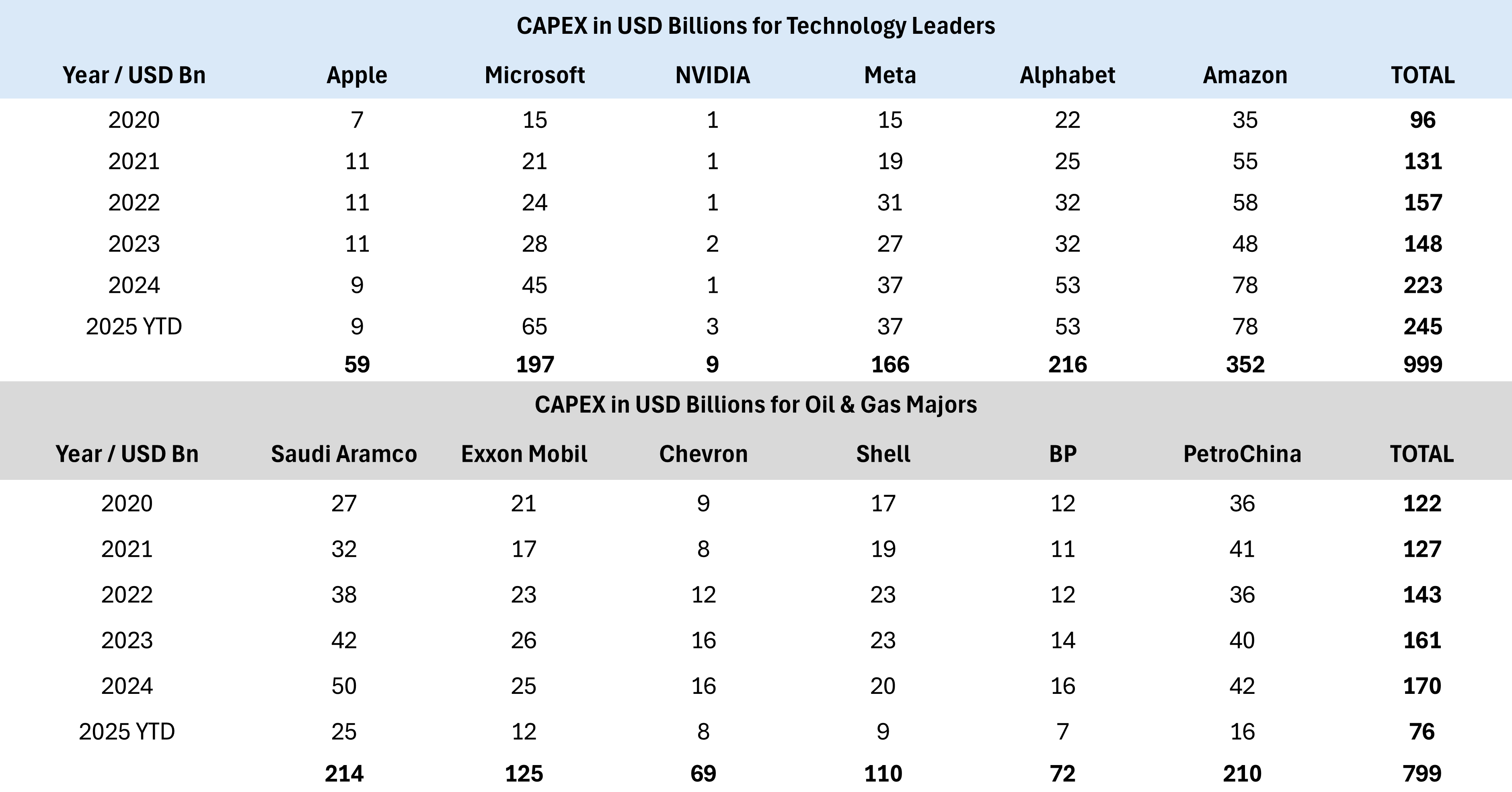

Over the last five years, the world’s most powerful technology firms: Apple, Microsoft, Amazon, Alphabet, and Meta, have spent close to $1 trillion in capital expenditure. By comparison, oil and gas majors, still powering over half of global energy consumption, invested $800 billion.

The math is simple but startling: tech now invests more than oil in shaping the world’s future.

But the real question: are the returns equally real?

(This blog is inspired by a post from Sahil Kapoor, whose framing of AI capex vs. oil capex raises one of the most important investor questions of our time.)

The Mirage of Scale

Oil has always been brutal but transparent. You drill, you refine, you burn. The gains are visible in electricity grids, transport, plastics, fertilizers.

AI’s gains are harder to pin down. Large language models correct grammar, gamers crush humans at chess, and yes, prompt engineers reinvent “search.” Those may sound trivial, but beneath them are deeper shifts: in drug discovery, fraud detection, education access.

The paradox is this: AI may change everything or very little.

And history tells us the mortality rate in new tech is high. Railroads, telecom, dotcoms all saw capital gush in, only to leave behind bankruptcies before survivors emerged.

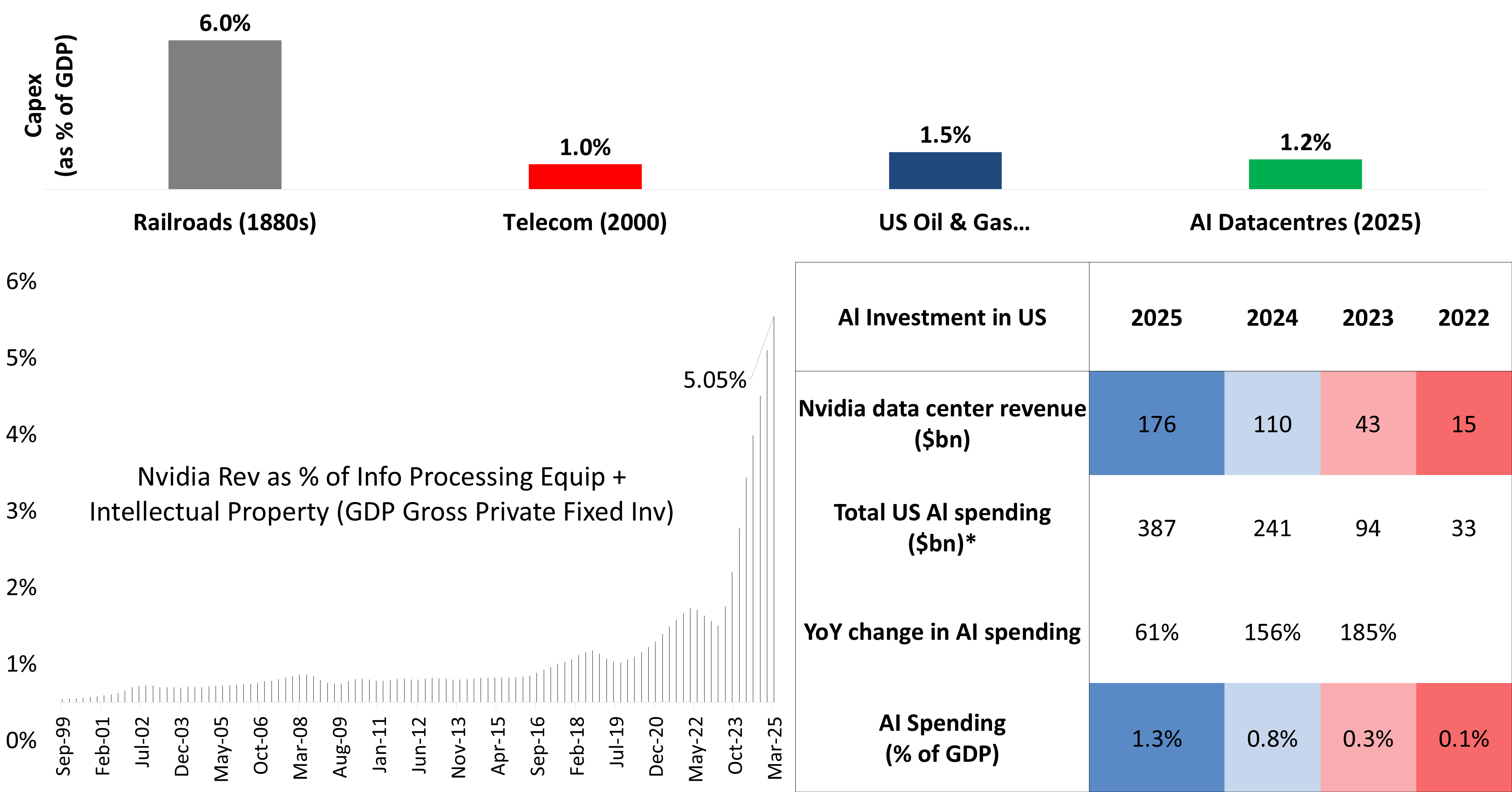

10 Years Ago, The World Was Crazy For Oil, Today It’s AI

* Modelled as function of Nvidia data center revenue

Source: Bloomberg, Paul Kedrosky, Jens Nordvig, DSP. Data as of July 2025.

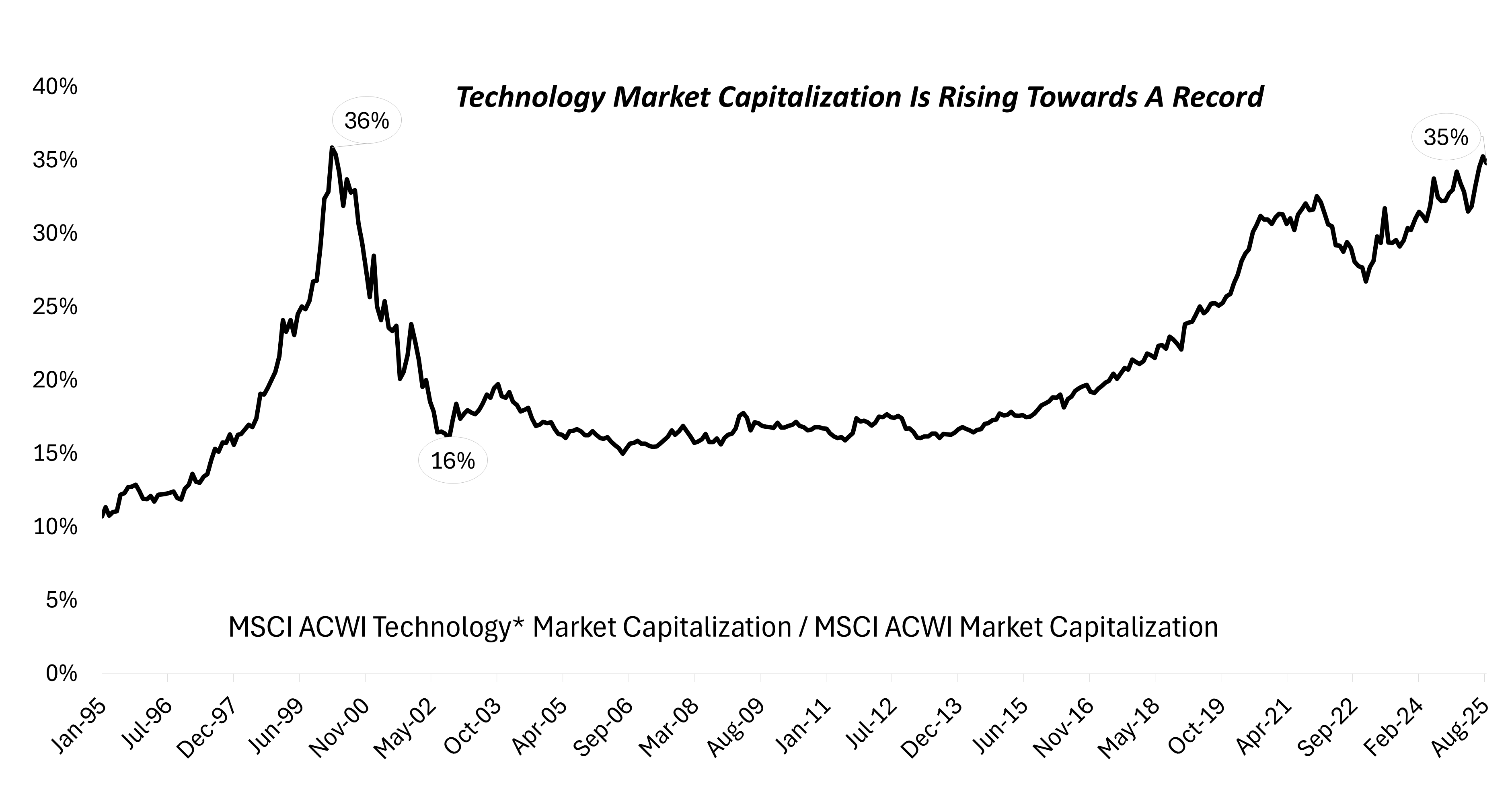

Valuations Have Run Ahead

Markets today have priced technology as inevitability.

- Global technology market cap: $36 trillion (≈ one-third of world GDP).

- S&P 500 oil & gas: $1.6 trillion.

- S&P 500 technology: $28 trillion.

Here’s the imbalance: tech’s implied earnings are about $600 billion, while seven “old economy” sectors (staples, energy, materials, utilities, real estate, consumer discretionary, industrials) deliver $1.5 trillion.

Yet, tech trades at 38x earnings vs. the “sleeping seven” at 22x.

Why? Return on equity. Tech’s ROE sits at 25%, double the 12% of those traditional sectors. Investors are extrapolating this advantage deep into the future.

That’s the danger of extremes. Extrapolated too far, they become mistakes.

Tech Isn’t Capital Intensive? What Economic Value Is AI Capex Creating?

Source: Bloomberg, DSP. Data as of August 2025

Lessons From Past Manias

This isn’t the first time capital found a new obsession:

- Railroads in 19th century America → peaked at 6% of GDP. They changed the country but bankrupted most investors first.

- Dot-com boom → billions in telecom infrastructure, much of it idle for years.

- Shale oil in the 2010s → US energy capex hit 1.5% of GDP, rivalling the dot-com peak.

Today, AI-related capex is already 1.2% of GDP, with Nvidia alone making up 5% of U.S. information-processing equipment investment.

This is not hype. It’s a reallocation of capital on a historic scale.

But just as railroads were indispensable yet disastrous for early investors, AI too could enrich nations but impoverish portfolios.

Technology Market Cap Share Approaching That of The ‘Dot-Com’ Bubble

*Technology includes IT and Communication Services Sector.

Source: Bloomberg, DSP. Data as of August 2025

The Margin of Safety Question

We believe investing is less about predicting the next revolution and more about surviving it.

Because revolutions don’t guarantee wealth creation for shareholders. They guarantee volatility.

Investors should ask three testable questions before betting on this AI build-out:

- Utilization → Are data centres running at capacity, or is half the spend sitting idle?

- Unit Economics → Are costs per inference falling enough to make AI commercially viable beyond a handful of tech firms?

- Diffusion → Are the productivity gains showing up in non-tech balance sheets: in hospitals, factories, classrooms?

Until these answers show up in earnings, the valuations are assumptions, not inevitabilities.

Takeaways for Investors

- Don’t extrapolate extremes → Railroads, oil, dot-coms all looked unstoppable until they weren’t.

- Diversify across cycles → The “sleeping seven” may look boring, but they generate 2.5x tech’s earnings at lower multiples.

- Respect market cycles → The market has prepaid for AI’s future. If reality lags, corrections will be sharp.

- Look for the margin of safety → In valuations, in cash flows, in sectors not priced for perfection.

The Oldest Rules Still Wins

AI could be the railroad of our century laying tracks for the next 50 years. But the first wave of investors in railroads lost fortunes.

The lesson is timeless: buy the future, but don’t pay for inevitability.

As sceptics, we watch. As investors, we measure. We wish to remind you: innovation excites, but discipline endures.

Because every craze (AI included) only rewards those who remember the oldest rule in investing: the margin of safety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for general information purposes only and contains the personal views of the Fund Manager. It should not be construed as investment advice. Viewers are advised to conduct their own investigation and seek appropriate professional advice before making any investment decisions. DSP Asset Managers Pvt. Ltd. (“the AMC”) has used information that is publicly available, including data developed in-house. While such information is believed to be reliable, neither the AMC nor any connected person warrants its completeness or accuracy, and disclaims all liabilities, losses, or damages arising from its use.

The investment approach, framework, or strategy mentioned herein is currently followed by the scheme and may change in the future depending on market conditions and other factors. Any opinions, figures, charts, or projections are subject to change without notice and may not remain relevant. Statements herein may include forward-looking statements that involve risks and uncertainties which could cause actual results to differ materially.

Any reference to sectors, stocks, issuers, or companies is purely illustrative. Such references should not be considered as recommendations to buy, sell, or hold any security, nor as an indication of future performance. The AMC, its affiliates, or schemes may or may not have any current or future positions in these securities.

Past performance may or may not sustain in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee in DSP schemes.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment