Summary

The Internet is brimming with resources that proclaim, “nearly everything you believed about investing is incorrect.” However, there are far fewer that aim to help you become a better investor by revealing that “much of what you think you know about yourself is inaccurate.” In this series of posts on the psychology of investing, we will take you through the journey of the biggest psychological flaws we suffer from that causes us to make dumb mistakes in investing. This series is part of a joint investor education initiative between Safal Niveshak and DSP Mutual Fund.

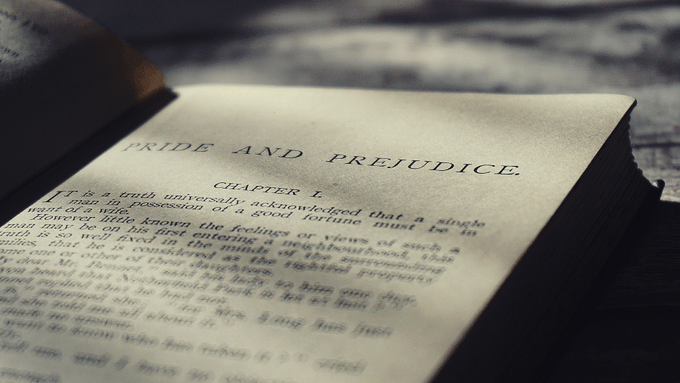

Niels Bohr, the Danish physicist who made foundational contributions to understanding atomic structure and quantum theory (for which he received the Nobel Prize in Physics in 1922), once proposed that the goal of science is not universal truth.

Rather, he argued, the modest but relentless goal of science is “the gradual removal of prejudices.” We start with grand ideas about the world, but as science advances, these ideas are broken down, and we realise we’re left with fewer certainties.

Take Copernicus’s discovery that the Earth revolves around the sun. It gradually removed the prejudice that Earth was the centre of the universe, shattering an age-old belief that had once seemed unshakable. Or Darwin’s theory of evolution, which gradually removed the prejudice that humans were a special creation, separate from the rest of the species. We had to rethink everything about our origin.

Newton’s discovery of gravity gradually removed the prejudice that objects were attracted to the earth because it was in their nature to do so. Then there’s Louis Pasteur’s discovery of the germ theory, which removed the prejudice that infections and diseases were somehow a result of divine punishment rather than the activity of microorganisms.

Then, much later, Daniel Kahneman and Amos Tversky dismantled another cherished assumption — that humans are rational animals. Their research on cognitive biases showed that our choices aren’t always logical, especially in areas like investing. Their work on behavioural economics and human irrationality gradually removed the prejudice that humans make financial decisions based on reason.

These shifts are more than facts. They’re complete overhauls of how people understood life and the world around them. And they weren’t quick; they took decades, even centuries.

Now, even when you move beyond science and look at life in general, being a lifelong learner serves a similar purpose – that of the gradual removal of prejudices we carry in our minds and the lenses with which we see and judge situations and people around us. We all start with our beliefs, moulded by family, culture, and experience. But it’s only by opening ourselves up, by being humble enough to unlearn, that we start to shed these layers of preconceptions.

I have lived with and suffered through several prejudices over the years, which were dispelled one after the other as I walked on my journey of lifelong learning. Every single time, I thought I had a clear understanding of something, only to later discover my grasp on it was incomplete or even completely wrong. And I know this process won’t stop.

Every time I started believing I knew how the world was, the world showed me more and more ways in which I was wrong.

I learned that I was wrong about what things are. The things I took for granted as “the way things are” were just one way to see them.

I learned that I was wrong about how things work. Even in fields I thought I understood well, there were layers of complexity I was blind to.

I learned that I was wrong about who people are. You meet someone and form opinions. And then time and experience reveal the many shades and stories that make them who they are.

When I started my investing career in 2003, I held onto a set of beliefs without questioning them. I believed:

- What Gordon Gekko said in the movie Wall Street, “I don’t throw darts at a board. I bet on sure things.”

- That greed was indeed good, and that success required a certain ruthless, profit-driven mindset.

- That stocks were blips on the ticker, just numbers to be bought low and sold high, rather than pieces of actual businesses.

- That the only thing that could help me succeed as an investor was my skill in stock picking—the ability to find that perfect stock that would make it all worthwhile.

- That making money from stocks required me to just be rational in my analysis.

These prejudices were gradually removed as I read and learned from Graham, Buffett, Munger, Fisher, Taleb, Kahneman, and others who approached investing as more than just a game of numbers. These thinkers challenged me to think beyond returns, to understand the nature of risk, and to see investing as a way to build sustainable wealth, not a quick win. Over time, I came to realise:

- There are no certainties in investing, only uncertainties.

- Greed is not good for an investor, and neither are fear and envy. These emotions cloud judgment and lead to impulsive actions.

- Stocks are representative of businesses, and to do well, I must think and act like a business owner.

- Investing is largely a game of luck, and that skill shines through only in the long run. Short-term wins can easily make you feel invincible, but it’s often just randomness giving you a temporary boost.

- Making money from stocks required much more than rational analysis; it needed emotional discipline and a great control over my behaviour. You might know the theory, but in the heat of the moment, emotions take over.

After 20+ years of being an investor and learner, I still have my prejudices and continue to look at the world with my own tinted glasses. And I am sure that will continue till I have my thinking faculties working intact (for it’s our prejudices that make us humans). No matter how much we learn, our biases never disappear; they only become quieter, easier to spot.

But as I continue my learning journey and keep unburdening myself with parts of my ego and blind spots, I also believe that I may see a greater light coming from the end of the tunnel of my ignorance. Learning doesn’t make us perfect thinkers; it just pulls back a few more layers, one at a time. And that possibility—that learning can clear a bit more fog—is what keeps me going.

I may never see things completely without bias, and maybe I’ll never truly “arrive,” but I believe I’ll become less prejudiced.

My life and thinking may get better, little by little, as I unlearn and relearn. And if you’re anything like me, I believe the same for you too.

Just keep learning.

The purpose of this series is to help you gradually get over your own prejudices and become a better investor. Each step forward clears a bit of that fog, bringing clarity to both life and investing.

This article is authored by Vishal Khandelwal of safalniveshak.com, an initiative to teach investors how to make simple and wise investment decisions.

Written by

Disclaimer

All Mutual fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF & procedure to lodge/ redress any complaints visit dspim.com/IEID.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Write a comment