Summary

Discover the pitfalls of being too much like Monica in the stock market. This blog highlights the importance of avoiding certain behaviors. This blog provides in-depth analysis and practical advice. These funds are suitable for long-term investors looking to save on taxes. They offer a unique combination of tax savings and potential for high returns over time.

Ever seen a real, perfect circle in your life? Or a perfect triangle, square, rectangle, sphere, cube, or pyramid?

What a mildly annoying question to begin with, right?

You’re probably thinking, “Is this guy for real? Has he never seen a tennis ball or a photo of the Earth? Hasn’t he heard of the Pyramids in Egypt? Aren’t the windows in his house rectangular? What has he smoked?”

What if I told you that there are in fact no circles, triangles, pyramids, etc. in the real world?

Before you furiously bust out your old geometry set to draw a flawless circle and prove me wrong or worse, come after me with your trusty old compass or divider, hear me out. I assure you that what I’m saying is, in fact, at least technically true.

You see, in the world of mathematics, geometric shapes are special in a very particular way: the lines and curves that make them up are supposed to have zero width. So, whether you draw a line with chalk, brush, pencil, or scalpel, it’s not a “true” line, but merely an approximation of what a line technically is. And since you can never have a “true” line in the real world, you can’t have any perfect shapes either.

Thus, all the shapes you’ve ever seen were imitations of ideal, pristine shapes that exist only in our minds. Or maybe not even there.

Greek philosopher Plato conjectured that every object in our world was an imperfect manifestation of an ideal “Form” that existed in a separate realm. So, every table manifested the ‘Form of Table-ness,’ every dog manifested the ‘Form of Dog-ness’, and so on.

Interestingly, this millennia-old idea can serve as a useful analogy when discussing the slight imperfections in passive funds.

Intrigued? Allow me to connect the dots.

But first, what is passive?

Passive funds are index or exchange-traded mutual funds that take a market index (such as the Nifty 50 or Sensex in India, or the American S&P 500) as a benchmark and aim to match or “track” it as closely as possible. This means that such funds don’t need analysts or expert fund managers to operate: the composition of the fund simply must be adjusted periodically whenever the target index constituents change.

In contrast, active funds seek to beat a chosen benchmark and deliver better returns than it does. Behind the scenes, they have a team of experienced portfolio managers and analysts, who study specific stocks, sectors and/ or the market as a whole and try to determine the best time to buy and sell various stocks to get the maximum returns possible, within a defined level of risk. Such funds therefore involve active interventions.

The simplicity of passive funds results in several advantages for investors. The one that should matter the most to you, is a low expense ratio (i.e., the proportion of returns charged as fees).

However, a market index is a lot like one of Plato’s abstract Forms. Just like an “ideal” triangle simply consists of a definition (e.g., three points not on the same line, but are connected), a market index can also be summed up in the form of a fixed definition (e.g., the top 50 Indian companies by market cap = Nifty 50), which is what multiple ‘imperfect’ passive funds could be trying to ‘live up to’.

But in what way are these funds imperfect?

Well, the real world brings with it several messy complications, which we will take a closer look at later. However, the imperfections these funds have with respect to their underlying market index result in something important you must learn about.

The ignored flaw called Tracking Error

The tracking error of a passive fund refers to the deviation between the returns from a fund and the returns from its benchmark index, measured over different periods of time. Let’s first look at how it is calculated and then we’ll study the causes of such errors.

To calculate the tracking error of a fund, first calculate the difference between the fund’s rate of return and the benchmark index’s rate of return over a certain period, and then calculate the standard deviation of this difference (which today online calculators can do). The result will give you the tracking error of the fund over the given period.

Note: ‘Standard Deviation’ may sound complicated, but it’s simply a measure of how a bunch of values are distributed around their average, i.e., the extent to which they deviate from the mean.

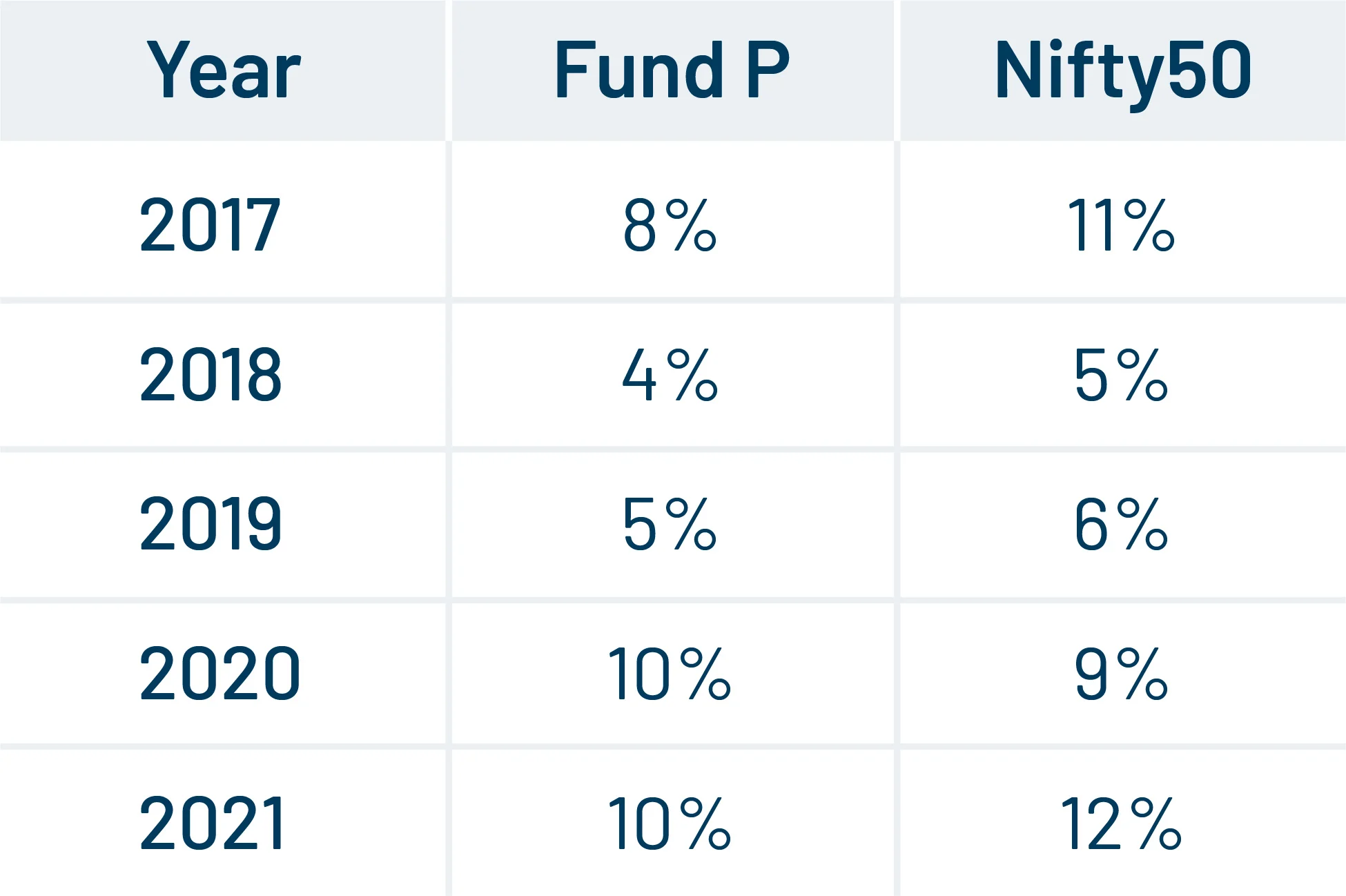

Let’s take an example. Suppose Fund P tracks the Nifty 50 and that return rates for the previous five years were as follows:

Let’s start by calculating the difference between these rates of return for each year. We thus get the series -3%, -1%, -1%, 1%, -2%.

The difference between the returns for each year reflects the Tracking Difference.

To get to the Tracking Error, we calculate the standard deviation of all these values, which in this case comes to 1.33%.

Note: For those machine-inclined, you can just plug a series of values into an online calculator like this one to calculate the standard deviation of the series.

Remember: Lower the tracking error of a fund, the closer it tracks its benchmark. So, if you are looking at multiple index funds or ETFs to choose from, do study their tracking errors too. This is truly what can differentiate one from the rest.

What causes tracking errors?

Tracking errors are consequences of real-world complications that prevent funds from matching their benchmarks with complete accuracy.

I already mentioned the most important factor above: expense ratio.

While the cost of managing a passive fund is lower when compared to an active fund, certain costs are inevitable. Some managers will need to be paid a salary, transaction fees will be paid whenever securities are bought or sold, and then distribution expenses will come in.

These expenses mean that every fund ‘leaks’ a bit every year, resulting in a lower return, which then induces a tracking error.

In principle, there are a few ways in which fund managers can reduce the impact of the expense ratio. For instance, proper dividend management and stock lending (yes: surprisingly, funds can lend the stocks they hold to raise some money) are two common ways in which funds can minimise tracking error. Sometimes, passive funds can even beat the underlying index (this is quite rare, though, and not repeatable with any consistency).

While the expense ratio makes up the lion’s share, a few other factors also have an impact on tracking error. Here are two of them: understand them & use them to impress your friends the next time you’re all hanging out and the conversation turns to money matters. 😉

1. The need for cash reserves

All funds keep a certain amount of cash at hand to manage redemption requests from investors. Moreover, if a fund receives dividends from any of its holdings, it will have to hold on to them in the form of cash for a short period of time, until they are reinvested in the corresponding stocks. This means that a fund cannot practically invest all the money they have at any given point in time, leading to a difference in returns.

2. Changes in the benchmark index

Indexes are based on certain criteria, rather than being exact lists of stocks. For instance, Nifty 50 represents the fifty largest Indian companies that trade on the National Stock Exchange (NSE). If a company becomes large enough to replace one of the existing constituents of the Nifty 50, the composition will change. At such a juncture, funds tracking Nifty 50 would need to sell all the shares of the company that got replaced and buy shares of the new constituent. This process can take a fair amount of time, during which the fund will not be in sync with the benchmark. Moreover, buying and selling large quantities of stocks itself affects their prices, which means that funds might not always be able to carry out all trades at the optimal price.

Why pay attention to the tracking error?

An index fund’s tracking error tells you if the fund’s managers are doing a good job of tracking the underlying index. Try to seek a fund with a low tracking error, as this means that the fund’s managers know what they’re doing and that your investment is doing the job it’s supposed to.

A high tracking error is typically a red flag and could indicate poor cash management, an absence of strict adherence to the index, or a sub-optimal execution of dividend management or stock lending strategies.

What is the ideal tracking error? Zero, but do we live in an ideal world?

The lower it is, the better the fund managers (and the fund) are working. Just for context, for all Nifty 50 tracking index funds in the industry today, the Tracking Error ranges between 0.03% to 0.95%*.

*Source: AMFI India, internal, as on Aug 30, 2022

If you’ve read till here, which end of this range would you choose your fund from?

What Shifu said

I was talking to my ‘sensei’ Arun the other day, telling him all about my ‘smart’ decision to consider index funds with lowest expense ratios. This to me made perfect sense- the differentiator in a sea of similar-themed index funds.

And that is when, like Shifu, he opened my eyes and made me realize that expense ratios are not the only factor one should use to evaluate index funds (or ETFs), and that they were already taken into account while measuring the Tracking Error.

And then he told me: Tracking error is the real secret sauce.

Mind= Blown. Well, not quite as blown as this lovely fella below, but you get the point :)

DSP offers a wide range of popular passive funds, including index funds and ETFs. We show all our Tracking Errors transparently under the ‘Portfolio’ section for each product. Go ahead and explore our diverse offerings, or drop in a comment if you want more information!

Also, want to learn more about Tracking Error? Click here.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Comments

Total 22

Arif Ahmed

23-09-2024

Mind enlightening write up. Share your universal knowledge on the subject for learning financial management of common people.

Moyukh Roy Choudhury

23-09-2024

Excellent read on discipline approach of investing and patience for long term wealth creation .

Dr.Haresh V. Mavadia

23-09-2024

Excellent

Yogesh Laddha

23-09-2024

Thanks for Sharing this Article, It's the real situation of all investors......

Jitu Pran Das

23-09-2024

Guarantee 👍

Saroj Kumar behuria

24-09-2024

Nice topic

Bhanu

24-09-2024

Beautifully penned down. Touches the right chord with the investors

Vikram Shah

24-09-2024

Great Article!

Chandra Bhushan Singh

24-09-2024

Yes patient is the key for equity investment. I remember the opportunity which I missed in 2008 Lehman Brother Crisis, The nav of DSP Tax saver was Rs 5 but now it is 80 i.e. whatever invented that time would have been converted to 16 times today. That is righ moment this blog is talking about.

Pradeep

24-09-2024

This is very interesting & a very lucid way to carry the story forward without making it a text book reading. Thanks for presenting this story to us.

Saroj behuria

25-09-2024

It's very encouraging.

Deborshi Bhattacharjee

25-09-2024

Your writing is so powerful, you put into words exactly what I struggle to convey.

Karnalsingh Bajaj

25-09-2024

Very correct, very authentic, true to life. Money is not every thing. Values of life count too.

MUSADDIQUE HUSSAIN

25-09-2024

Thank you for making me aware of such an important issue. I appreciate your insights.

Partha Sarathi Chandra

25-09-2024

It’s really encouraging

RAFIQUDDIN AHMED

25-09-2024

Very informative

Reny Gomes

25-09-2024

I didn't know something like LRS even existed. Good one. Very different way of talking about a boring concept. Thanks for sharing.

Jitendra

24-09-2024

Excellent explanation. Agreed with your views and are absolutely right.

Pallav Tewari

24-09-2024

This is your first ever blog😊 , you have really displayed excellent creativity, and I am really pleased with how well you have started . Insightful & excellent analogy between cricket & investment. I 100%agree that investing is like playing a test match & not 20-20. Patience is the key in achieving success in both . I am sure you must have already received many positive comments in your first ever blog . Keep up the excellent work !! Looking for more such interesting blogs 👍

Rizwan

25-09-2024

Ehsan that's a great read buddy, I am doing one for my son tomorrow.

Madhulika Sanghvi

25-09-2024

This is indeed so very well written - Firstly the dare to dream big but through small disciplined actions over time. Most of us imagine that one stroke of luck , that one big jump or only being a business owner or having a very senior well paying role is what creates wealth for us. Secondly the analogy to religion & human behavior that is so easy to connect to with the flow of yout writing. An excellent reminder that daily doses of discipline , is important not just in wealth creation but also in work, health, relationships and life. Thanks for this piece Ehsanur!

Abhisek Mitra

25-09-2024

The parallels drawn here to illustrate the human psychology and behavior towards investing is very very apt... However the motivating factor of building a 100cr legacy for your child over a period of time with strict financial discipline is something put across the mind very thoughtfully... It's definitely a message that needs to be put across to all investors as a thought provoking one and finally help them in their pursuit of achieving this much cherished goal of "creating a 100cr legacy" by starting immediately with their SIP...

Write a comment