Summary

Pre-IPO investing offers discerning investors early access to high-growth, innovation-led businesses at attractive valuations. This exclusive article explores valuation dynamics, risks, fund structures, and case studies, helping HNIs navigate the evolving private-to-public journey. For those with insight and patience, it’s a rare chance to invest before visibility meets value.

You’ve built wealth. Now comes the real question; is it building the world you want to live in? To explore this idea, we’re launching a new series of thoughtfully curated articles, designed exclusively for our most discerning readers. Crafted through in-depth conversations and meticulous research, this series reflects what truly matters to you, especially our High Net-Worth Individual (HNI) audience.

From wealth creation and preservation to fine art, luxury travel, and lifestyle choices that reflect sophistication, our content will align with your evolving interests.

But this isn’t a one-way dialogue. We see this as a shared journey and welcome your voice. Share your thoughts, suggest topics, or tell us what’s missing in today’s content landscape on [email protected].

This is content with purpose for readers who expect more.

In Volume 1, we explored the evolving world of pre-IPO investing, a realm once limited to insiders, now increasingly open to HNIs, family offices, and institutional investors. We decoded the various stages of a startup’s life cycle and identified where pre-IPO fits in. We also detailed access routes PMS, AIFs, curated platforms, and secondary sales, while outlining exit options and taxation nuances. From capturing listing-day gains to owning the next market leader early, pre-IPO investing offers access to a sweet spot, right before visibility meets valuation rerating.

But what determines whether that early investment becomes a multi-bagger or flatlines post-listing?

In this second volume, we go deeper into valuation dynamics, value creation levers, and real-world case studies to help you decode what truly drives the pre-IPO advantage.

Pre-IPO investing offers a powerful mix of value, access, and early exposure to high growth, innovation led businesses. Unlisted shares often trade at a discount due to limited liquidity and transparency, but as companies mature and approach listing, this gap can narrow sharply, unlocking meaningful upside for informed, patient investors.

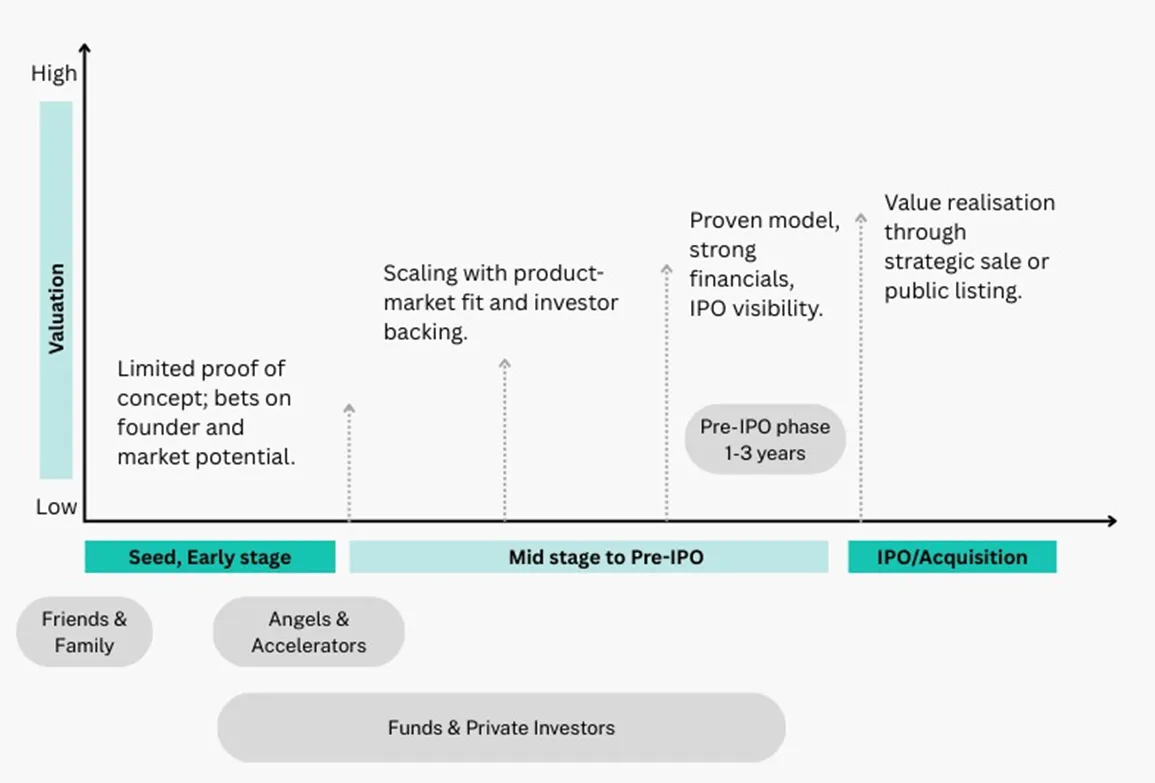

Here is how valuations evolve across a company’s growth and funding stages as opportunity aligns with maturity.

Exhibit: Valuation, company stage and funding stage evolution.

How Are Pre-IPO Valuations Done?

Pre-IPO valuations are a blend of science and art shaped by financial track record, investor appetite, and layered due diligence. The key lies in identifying the right company at the right time and valuation, making expert guidance crucial.

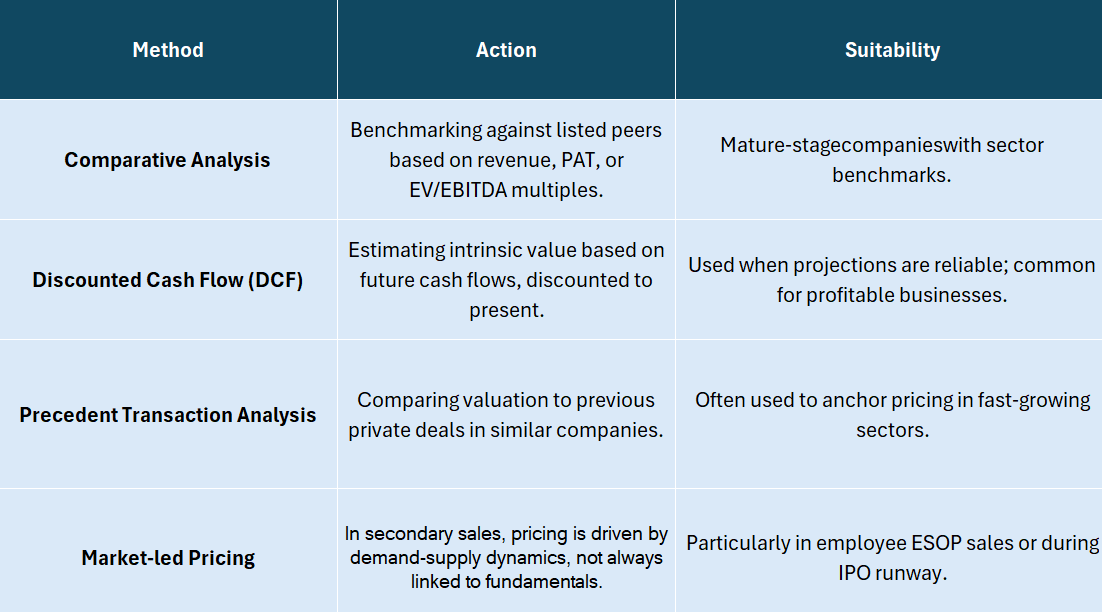

Below is a snapshot of common valuation methods used in the pre-IPO space.

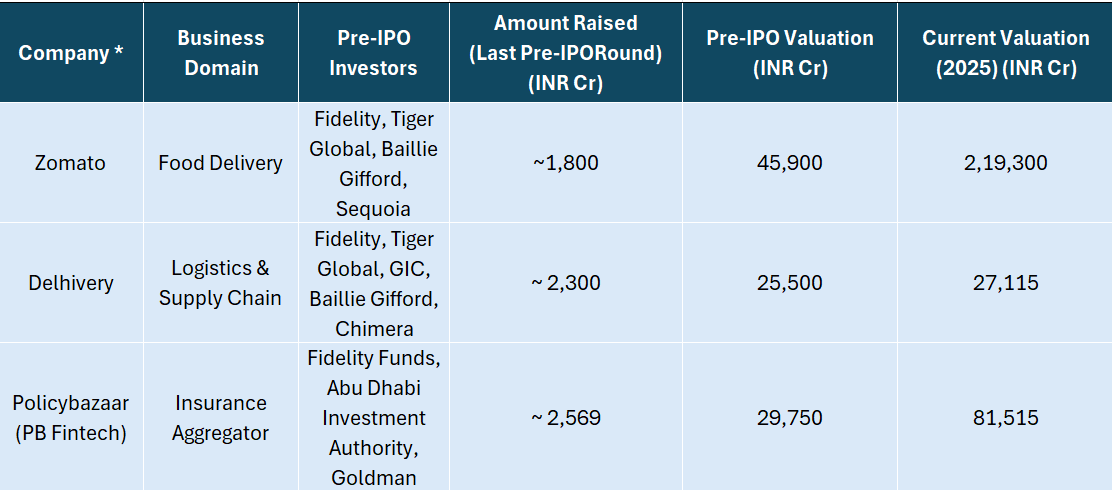

Case Studies: From Unlisted to Unlocked Value

Here’s a closer look at five high-profile names in India’s Pre-IPO universe and the potential value they generated1. Take Zomato *, for instance. As one of India’s earliest food delivery platforms, it built strong consumer recall, wide geographic reach, and deep integration with restaurants, long before profitability became a market demand. By the time it raised INR 1,800 Cr in its pre-IPO round, Zomato had already demonstrated high-growth potential, sector leadership, and a clear path to public markets. The business capitalised on rising digital adoption and changing consumption patterns, positioning itself as a scalable, tech-driven logistics play. Zomato’s journey from a food listing to food delivery to a full-fledged tech-enabled platform reflects how pre-IPO businesses can evolve far beyond their original thesis.

Not just stocks funds are catching on too

It’s not just individual investors who are riding the pre-IPO wave. A growing number of Alternative Investment Funds(AIFs) are tapping into the pre-IPO space, offering investors structured access to late-stage private companies with clear listing potential. These funds typically focus on high-growth businesses nearing public markets, aiming to capture valuation uplift as they transition from private to listed. Most are designed with concentrated allocations to unlisted equity, often deploying capital over 12–24 months. Several funds in this category have recently closed or launched with corpus sizes ranging from ₹300 crore to over ₹2,000 crore, reflecting strong investor appetite for curated, early-access opportunities in India’s evolving capital markets.

Here’s why they are gaining popularity:

-

Expert screening by fund managers: Experienced fund managers apply rigorous filters to assess business quality, promoter credibility, and IPO-readiness helping investors avoid speculative or overhyped names.

-

Access to multiple opportunities in one go: Instead of picking a single unlisted company, investors get exposure to a curated portfolio of 10-20 pre-IPO opportunities across sectors like fintech, healthcare, consumer tech, and enterprise SaaS.

-

Staggered deployment and exits: Fund capital is deployed gradually over time, aligned with deal pipeline and market cycles, allowing managers to time entries wisely. Exits are also staggered, reducing concentration risk.

-

Compliance and governance: Category II AIFs are regulated by SEBI, ensuring robust fund structures, transparent reporting, and investor protections.

Selecting the right fund structure depends on your investment strategy and risk appetite.

-

Category II AIFs are well-suited for investors targeting unlisted companies with planned IPO exits. With the ability to allocate up to 25% in a single company, they are ideal for making concentrated bets on high-growth businesses nearing listing.

-

Category III AIFs, in contrast, are designed for strategies that extend beyond the IPO, aiming to capture post-listing gains. These funds encourage diversification with a 10% cap per investee company, making them better suited for more market-linked, multi-asset approaches.

Understanding the Risks

While pre-IPO investing offers compelling upside, it comes with its own set of risks. Not all investments deliver immediate success and being aware of potential challenges is key to making informed decisions.

-

Illiquidity: Exits may be delayed, depending on IPO timelines or market conditions.

-

Valuation Risk: Late-stage rounds can be overpriced, especially in high-demand sectors.

-

Narrative vs. Reality: Strong media presence doesn’t always translate into financial strength.

-

Regulatory Shifts: Sectors like fintech and edtech can be impacted by evolving policies.

Questions to Ask Before Investing

Before participating in a pre-IPO round, either directly or through a curated platform, answering the following questions may address the risks involved:

-

Is the business model tested and either profitable or on a credible path to profitability?

-

Has the company filed its Draft Red Herring Prospectus (DRHP), or is there visibility on a timeline to listing?

-

Who are the institutional investors already backing the company?

-

Is the sector supported by long-term tailwinds, or is it exposed to cyclical or regulatory volatility?

-

What is the expected exit path—IPO, strategic acquisition, or promoter buyback?

If you're not equipped to evaluate these aspects in detail, consider taking the fund route through a structured AIF or PMS that offers pre-IPO access with institutional diligence. Alternatively, seek the advice of a trusted financial advisor who understands this segment.

Closing Thoughts: Not for the Faint-Hearted, But Built for the Far-Sighted

Pre-IPO investing occupies a unique space a blend of public market ambition and private market discipline. It isn’t driven by momentum, but by insight. It isn’t about immediate liquidity, but long-term conviction.

For discerning investors, this segment offers a front-row seat to India’s emerging market leaders, a stage where the stories are still being written, and the valuations are still attractive.

Don’t just invest in stories that are already written. Be part of the ones still being told.

Because sometimes, the best investment is simply being early and being ready.

- The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

Industry insights you wouldn't want to miss out on.

Disclaimer

The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). In this note, DSP Asset Managers Private Limited (“the AMC”) has used information that is publicly available, including information developed in-house. While utmost care has been exercised while preparing this document, neither the AMC nor any person connected warrants the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s), before acting on any information herein, should make his/her/their own assessment and seek appropriate professional advice. Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in any scheme of DSP Mutual Fund.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Write a comment