Summary

The largest large-cap stocks have hit historic lows in both market capitalization and price performance, potentially signaling a strong rebound. With concerns over frothy small- and mid-cap stocks, investors may find value in large caps, despite their higher prices, as a safer, relative play in a risk-off environment.

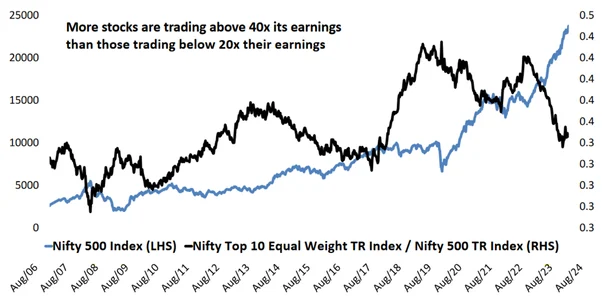

The largest of the large caps: we’ve talked about them several times in the recent past, and for good reason. These stocks have perhaps never had it so bad before. Not only has their weight in the total market capitalisation dwindled to an all-time low, but their relative price performance also hit an all-time low recently. This latter point can be observed in the chart below.

Source: NSE, DSP. Data as of Aug 2024

This spell of underperformance from the very biggest stocks might represent an excellent opportunity for investors, simply because a regression to the mean from this point is quite possible.

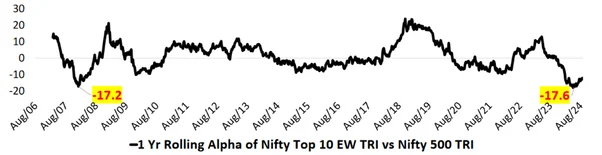

Consider the chart below, which plots the 1-year rolling alpha (i.e. outperformance) of the Nifty Top 10 Equal Weight index relative to the Nifty 500. The last time this rolling alpha was at roughly the same level as its current level was between 2007 and 2008: at that time, not only did its bottom serve as an inflection point, but it also bounced back very strongly over the next year, as can be clearly seen.

Source: NSE, DSP. Data as of Aug 2024

Moreover, the large addition to India’s overall equity market capitalisation from new listings has made the top 10 cohort even more attractive. This is because more than two-thirds of these new issues were listed at prices that were greater than 50x of their trailing earnings. As a result, this newly infused market cap component has a low profitability base when compared to the top 10 stocks.

Historically, periods of inflection in the underperformance of the 10 largest-cap stocks versus the rest of the market have coincided with a general ‘risk-off’ environment, i.e. during such times, investors have usually been especially keen on reducing their risk exposure and protecting their capital. Given recent concerns that the small- and mid-cap (SMID) category might be too frothy and overvalued, it’s possible that such a risk-off environment might be on the horizon.

Lastly, it’s important to note that on an absolute basis, even the top 10 stocks aren’t currently cheap from a historical perspective. Hence, they should be looked upon as a relative play for investors looking to add some equity exposure.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of July 2024 (unless otherwise specified) and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme.

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

For Index disclaimers click here. Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250, small-caps as 251 and above.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment