Summary

Invest in mutual funds that specialize in the banking sector. These funds offer exposure to a diversified portfolio of banking stocks managed by professional fund managers. By investing in banking-focused mutual funds, investors can benefit from the expertise of the fund manager and gain access to a broader range of banking companies, reducing the risk associated with investing in individual stocks.

In the world of global finance, the Indian banking sector is like a shining light of opportunity. It offers attractive ways to achieve financial success. Think of it as a strong fortress that remains steady even when the economy is changing.. With the dependence of an ever-growing population on the banks for their financial needs, the sector promises safety of capital and steady growth even in tumultuous economic times.

The Indian banking sector is a diverse landscape comprising both public and private sector banks, each with its unique potential. Public sector banks are like reliable giants supported by the government. They provide stability and security, ensuring that the financial needs of the people are met. On the other hand, private sector banks are agile and competitive players in the market. They bring innovation and efficiency, constantly striving to offer better services and products to customers. Together, these banks create a dynamic environment where different strengths and strategies coexist. This blend of public and private sector banks ensures a balanced and robust banking system in India, catering to the diverse needs of individuals and businesses.

Right now, investors have a great chance to enter a market that holds a lot of promise for the future of banking in India. It's like an open gateway to prosperity. Investing in India's banking sector is like discovering a world full of potential. It calls upon smart investors to take action and unlock a future filled with financial rewards.

Unveiling the Growth of Private Banks in India

Unprecedented Expansion and Significant Economic Impact

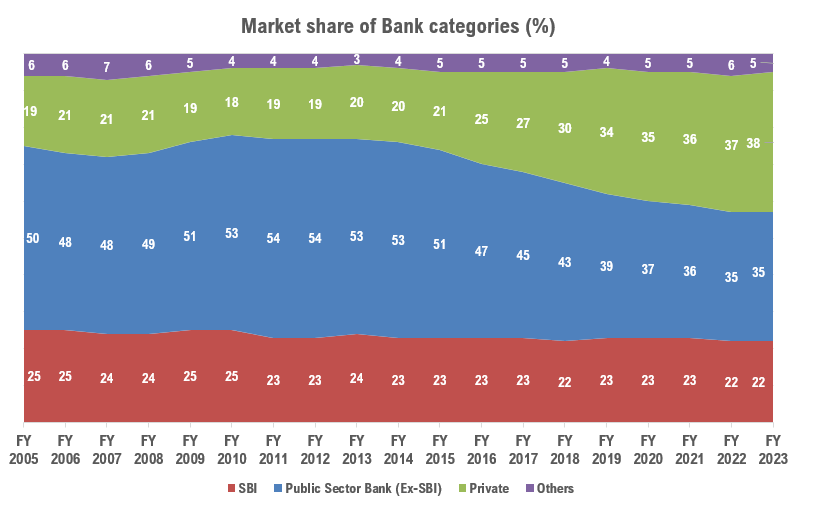

Source – RBI, ICICI Securities.

From 2005 to 2023, the Indian banking landscape experienced a significant transformation, marked by a noteworthy shift in market share dynamics. Public sector banks (excl SBI), which once held a commanding 50% share, have witnessed a decline, now accounting for 35% of the market. In contrast, private sector banks have seized the opportunity and experienced a remarkable surge in their market share, more than doubling from 19% to 38% during the same period. This transformation signifies a monumental change in investor and customer preferences, as private banks have emerged as formidable contenders, driven by their adaptability, innovative strategies, and unwavering commitment to customer satisfaction.

The Balance Sheets Indicate a Strong Foundation for Private Banks

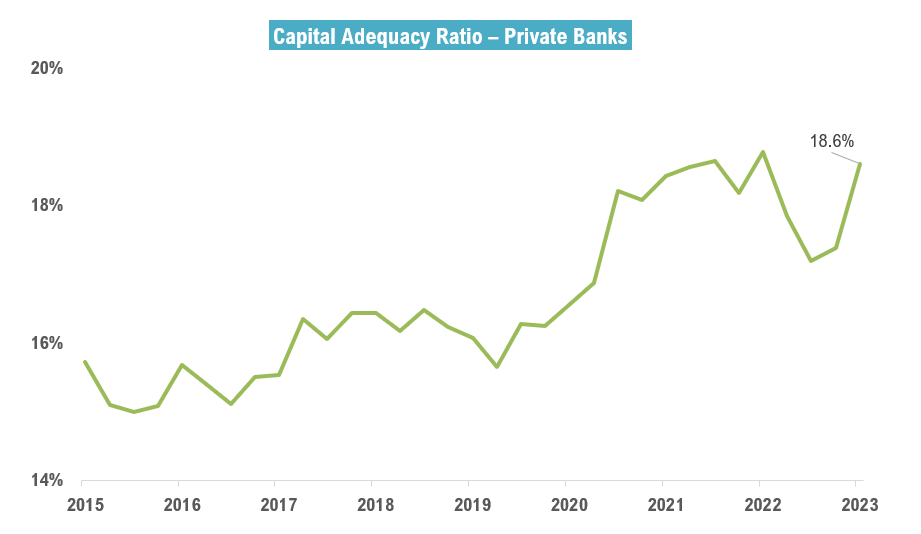

Source – RBI, CMIE. Data as on 31 Mar 2023

Over the years, private banks in India have fortified their balance sheets, reinforcing their financial strength and resilience. These institutions have demonstrated remarkable capitalisation, positioning themselves favourably to sustain and foster continued growth in deposits and credit. The capital adequacy ratio, a key indicator of a bank's financial soundness, serves as a testament to the robustness of private banks' balance sheets. From being slightly below 16% in 2015, the capital adequacy ratio of private banks has steadily climbed to an impressive 18.6% in 2023. This upward trajectory highlights the concerted efforts of private banks to bolster their capital base, ensuring they have a solid buffer to support their expanding operations and meet regulatory requirements.

Indian Private Banking Sector at Attractive Valuations Compared to its History

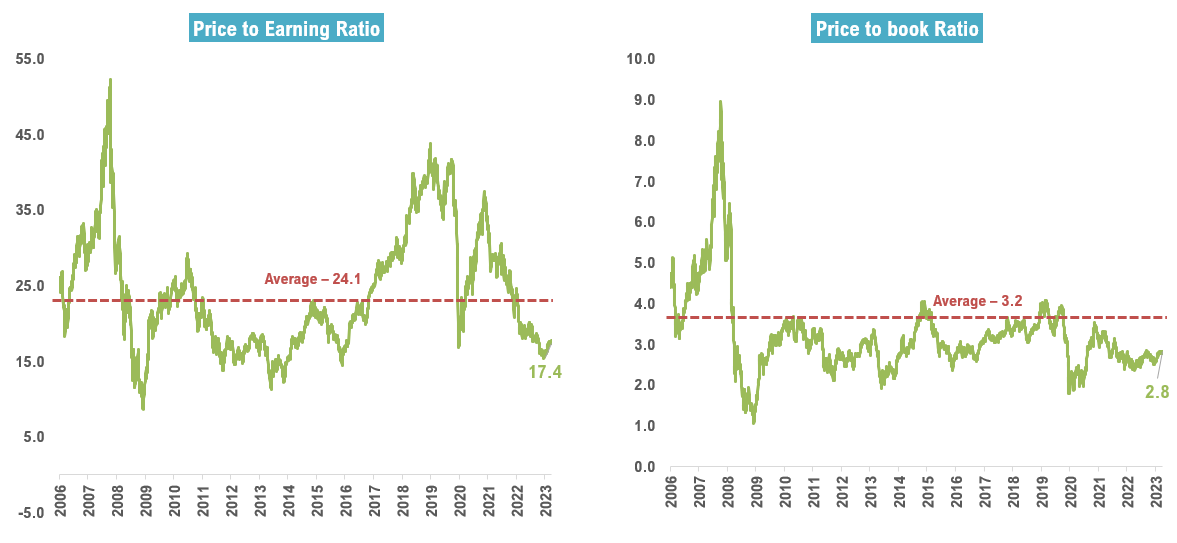

Source – NSE. Data as on 28 Jun 2023

When assessing the valuations of private banks, a striking trend emerges, showcasing attractive levels in comparison to historical benchmarks. Over the years, the price-to-earnings ratio has experienced a significant shift, declining from 25 in 2006 to a favourable 17.4 in 2023. This indicates that private banks are currently trading at a more reasonable price in relation to their history, presenting an opportunity for investors to acquire stocks at a potentially discounted value. Additionally, the price-to-book ratio, reflecting the market value of a bank in relation to its book value, has exhibited a substantial decrease from 5 in 2006 to an enticing 2.8 in 2023. This implies that private banks are priced relatively lower compared to the underlying value of their assets, further bolstering the attractiveness of investment opportunities in this sector.

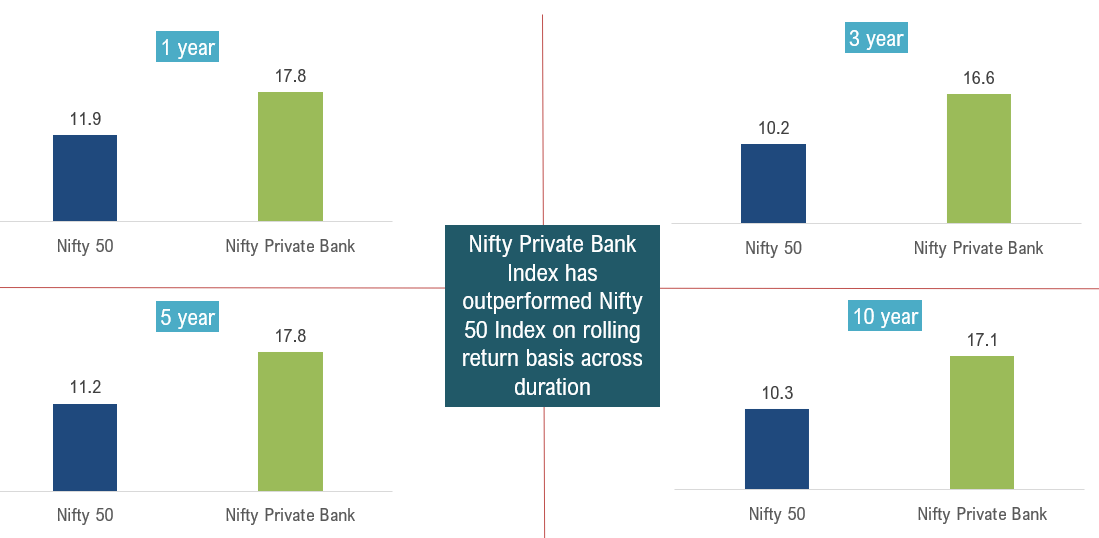

Nifty Private Bank Index and its Impressive Long-term Performance

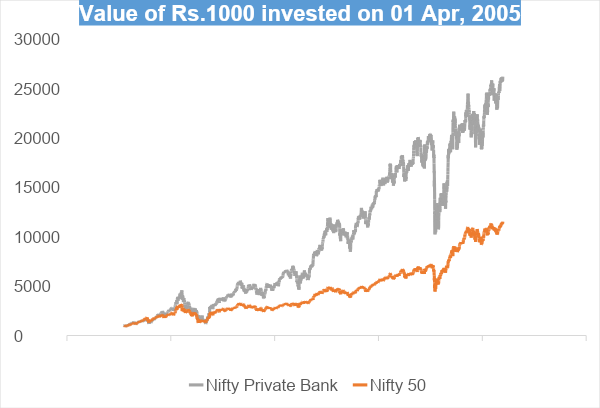

Source – MFIE. Data as on 28 Jun 2023.

The Nifty Private Bank Index, a benchmark representing the performance of the private banking sector in India, has witnessed a remarkable growth trajectory over the past 18 years. Surpassing expectations, the index has surged by a staggering 26 times, outpacing the Nifty 50 Index, which grew by 12 times during the same period. This exceptional growth underscores the strength and potential of the private banking sector, positioning it as a dynamic force within the Indian financial landscape.

Source – MFIE. Data as on 30 Jun 2023.

The Nifty Private Bank Index has also consistently demonstrated better performance compared to the Nifty 50 Index across various time durations based on median rolling returns. This notable outperformance further solidifies the strength and resilience of the private banking sector. Investors can find confidence in the track record of the Nifty Private Bank Index, as it consistently outshines its broader counterpart, the Nifty 50 Index, on a rolling return basis, showcasing its potential as a rewarding investment avenue.

Robust Growth in Deposits and Credit

Within the private banking sector in India, the growth in both deposits and credit has been remarkably strong, serving as a testament to the strength and resilience of these banks.

Source – CMIE. Data as on 31 Mar 2023

The growth rate of deposits and credit for private banks has consistently hovered around 15%, showcasing their ability to attract and retain customers' funds while extending credit to individuals and businesses.

The robust growth in deposits highlights the trust and confidence that customers place in private banks, as they entrust their savings and financial assets to these institutions. The ability of private banks to consistently grow their deposit base speaks to their strong customer relationships and effective deposit mobilisation strategies.

Private banks have successfully expanded their lending portfolios, providing credit to support economic activities and fuel growth. This growth in credit is a result of effective risk assessment, efficient underwriting processes, and tailored lending solutions that cater to the specific needs of borrowers.

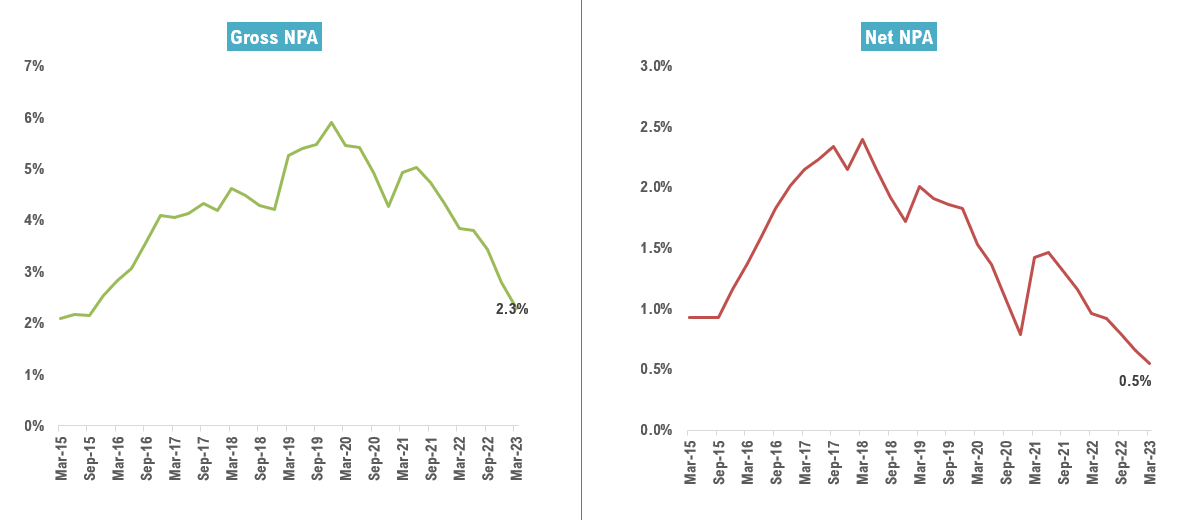

Improved Asset Quality with Net Non-Performing Assets (NPAs) at an 8-Year Low:

Source – CMIE. Data as on 31 Mar 2023. NPA – Non-Performing Asset

NPAs, which indicate the proportion of non-performing assets to total advances, have reached an 8-year low for private banks. This achievement signifies an improvement in the asset quality of these banks and their ability to manage credit risks effectively.

The decline in net NPAs is a positive indicator, as it reflects a lower level of bad loans in the loan portfolios of banks. Private banks have implemented rigorous credit risk management practices, including robust loan monitoring systems, stringent underwriting standards, and timely resolution of non-performing assets.

The decline in net NPAs is not only a positive signal for private banks' financial health but also instills confidence in investors and stakeholders. It indicates the banks' ability to maintain sound asset quality, mitigating potential losses and preserving their capital base.

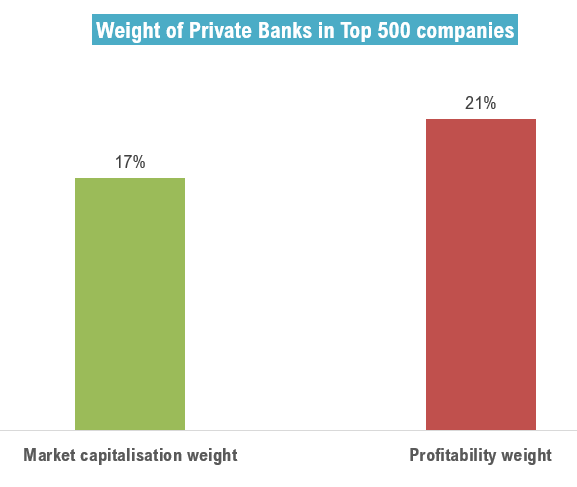

Under representation of Private Banks Despite Substantial Profitability

Data as on 30 June 2023. Source – DSP Internal, Bloomberg

A fascinating disparity has emerged as private banks showcase their resilience and financial prowess. When it comes to the market capitalisation based indices comprising the top 500 companies, private banks command a weight of 17%, highlighting their significant presence. However, a closer examination reveals an intriguing twist—their weight in terms of profitability surpasses that of their market capitalisation. Private banks contribute a substantial 21% to the overall profitability of these indices, signifying their remarkable ability to generate substantial earnings and bolster the banking sector's growth. This disparity between market capitalisation and profitability weights offers investors a unique perspective and potential advantage. It suggests that private banks' profitability potential may be underestimated by the broader market, providing investors with an opportunity to uncover hidden value.

Does the performance of private banks mean darkness for PSU Banks?

It is evident from the data that the future looks bright for private banks, and investors wouldn’t be disappointed if they banked on its potential. However, does that mean a dungeon of disappointment for PSU banks?

Well, not really! The story of revival for Public Sector Undertaking banks in India may have just begun. With recent reforms, capital injections, and strategic measures, PSU banks are poised for a turnaround. This revival story holds the promise of renewed growth, improved asset quality, and enhanced profitability.

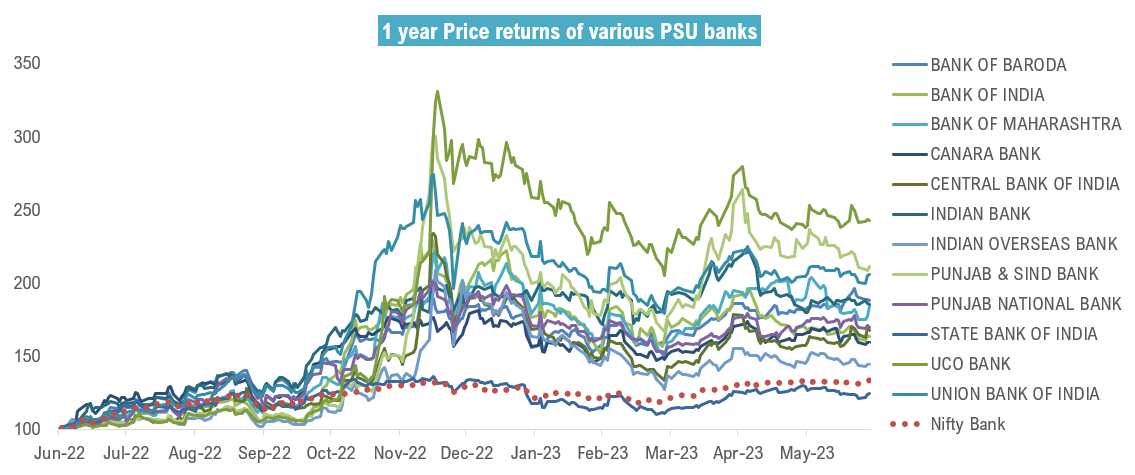

Finding a ray of hope in the revival of PSU banks

Over the past year, the price returns of various PSU banks have improved, indicating that the sector is on the path to revival.

Source – Bloomberg. Data as on 30 June 2023.

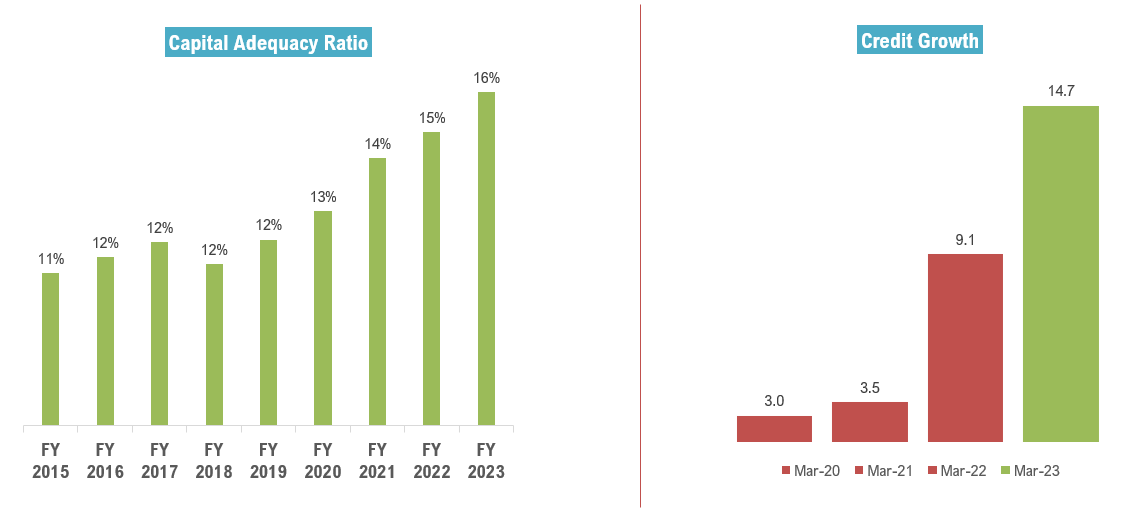

Public sector banks (PSUs) in India have started to outperform private banks after a decade of underperformance, signaling a significant shift in the banking sector. This revival is driven by comprehensive reforms and restructuring measures undertaken by the government, including capital infusion, governance reforms, and improved risk management. PSUs have shown notable improvement in asset quality, reducing non-performing assets and provisioning for bad loans. Their profitability and capital adequacy ratios have strengthened, instilling investor confidence. Furthermore, PSUs have enhanced their lending capabilities and expanded credit portfolios, supporting businesses and economic growth. This outperformance of PSUs highlights the importance of a strong public banking system for financial stability, inclusive growth, and sectoral support. Investors now have the opportunity to consider a balanced investment strategy that includes both private and public banks, capitalising on the strengths and potential of each segment.

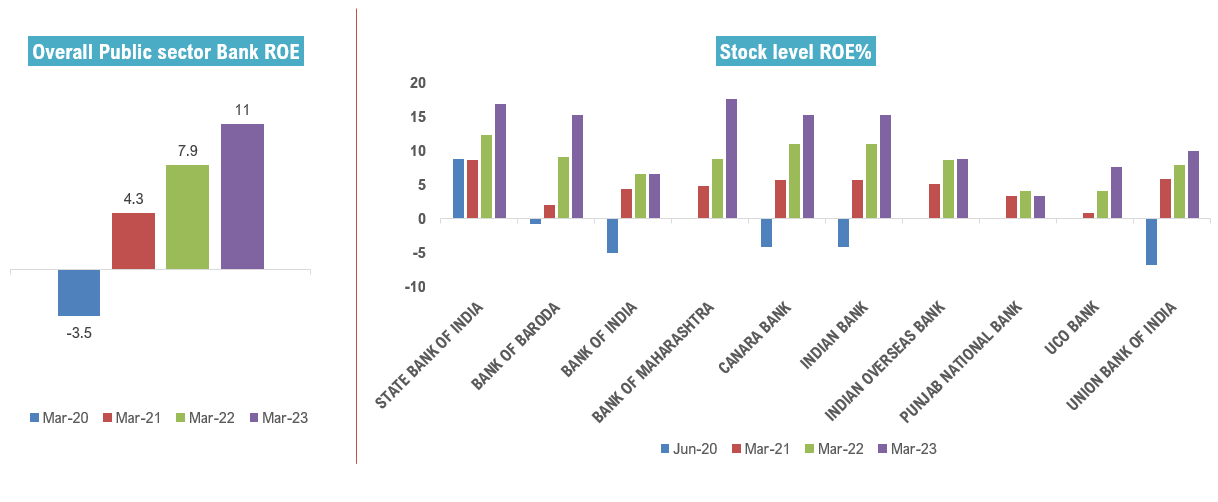

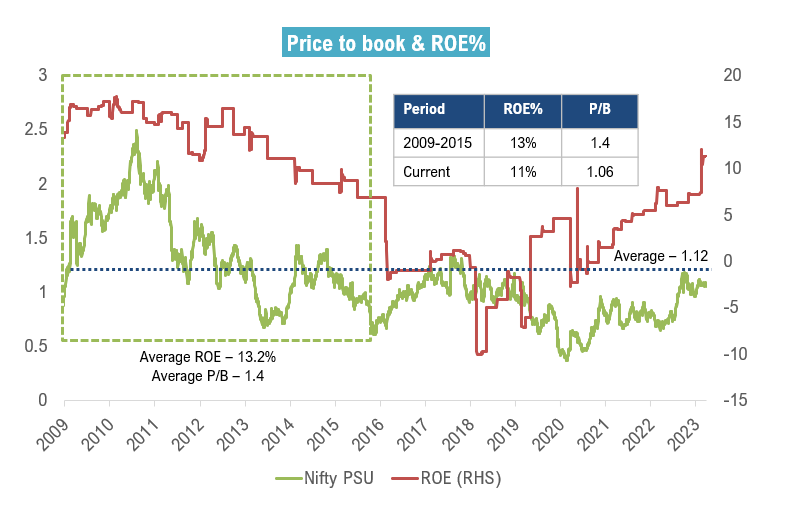

Striking Turnaround with Significant Improvement in Return on Equity (ROE)

Source – Bloomberg. Data as on 31 Mar 2023.

From March 2020 to March 2023, the Return on Equity (ROE) for the entire PSU sector has improved from -3.5% to 11%. This improvement in ROE is reflected in the performance of individual banks within the sector, with many showing positive growth in profitability and financial stability. This suggests that despite the challenges faced by the sector, there are positive indications of recovery and growth.

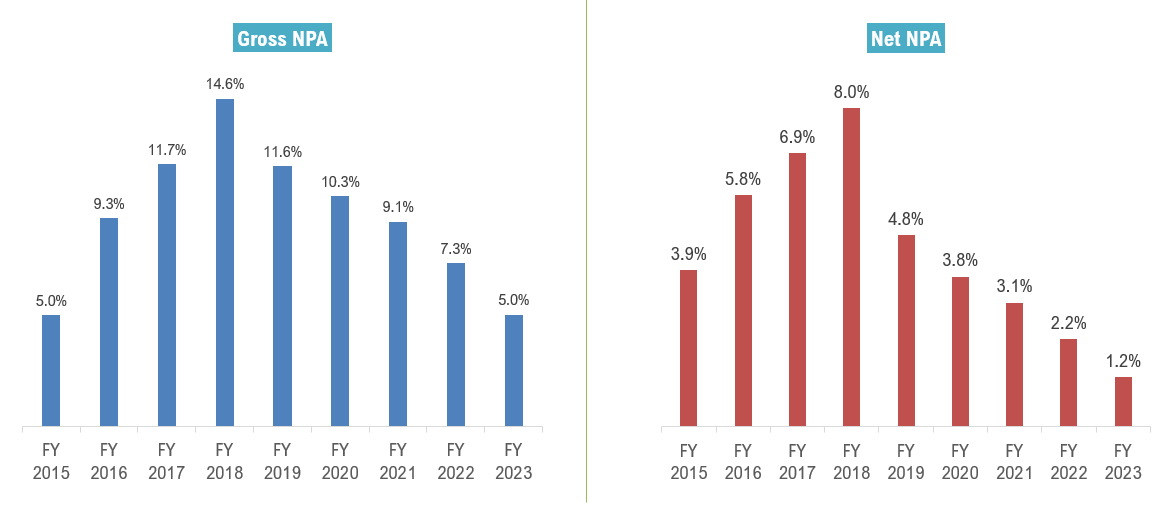

Public Sector Banks achieve a 9-Year low in NPAs indicating remarkable progress

Data as on 31 Mar 2023. Source - RBI

The non-performing assets (NPAs) of public sector banks in India have reached a nine-year low, indicating a significant improvement in asset quality. This achievement highlights the effectiveness of reforms and restructuring measures implemented by the government to strengthen public sector banks. The reduced NPAs not only enhance the profitability and stability of these banks but also instil confidence in investors and stakeholders. This positive trend showcases the resilience and potential of public sector banks in contributing to the growth and stability of the Indian banking sector.

The merger of public sector banks plays a significant role in the revival story

Source – CMIE, RBI. Data as on 31 Mar 2023.

The merger of public sector banks in India has had a profound impact on their balance sheets and credit growth, leading to strengthened financial positions. The consolidation of PSUs aimed to improve efficiency, synergise operations, and enhance capital adequacy. As a result, the merged entities have experienced improved asset quality, reduced non-performing assets, and increased provisioning coverage. Additionally, the merged PSUs have witnessed enhanced credit growth, as they are now better equipped to meet the financing needs of individuals and businesses. This strategic consolidation has played a vital role in bolstering the overall stability and resilience of the public sector banking sector in India.

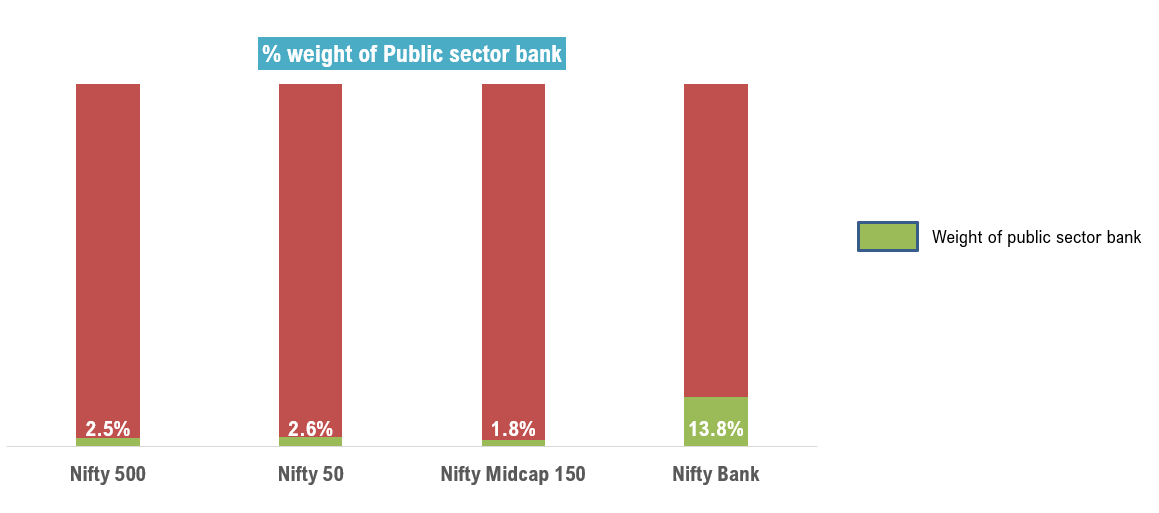

Current Underrepresentation In the Broader Indices makes case for separate investment

Source – NSE. Data as on 31 Mar 2023.

While public sector banks in India have shown significant improvement in their financial performance and stability, their representation in the broader market index remains relatively lower. This disparity presents an opportunity for growth and potential upside for PSUs. As the reforms and consolidation efforts continue to strengthen PSUs, their ability to generate substantial earnings and contribute to the banking sector's growth becomes evident. With ongoing reforms and increased focus on governance, risk management, and operational efficiency, PSUs are poised to bridge the representation gap in the broader market index and unlock their full growth potential. As investors recognise the untapped value and growth prospects of PSUs, they can capitalise on this opportunity to gain exposure to a sector with promising future prospects.

With its Undervalued Potential, the Sector may be Primed for Re-Rating and Investment Opportunities

The Nifty PSU Bank Index, which represents the performance of PSU banks listed on the National Stock Exchange (NSE), is currently trading at a valuation below its historical average. This suggests that the market is undervaluing the PSU bank sector, possibly due to concerns over non-performing assets and other operational challenges faced by some banks in the sector.

Source – Bloomberg. Data as on 30 Jun 2023. ROE – Return on Equity

However, as mentioned earlier, there are positive signs of improvement in the fundamentals of the PSU bank sector. The ROE for the entire sector has improved significantly over the past few years, and NPA has gone down, indicating that banks are becoming more profitable and efficient. This improvement in ROE suggests that the sector is well-poised for a re-rating, where the market recognises the improved financial health and growth potential of PSU banks and adjusts their valuations upwards.

Overall, the combination of undervaluation and improving fundamentals make the PSU bank sector an attractive investment opportunity for investors with a long-term investment horizon.

How Can Retail Investors Benefit from the Growth of the Indian Banking Sector

To harness the potential of the Indian banking sector, retail investors can explore the following avenues:

Investing in Banking Stocks: Conduct in-depth analysis of banking company stocks, industry trends, and market conditions. Select stocks of well-established banks demonstrating strong financial performance, efficient operations, and a robust business model. However, this approach requires careful research and monitoring of individual banks to make informed investment decisions.

Banking-focused Mutual Funds: Invest in mutual funds that specialize in the banking sector. These funds offer exposure to a diversified portfolio of banking stocks managed by professional fund managers. By investing in banking-focused mutual funds, investors can benefit from the expertise of the fund manager and gain access to a broader range of banking companies, reducing the risk associated with investing in individual stocks.

Banking Sector ETFs: Consider banking sector Exchange Traded Funds (ETFs), which track the performance of specific banking indices or the overall banking sector. By investing in banking sector ETFs, investors can gain exposure to a basket of banking stocks, providing diversification and the flexibility to buy and sell throughout the trading day at market prices.

Banking Sector Bonds: Explore investing in banking sector bonds issued by banks or financial institutions. These bonds offer fixed-income returns and can provide a stable income stream for investors. However, it is important to assess the creditworthiness and risk associated with the bonds before investing.

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment