INVEST IN THE TOP PRIVATE AND PSU BANKS OF INDIA

INTRODUCING TWO NFOs

^ An open ended scheme replicating/ tracking Nifty Private Bank Index

# An open ended scheme replicating/ tracking Nifty PSU Bank Index

DSP NIFTY PRIVATE BANK ETF

Why consider investing in DSP Nifty Private Bank ETF?

Long-term outperformance

The Nifty Private Bank Index has grown by 26x vs 12x by the Nifty 50 index in the last 18 years1

Increase in market share

The share of Private Banks has doubled from 19% to 38% in last 18 years, indicating growing trust in the sector2

Attractive valuations

With a fall in Price to Earnings (P/E) ratio by 6.7% compared to the historical average in the last 2 years, valuations in private banks have become attractive for investments4

Future potential

The private banking space is expected to potentially grow, backed by increasing wealth, globalisation, technological advancements and high demand for specialised services

Strong financials

Relatively Strong and well capitalized balance sheets backed by credit growth growing at ~15% and Non Performing Assets (NPAs) at a 8 year low3

Where exactly does it invest?

DSP Nifty Private Bank ETF is an open ended scheme replicating/ tracking the Nifty Private Bank Index. It invests in private bank stocks in the same proportion as that of the Nifty Private Bank index.

Who should invest?

If you value low-cost investing ideas

If you are okay with the returns not beating the respective Index the ETF is tracking

If you can stay invested for more than

5 years

If you can time the sector based on market

dynamics

Know this before you invest

Expect short term return fluctuations, especially during periods of market volatility

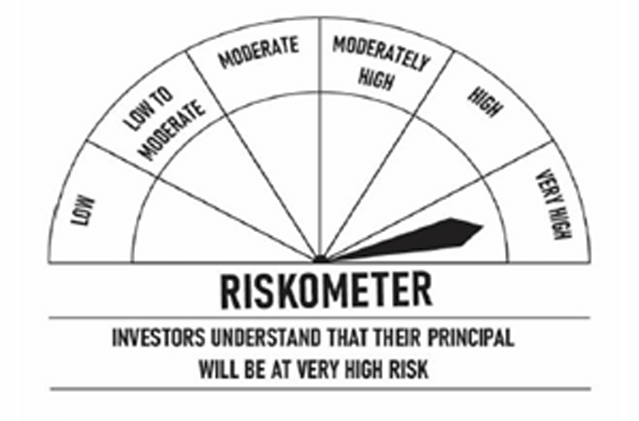

Being a single sector based fund, DSP Nifty Private Bank ETF comes with high risk as well

What do you need to invest?

01

A trading account

You need a trading account with a broker/ sub-broker

02

A Demat account

You also need a Demat account for holding the ETF units

Frequently Asked Questions

What is an ETF?

Exchange Traded Funds, or ETFs, are a type of funds/schemes that track an index, sector, commodities or other assets, but which can be purchased or sold on the stock exchange like any regular stock. They combine the features and potential benefits of stocks or bonds and mutual funds. Like individual stocks, ETFs can be traded throughout the day at real time prices that change based on supply and demand.

What are the benefits of an ETF?

Simplicity - Buying / Selling ETFs is as simple as buying / selling any other stock on the exchange.

Realtime Trading - ETFs allow investors to take benefit of intraday movements in the market, which is not possible with open-ended Funds.

Low cost - The cost of investing in ETFs is generally lower than an active fund invested in the same market of assets.

Seamless trading - Existing investors insulated from bearing transaction costs of other investors coming in or going out.

Transparency - Holdings published daily, so investor always knows exactly what is owned.

Who is the fund manager for the fund?

Mr. Anil Ghelani and Mr. Diipesh Shah will be the fund managers of the Scheme.

Disclaimer

1 Source – MFIE. Data as on 28th June 2023. This figure pertain to performance of the index and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.

2 Source – RBI, ICICI Securities. Data as on 31st March 2023

3 Source - CMIE. Data as on 31st March 2023

4 Source – NSE. Data as on 28th June 2023

During the NFO period, you can invest as low as Rs. 5,000/- and in multiples of Re.1/-. Note that unit allotment (if you invest during the NFO period) units will be issued at a premium approximately equal to the difference between face value and Allotment Price during the NFO and at NAV based prices on an on-going basis

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned Schemes.

|

DSP Nifty Private Bank ETF An open ended scheme replicating/ tracking Nifty Private Bank Index |

This product is suitable for investor who are seeking*

|

|

||||||||

* Investors should consult their financial advisers if in doubt about whether the Scheme is suitable for them.

BSE Disclaimer

It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer clause of the BSE Limited.

NSE Disclaimer

It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the ‘Disclaimer Clause of NSE’.