Summary

Indian equities may be in an overvalued phase, as market returns have outpaced profit growth, with the Nifty TRI showing a sharp rise in price multiples over the last 12 years. This trend highlights potential risks for investors, underscoring the importance of careful evaluation to avoid overpaying for equities.

Recently, there has been much discussion about how the Indian equities market might be going through an overvalued phase. What follows is a perspective on this question that’s grounded in what global markets have taught us over the past several decades.

Historically, corporate profit growth has tended to lag nominal GDP growth. It’s true that once in a while, profit growth can exceed nominal GDP growth. However, if profits were to consistently beat nominal GDP (which is possible only in an economy dominated solely by exporters), then corporate profits would eventually exceed the GDP, and such a scenario is quite unlikely. Thus, typically, Indian corporate profits do not grow at the same rate as the country's nominal GDP.

Now, over time, stock market returns tend to trail corporate profit growth due to a lack of high-quality business managers, as many firms have to contend with mediocre management that detracts from their growth potential. Going further down the chain, investor returns often lag stock performance due to transaction costs and the difficulty of generating alpha, as the market largely behaves as a passive, no-alpha aggregation.

The upshot is that if nominal GDP grows at 10% then, over time, corporate profits will lag nominal GDP, stock price total returns will lag corporate profits, and investors returns will lag stock price total returns.

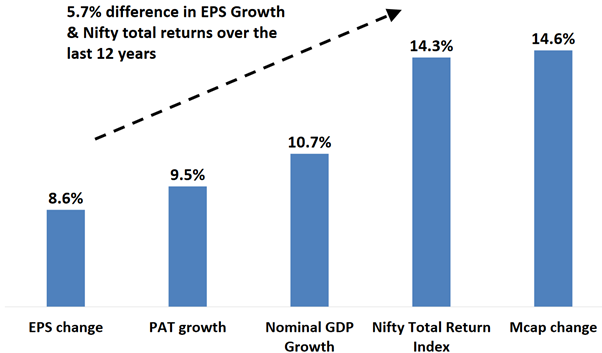

How well does this typical historical picture match up with what we’re currently seeing? Well, current returns in the Indian market, as indicated by the Nifty Total Return Index (TRI), reflect a significant increase in price multiples, thus posing a key risk for investors. In the last 12 years, the PE (price-to-earnings) multiple for the Nifty Index has increased by approximately 680 basis points (from 17x to 23.8x).

Source: Bloomberg, CMIE, DSP. Data as on 31 Oct 2024.

As you can see in the graph above, far from lagging behind profit growth (as measured by the change in EPS, or earnings per share), the market’s returns have greatly exceeded the latter. This seems to suggest that the Indian market is indeed overvalued at this point, and that new investors could easily end up overpaying for equities if they’re not circumspect.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of July 2024 (unless otherwise specified) and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment