Summary

You think you understand investing, equity, debt, large cap, international. But then you open a fund’s portfolio page… and boom, instant confusion. What does 65% equity really mean? Is gold debt? Are ETFs equity? We’ve been there too. So we rebuilt how portfolios show up on our platform simpler, clearer, smarter.

When I first started investing, I thought I understood the basics terms like equity, debt, market cap, domestic, international. They all made sense. Separately.

But then I opened a mutual fund scheme’s portfolio page.

Boom. Instant confusion.

I saw something like “Equity - 65%” and thought:

Is that domestic or international?

If it says 'large cap', does that include Apple? Or Tata?

What about ETFs, are they equity or something else?

Where do silver and gold fit in? Equity? Debt?

And when they say ‘holdings’, is that just stocks, or debt too?

Every app I opened just made things messier. More charts. More categories. More questions.

Turns out, it wasn’t just me.

So, We Asked Around

When we started asking around new investors, seasoned professionals, even some financial advisors, the response was unanimous:

“Yes, we struggle too.”

That’s when we decided: let’s fix this. At least on our platform.

We didn’t want investors to just see numbers we wanted them to understand their investments.

What Happened Behind the Scenes

So began our deep-dive. We at digital experiences team, had over 20 conversations with investment experts, data teams, designers, and developers. We argued about everything from how to show gold to whether ETFs should get their own category.

We didn’t want another fancy-looking pie chart. We wanted real clarity.

So we focused on the stuff that actually helps:

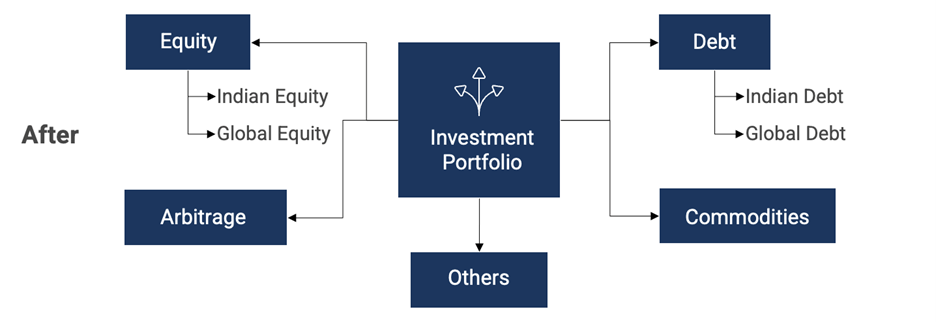

- Clear breakdowns of equity (domestic vs. international)

- True market cap segmentation (what’s really large cap)

- Separating out different kinds of debt

- Clear separation of holdings

- Classification of ETFs, gold, silver, REITs and more

And we had to make this understandable to someone investing ₹500 or ₹50 lakh.

What’s New (and Why It’s Awesome)

Six months later, after countless revisions, backend builds, design refinements, and user testing, we launched the new Asset Allocation view on our scheme pages.

Now when you open a fund on our platform and tap “Portfolio”, it won’t feel like reading a foreign language.

You’ll actually get what you’re seeing.

Like, “Ohh cool, that’s how much is in Indian equity. That’s international. That’s gold. Got it.”

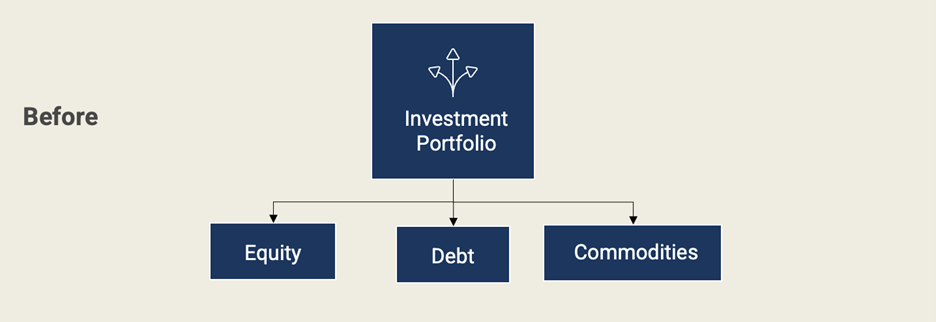

Here’s a quick snapshot of the changes we implemented Before vs. After:

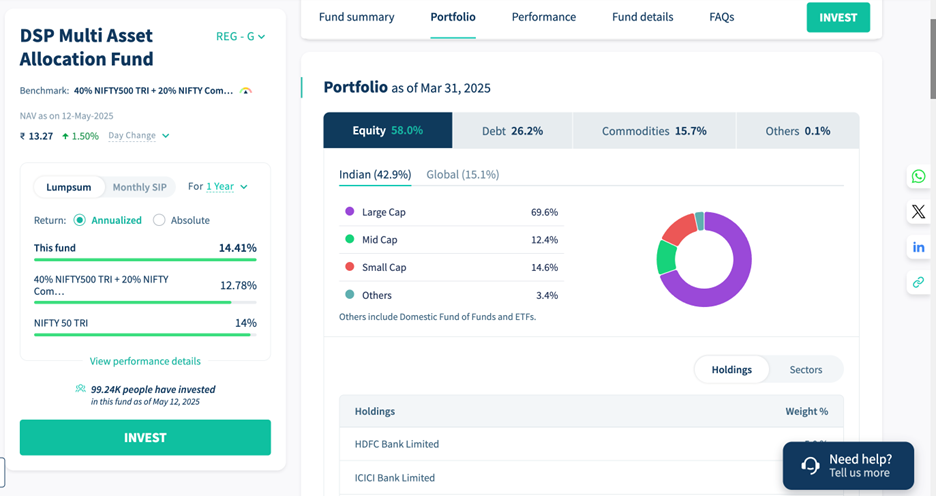

You may also look at our DSP Multi Asset Allocation Fund or any of our other schemes here. Click on ‘Portfolio’ and see how every investment is now mapped clearly, simply, insightfully.

Still Lost? Ping Us.

This update isn’t the end, just the start. If you explore the new layout and still go, “uhh what?”, just let us know.

Seriously. We’re listening.

Because the more you understand your money, the better (and more confident) your investing decisions will be.

Have feedback on our website or app? Want us to change something? Make some improvements? Tell us on [email protected] so we can get better 🙏🏻

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Comments

Total 1

Anonymous

09-06-2025

Very Helpful

Write a comment