As you might have learnt in the previous article, diversification is a risk management practice of spreading your investments over a range of securities and industries so that your portfolio can withstand market volatility.

There has to be a defined proportion of various assets in your portfolio. Over exposing or under exposing your portfolio to any single asset might expose you to greater investment risk, thereby resulting in lesser return.This is where asset allocation becomes important. Asset Allocation is distributing your money over multiple asset classes to balance risk with potential reward. This is done by allocating different specified percentages of your total investment corpus to the various identified asset classes. The allocation to each asset class is determined by your risk tolerance, goals and investment time horizon.

The cornerstone of the asset allocation process is the need to rebalance your portfolio periodically. Every asset has its own performance cycle and each of them performs differently in a given time period. It is quite possible that the asset that has performed well recently is dominating your portfolio. This however increases your risk and your portfolio has to be rebalanced correctly to a suitably balanced allocation.The cornerstone of the asset allocation process is the need to rebalance your portfolio periodically. Every asset has its own performance cycle and each of them performs differently in a given time period. It is quite possible that the asset that has performed well recently is dominating your portfolio. This however increases your risk and your portfolio has to be rebalanced correctly to a suitably balanced allocation.

How does Asset Allocation help?

Just like the chess game requires different pieces that can move in different directions, your portfolio requires a good mix of equity, debt, cash and other asset classes, each with specific roles to play in your portfolio.

For instance, if equities perform well, the value of your portfolio allocated to equities will increase over a period of time but it will also involve higher risk.

Debt, on the other hand, helps add stability to your portfolio and offers only limited returns but importantly at lower risk.

Cash in the bank may give you a sense of security, but it doesn’t earn much income, especially given the menace of inflation.

Asset allocation helps you control investment risk even while ensuring that you participate in the returns generated by the different asset classes. It builds discipline into your portfolio by fixing an allocation pattern with defined percentages for each asset and ensuring that you bring your portfolio back to that allocation pattern periodically (rebalancing), you optimize your portfolio’s risk-return properties.

How can you decide the right asset allocation?

There is no fixed formula for deciding your asset allocation. It really depends on your risk profile and the financial goals you want to achieve. Your risk profile is determined by a combination of your capacity to take risk (risk capacity), your willingness to take risk (risk tolerance), and the actual risk you have to take for you to achieve your financial goals.

But why should one take any risk at all?

Don’t forget that risk and returns are really two sides of the same coin. If you want higher returns, you must take on higher investment risk. Remember that risk is essentially the price you are willing to pay for an opportunity.

Often, risk capacity and risk tolerance may be out of sync; for example, suppose your income is highly stable and you have job security, you may be in a position to take on higher risk. So your risk capacity is high. However, if you get easily upset with temporary erosion to your investment value, your general risk tolerance may be low. The asset allocation for this profile should have a balance between debt and equity in a manner where the investor is comfortable with the risk and expected returns from the portfolio.

Based on risk profile, investors may be slotted into the following three broad categories:

Allocation |

High risk profile |

Medium risk profile |

Low risk profile |

Equity |

50% |

30% |

10% |

Debt |

15% |

30% |

50% |

Real Estate/ Gold |

30% |

20% |

20% |

Cash and Deposits |

5% |

20% |

20% |

Note: The above table is only an illustration for understanding. Please consult your investment advisor to decide your asset allocation pattern.

The proportion of each asset varies according to the risk profile of the individual. The asset allocation pattern could be expressed as a band for each asset with a lower and higher limit. Only when either of the limits is breached, it requires your action in rebalancing.

Changes to Asset Allocation and Rebalancing

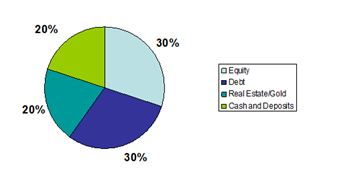

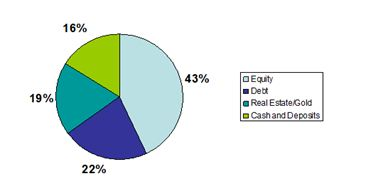

Let us assume that you are a medium risk profile person.

In a given period, your chosen equity assets performed well and increased in value. This would mean that despite no additional investment from you, equity will now form a larger part of your portfolio. In fact, with the market movements, your holding across various assets may breach their stipulated upper or lower limits. This may increase the risk you’re exposed to without you even realizing it.

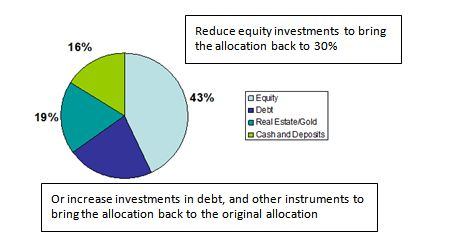

Therefore, your portfolio will need to be rebalanced to the allocation that you wanted initially. To rebalance your portfolio, you must reduce the percentage of equity investments or increase your investment in debt or other asset classes until the asset allocation falls within your originally assigned limits.

Remember, your asset allocation pattern is not cast in stone. It could change with time due to change in your income/expenditure pattern, addition/reduction of debt, new/reduced financial commitments, life stages, etc. This is why you must review your asset allocation periodically in consultation with your investment advisor and rebalance your portfolio if required.

In conclusion a well diversified portfolio needs an asset allocation pattern that optimizes your portfolio’s risk- return characteristics.

A great way for you to benefit from asset allocation is by investing in Mutual Funds. They offer you the in-built advantage of investing in a combination of different asset classes along with an expert constantly reviewing your portfolio and maintaining the right balance among assets.

Consult an investment advisor to know the right type of fund that is suitable for you.

Before we end this, you must keep these 4 steps in mind:

4 steps to optimal asset allocation

- Evaluate your risk capacity

- Judge your risk tolerance

- Identify your risk profile

- Formulate your asset allocation pattern according to your risk profile.

Key Takaways

- Asset allocation involves allocating specified percentages of your total investment corpus to the various identified asset classes.

- The allocation to each asset class is determined by your risk profile (risk capacity, risk tolerance and the actual risk you have to take).

- The key idea behind asset allocation is balancing the risk taken with the potential rewards.

- Periodic rebalancing to bring back the portfolio to your stipulated asset allocation is important to minimize investment risk.

Disclaimer: All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF & procedure to lodge/redress complaints, visit dspim.com/IEID. This is an investor education & awareness initiative by DSP Mutual Fund.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us