DSP TATHYA - September 2023

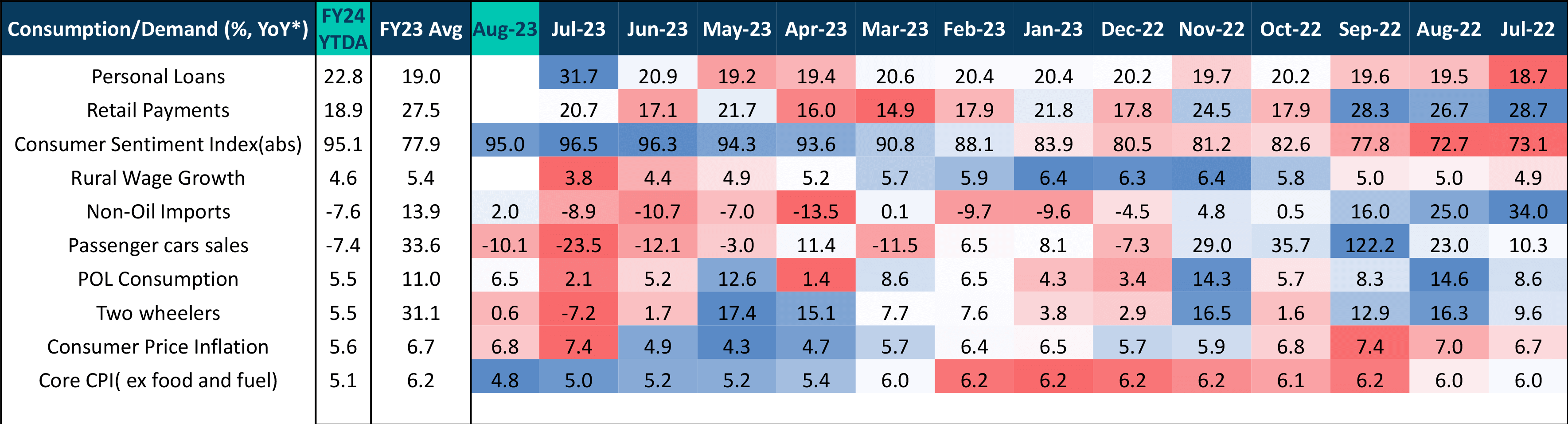

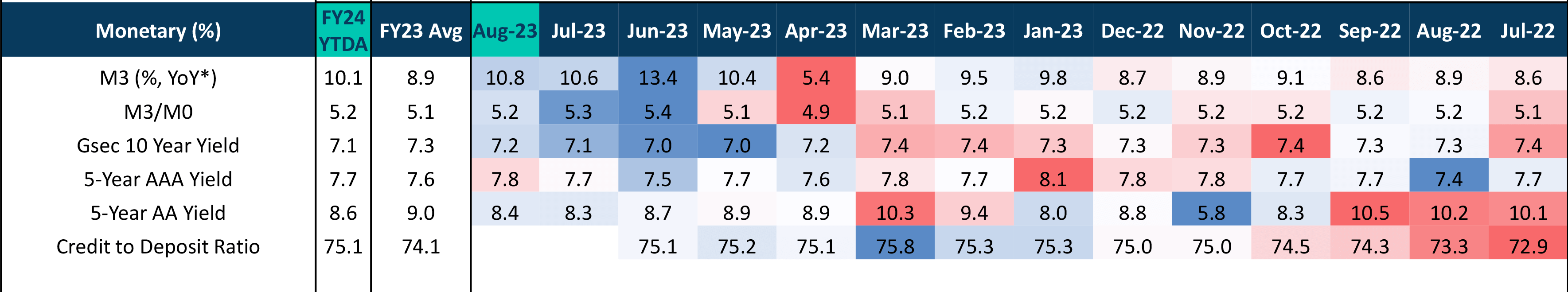

Consumer confidence remains strong, as reflected by the massive expansion in personal loans, despite an uptick in lending rate. The substantial jump in consumption of petroleum products, is majorly owed to high volumes sold amidst anticipation around rise in oil prices.

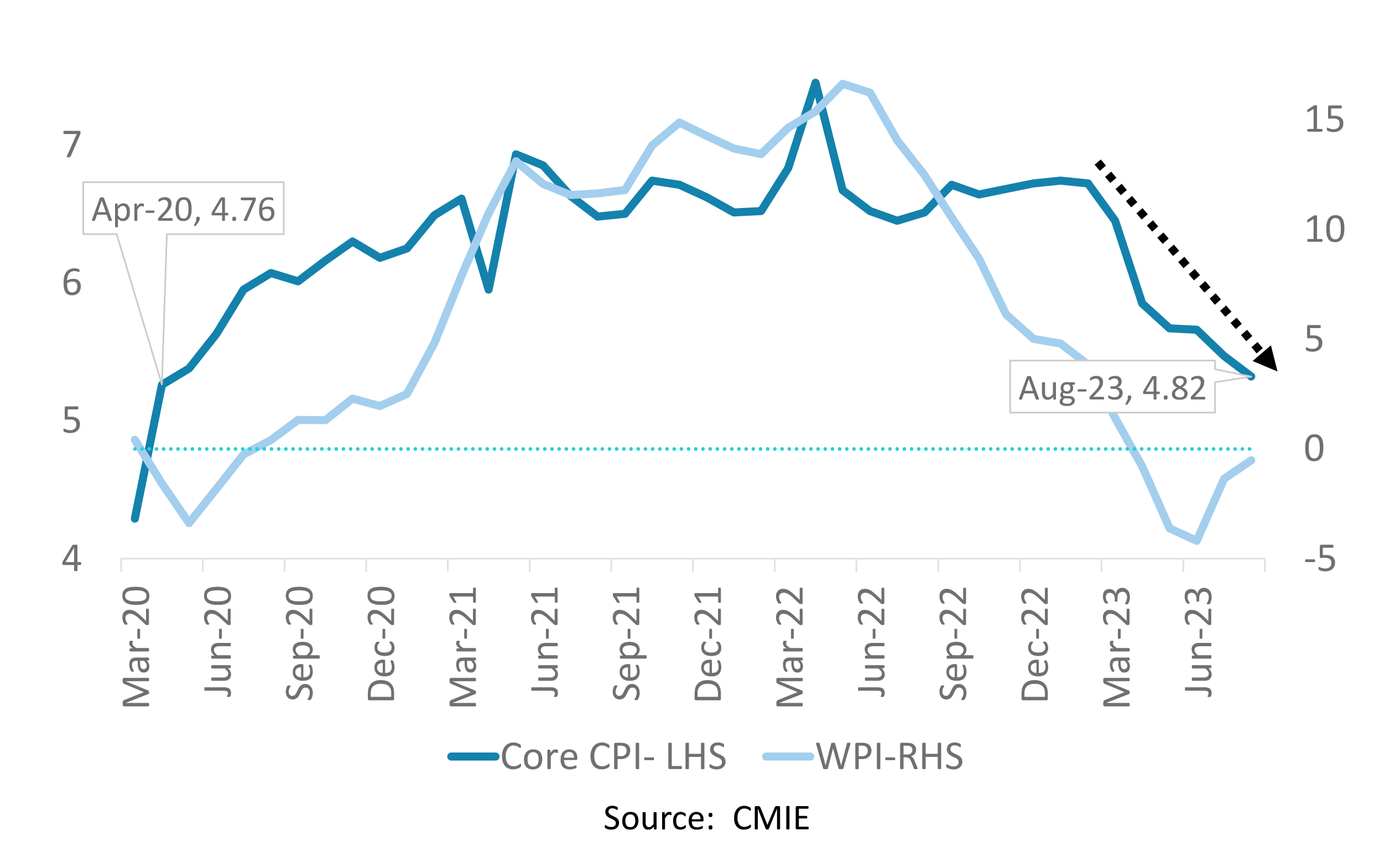

With core inflation dropping to a 40- month low, it has maintained a disinflationary trend for 2 quarters now. Growth in headline number remains high, owing to a rather swift rise in food prices.

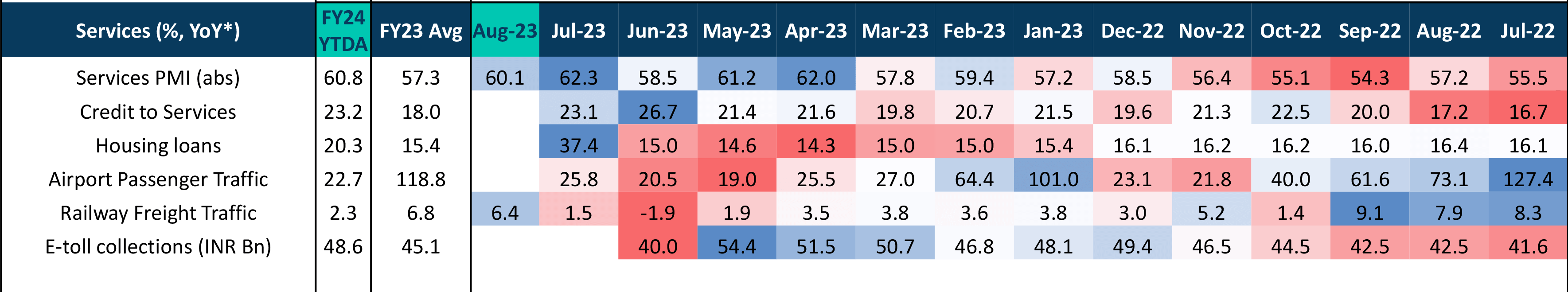

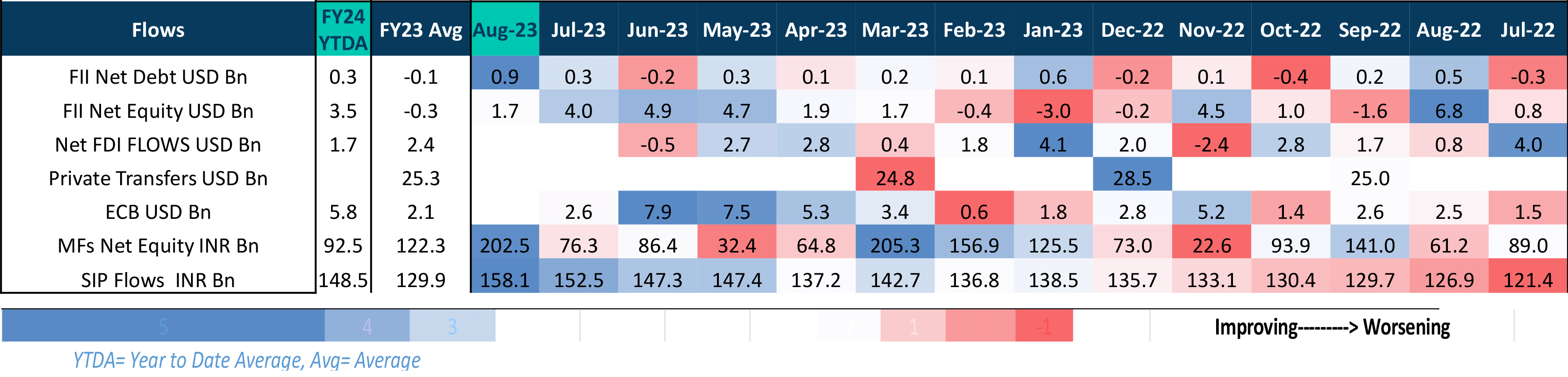

While FII flows in equity have slowed, the debt portion after reviving from temporary fall, has made a notable expansion. We re-iterate that given India is appearing a steady ship in choppy waters, it is likely to get its fair share of FII flows. Both, MF equity flows and the SIP book have experienced a notable increase.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.