DSP TATHYA - May 2024

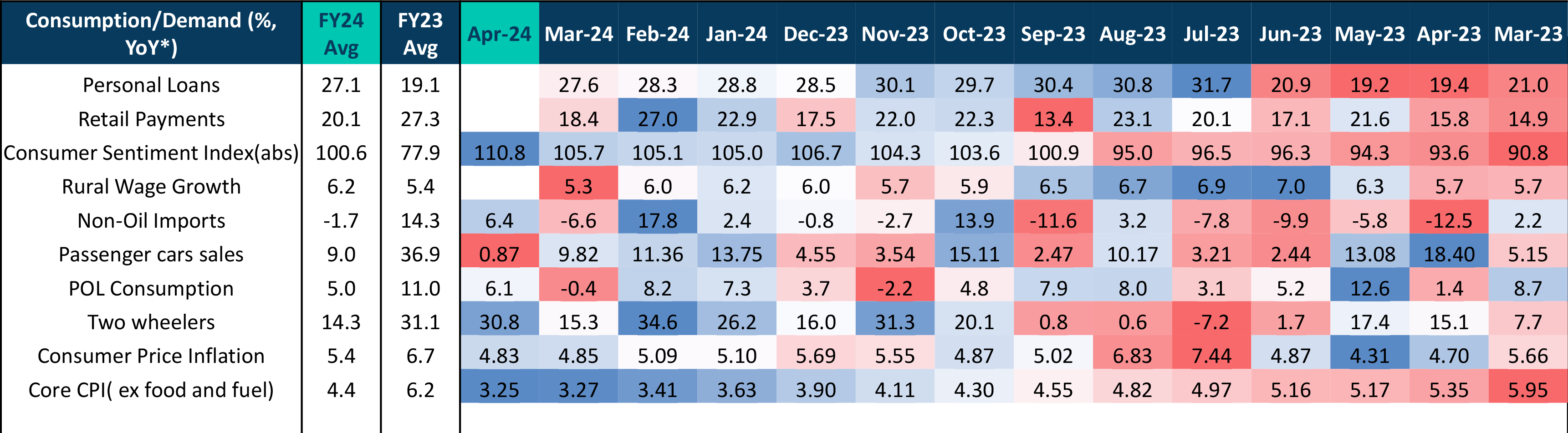

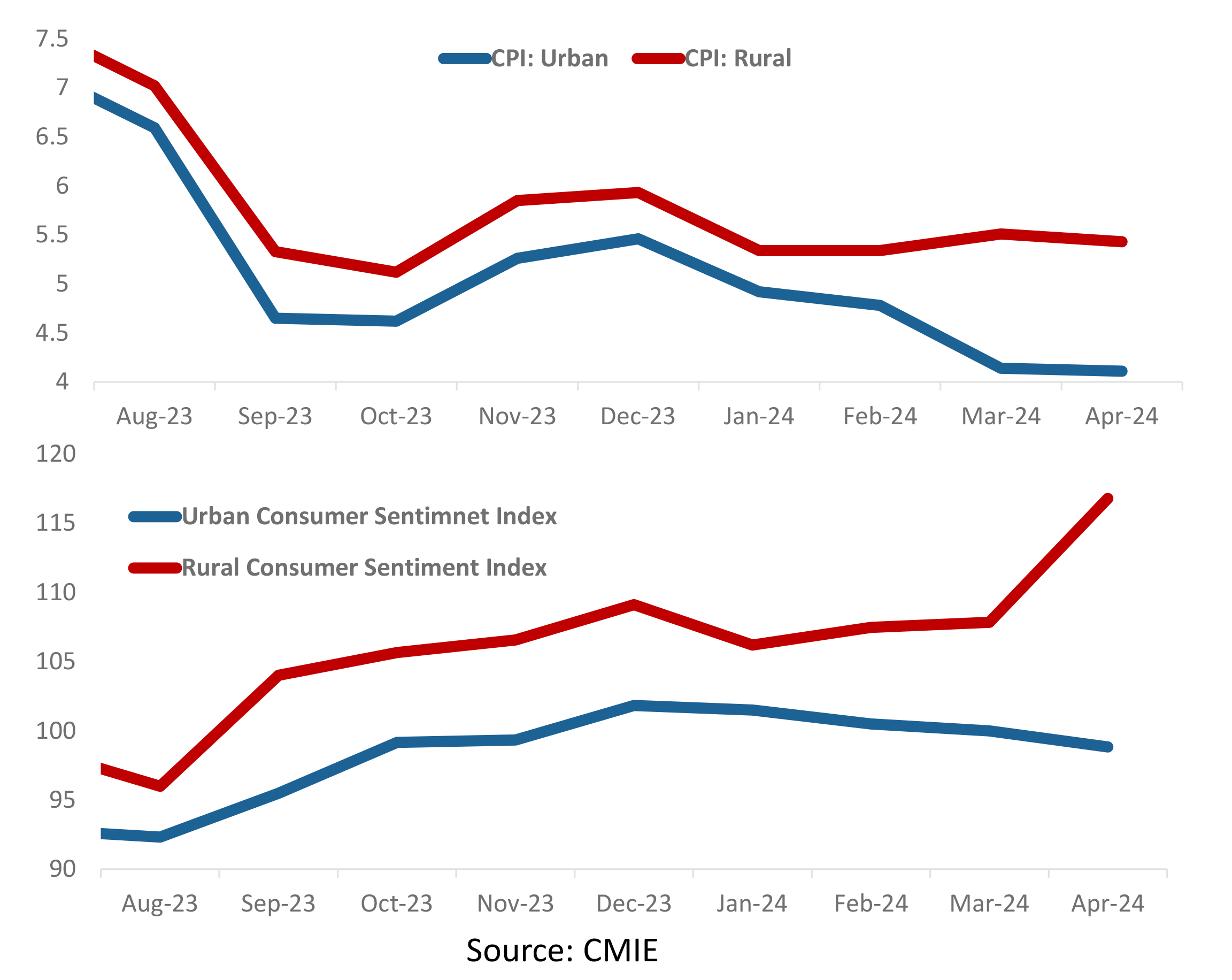

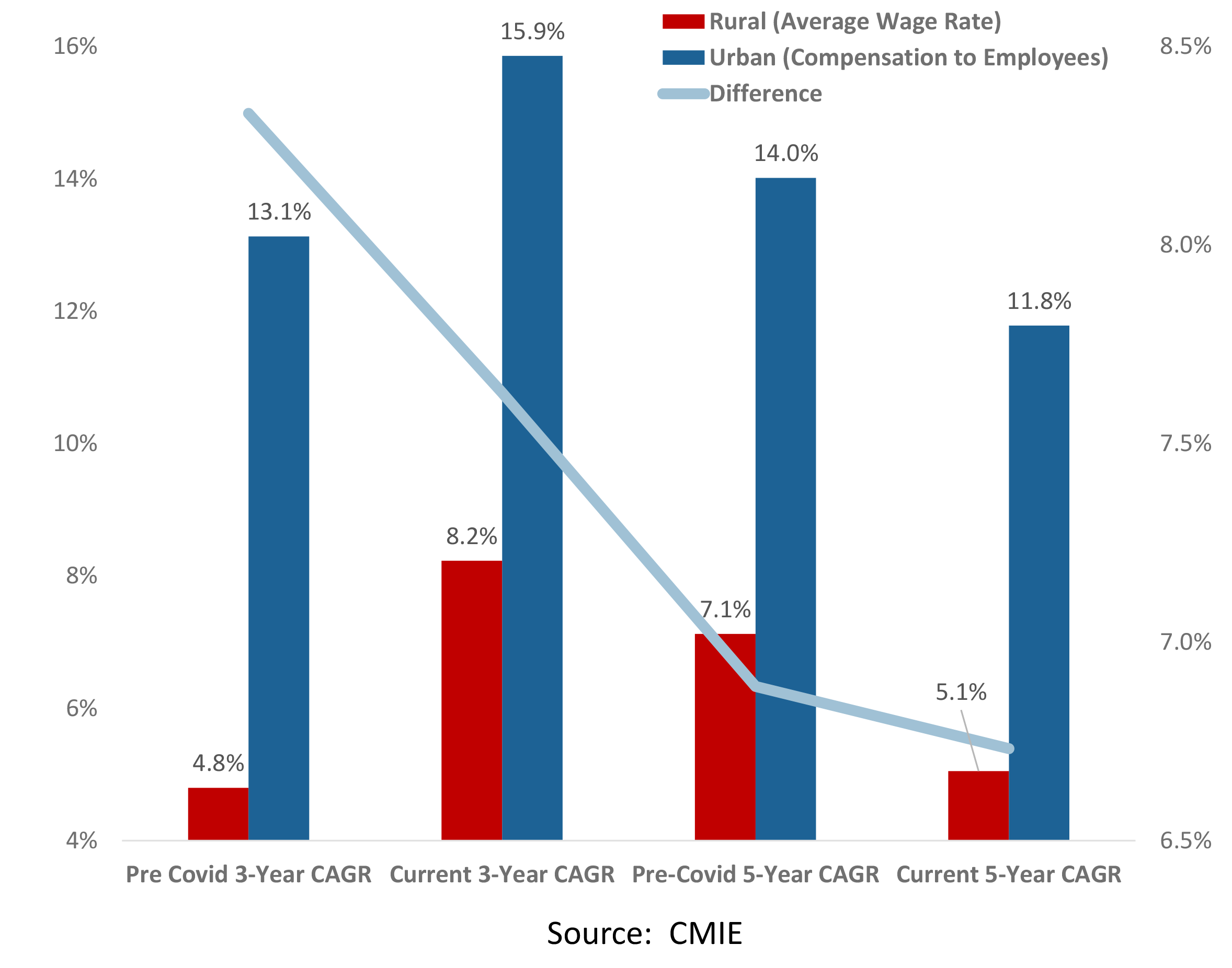

Consumer sentiment is stronger than ever before, not just registering a new high, but a significant uptick from the previous month’s number. But such optimism barely reflects across other demand numbers. Other than a few select indicators, most indicators’ FY24 Avg is significantly lower than that of previous year’s.

While a lower core inflation is pushing the headline number closer to the target with each print, the sustained low in the core number establishes a more serious concern around depressed demand in the face of higher rates. While a better than average monsoon could ease pressure on food inflation, it will still be few months before this effect begins to show in data.

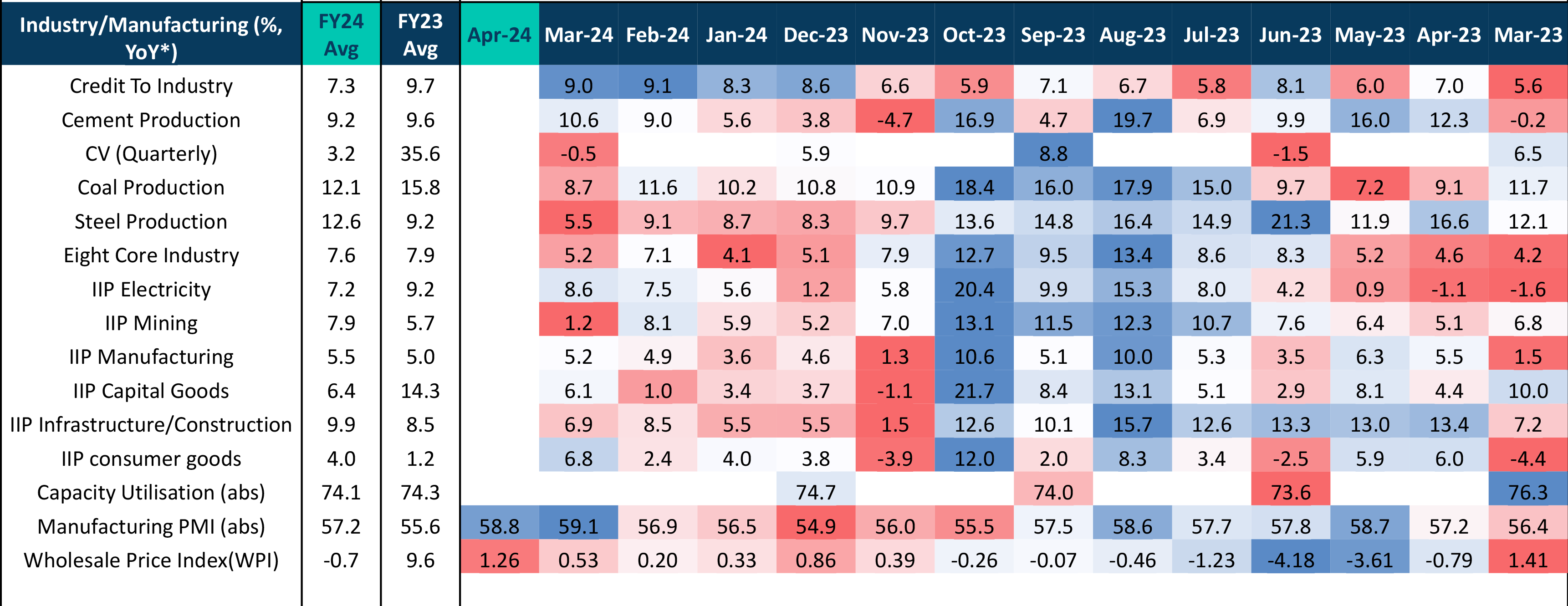

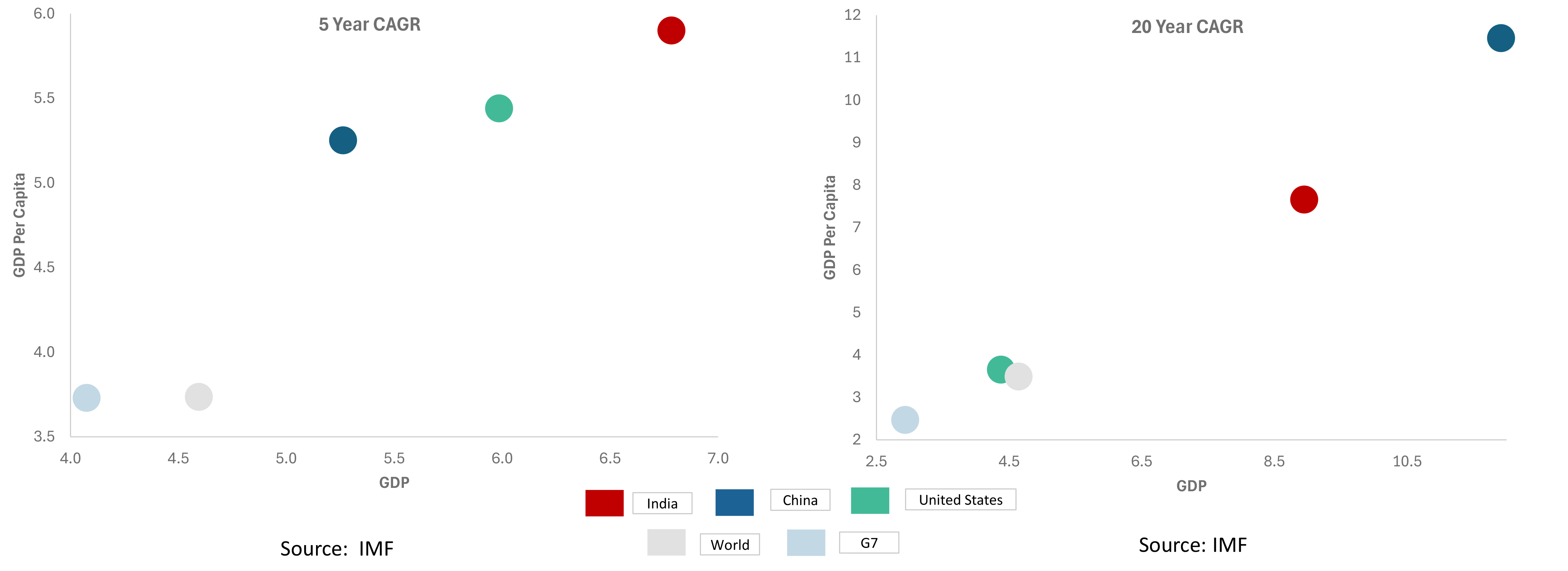

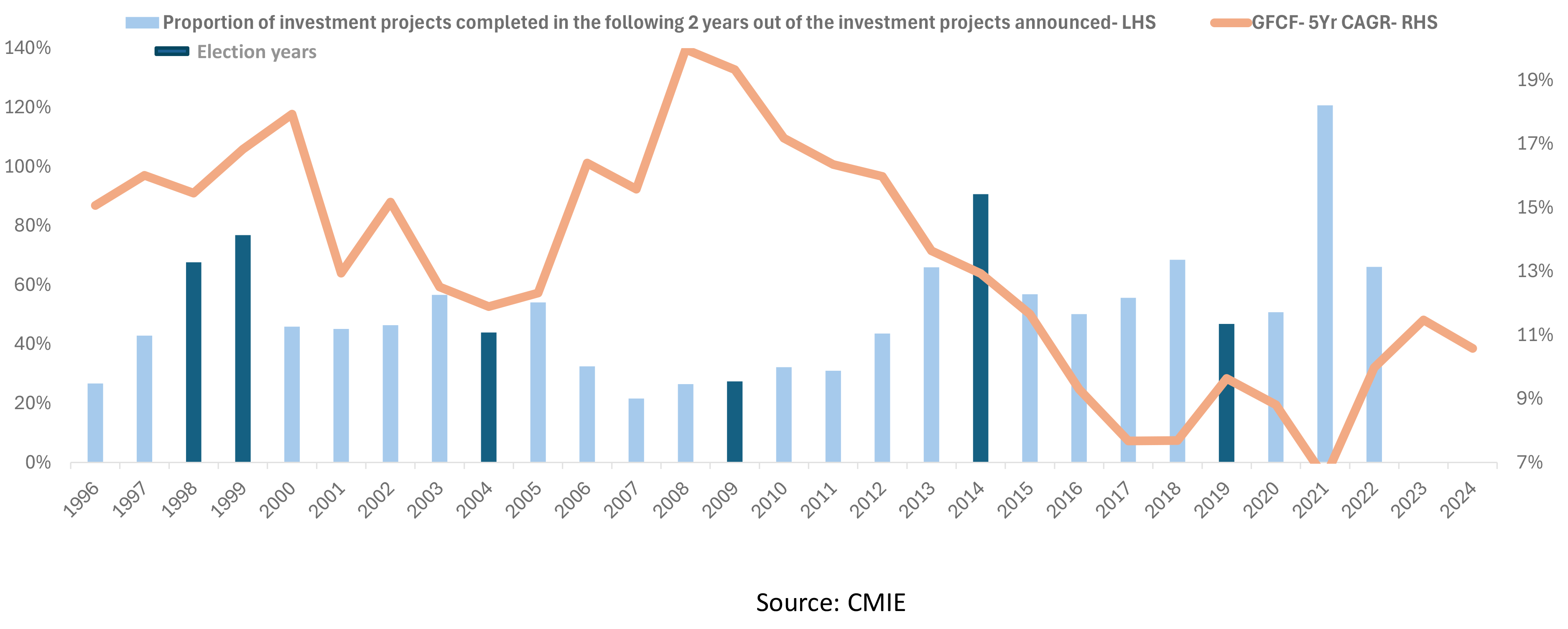

The Financial Year ended with a significant slump in the IIP numbers, with most sectors bleeding, with an already low base, and credit to industry remaining high. With GFCF being the sole driver of GDP growth, especially across the past few quarters, such tepid growth across industrial performance and infrastructure development, puts the GDP growth under greater scrutiny in the coming quarters. While WPI has recovered from its lows, it can reflect in turning around the disinflationary trend in the headline number.

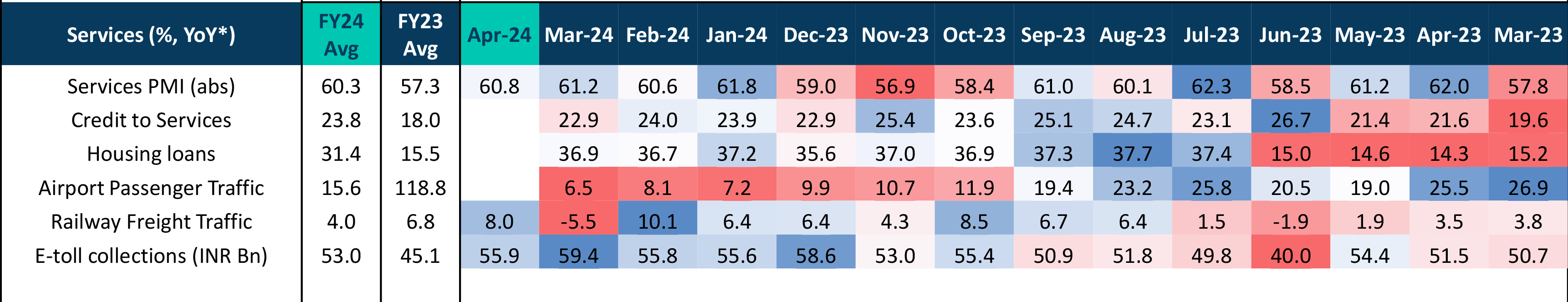

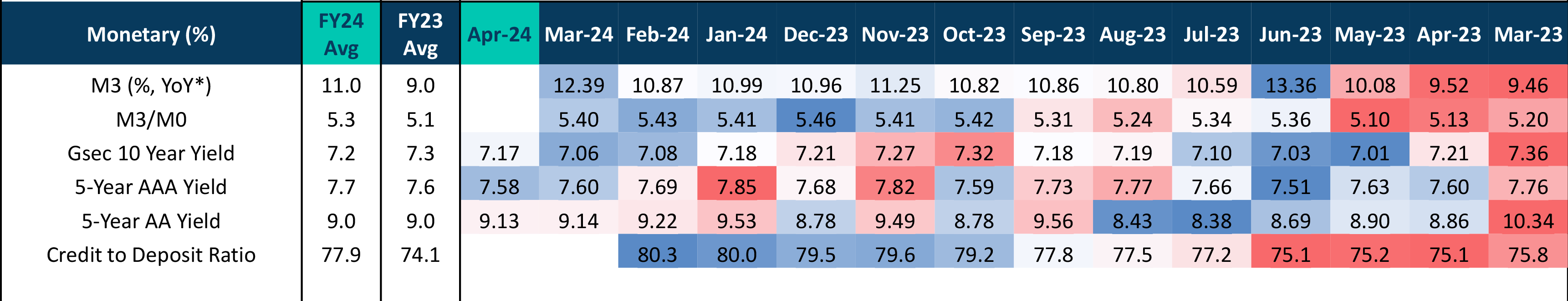

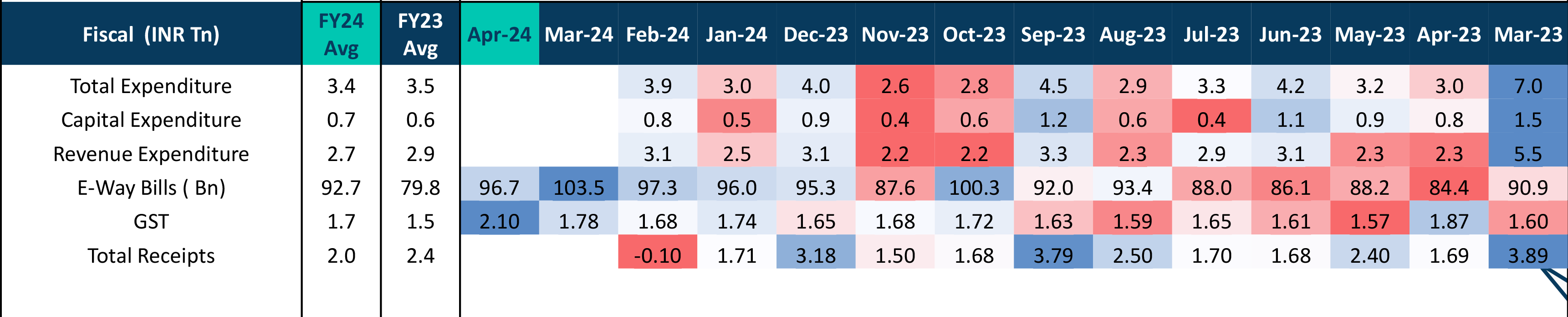

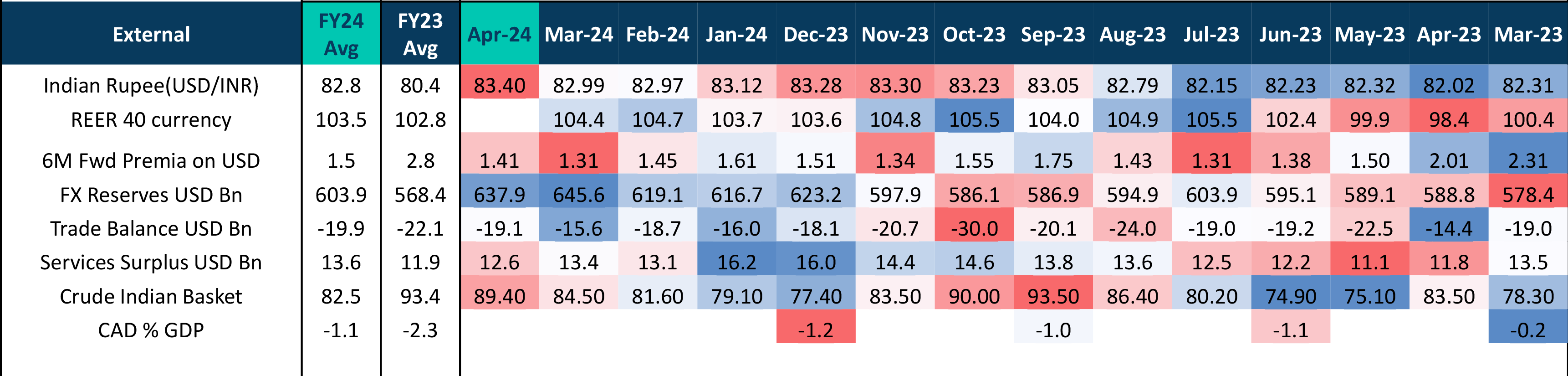

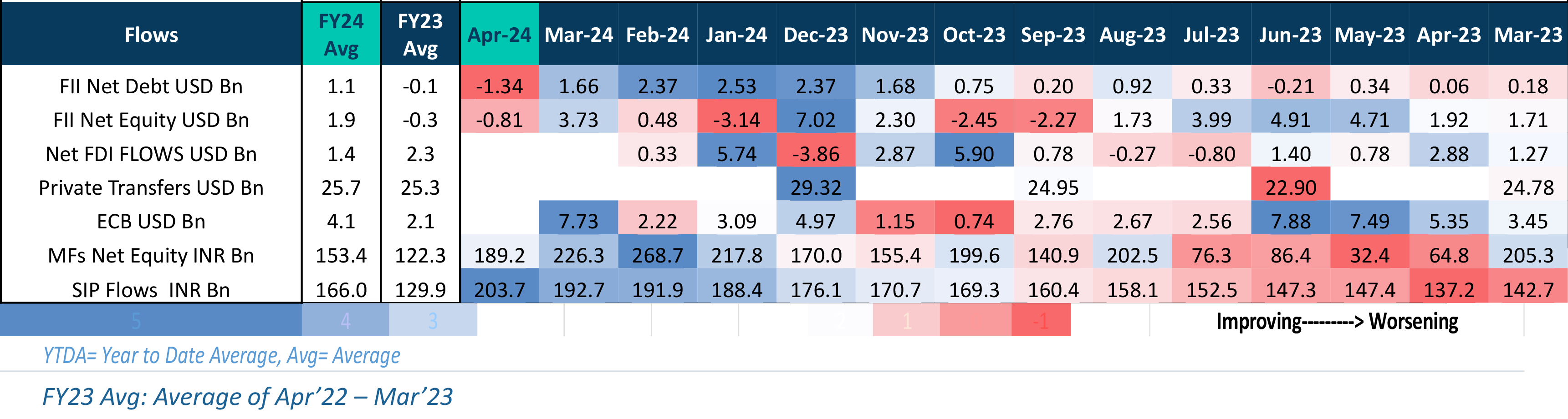

Credit to deposit shows marked strength, while money supply also made a significant rise, though banking liquidity remains low because of a pause in government expenditure and should recover once normal activity resumes. A sudden fall in foreign debt flows could be a reason for rise in yields, while this is only a temporary development, and shall reverse once the foreign debt flows begin to rise with the implementation of India’s inclusion in Foreign Bond Indices.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.