It is finally time to

ADD DURATION!

The reasons lie ahead

Our View – Summary

-

Risks to yields moving higher greatly diminished

Thus risk/reward gravitates towards a long duration position:

- Favorable Demand-Supply: Announced govt borrowing for FY24 is just 8% more than FY23. Demand expected to grow at faster pace.

- RBI OMOs: In FY24, RBI will finally purchase govt bonds, after a gap of more than 1-year.

- Bond index inclusion chatter: An unlikely event, but with large impact. If risk of yields spiking up is very low, it is prudent to be invested to be able to benefit from such tail events.

- Global central banks: Closer to end of rate hike cycle. Powell was much more benign in Feb policy as compared to Dec policy.

-

Risks to our view

We had mentioned three reasons for yields to be under pressure in this quarter.

- Rupee depreciation: We are confident that the BoP risks are still not behind us, despite rupee stability in recent weeks. However, these risks seem to be overshadowed by the positive drivers.

- Global inflationary pressures: While markets expect inflation to subside, most central banks (including FED) concerned about sustainability of easing inflation. They may wait longer before pausing.

- Liquidity: Liquidity to tighten – even though at a lower pace. There is a risk that RBI might delay its liquidity infusion actions – especially if there is concern on currency.

-

Risk/Reward to buy duration

For long duration investment: With low chances of yields spiking up, we advise to add duration. The event risks also favor long bonds.

For money markets investment: We like the 1-year segment because of its high term premium. The high carry is lucrative. Central banks stance change will lead to fall in yields in this segment.

Fed: Federal Reserve; RBI: Reserve Bank of India; G-Sec: Government Securities; OMO: Open Market Operation

To start with,

What has changed since last

Converse edition?

Firstly,

Prudent & Manageable

Budget

Keeping supply worries at bay

Key Budget Highlights

-

G-sec supply not significantly high from FY23

- Gross market borrowing at ₹ 15.43 tn and net market borrowing at ₹ 11.8 tn, lower than the market expectation

- Reliance on NSSF funding par for course at ₹ 4.7 tn FY24 BE vs ₹ 4.4 tn in FY23 RE

-

Credible assumptions

- Fiscal deficit for FY24 set at 5.9% of GDP with nominal GDP growth of 10.5%

- Tax collections growing close to GDP growth

-

Subsidy expenditure to be lower

- Raised capex outlay to ₹ 10 tn (3.3% of GDP) from an already elevated ₹ 7.3 tn (2.7% of GDP) in FY23

-

Normalization of food and fertilizer subsidy expenditure

- ✓ Barring surprises, this is achievable

Takeaway:

Market friendly budget with focus on capex spending and moreover with contained market borrowings

Source – Indiabudget.gov NSSF – National Small Savings Fund, GDP - Gross Domestic Product; Capex - Capital Expenditure; BE – Budgeted Estimates; RE – Revised Estimates; G-Sec: Government Securities

Secondly,

Inflation is trending lower, globally

Central banks sounding more

dovish

Thirdly,

Possibility of OMO purchases

pushed to FY24

Core Liquidity hasn’t reduced

significantly

Now our framework

And

What we track

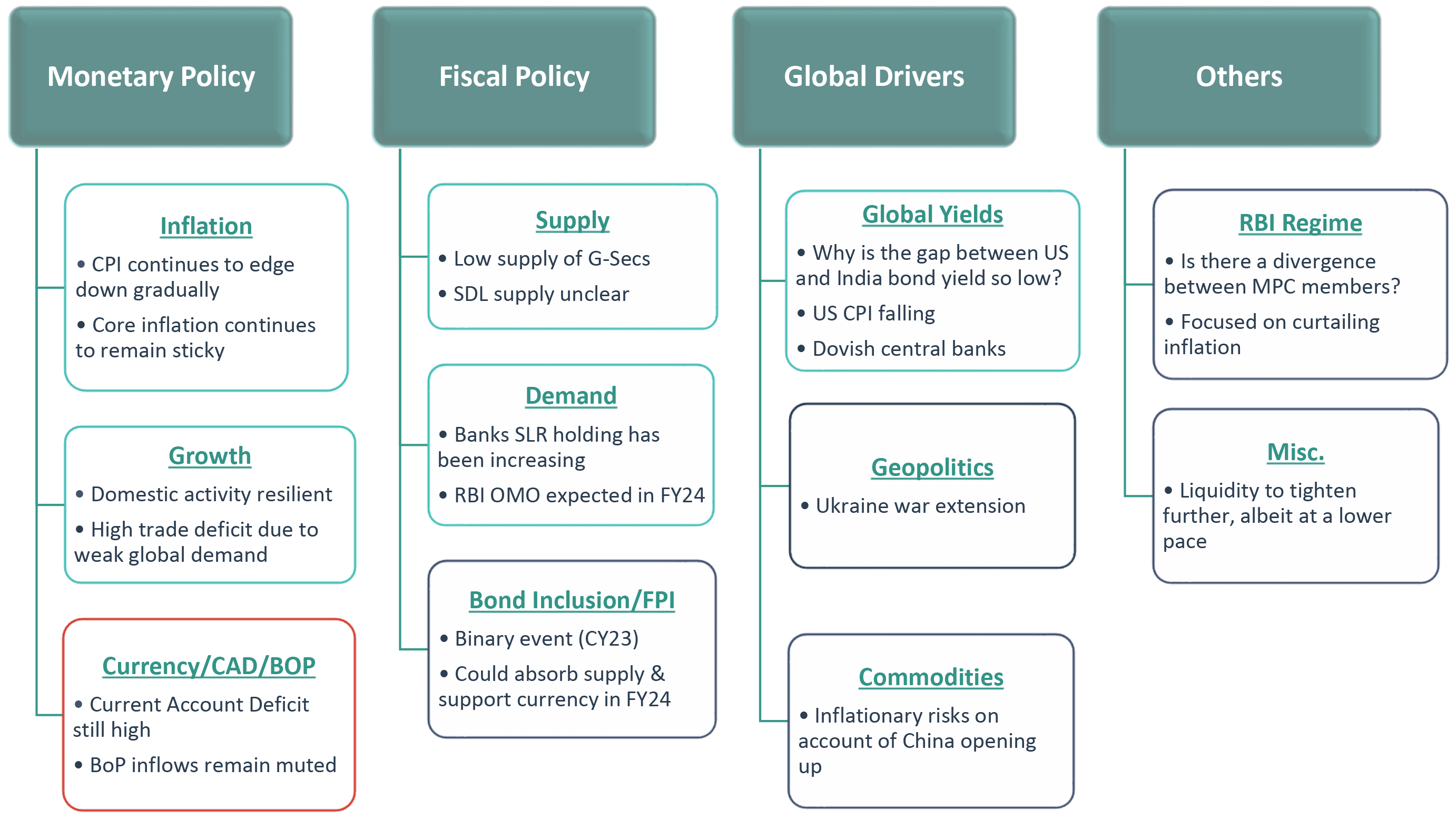

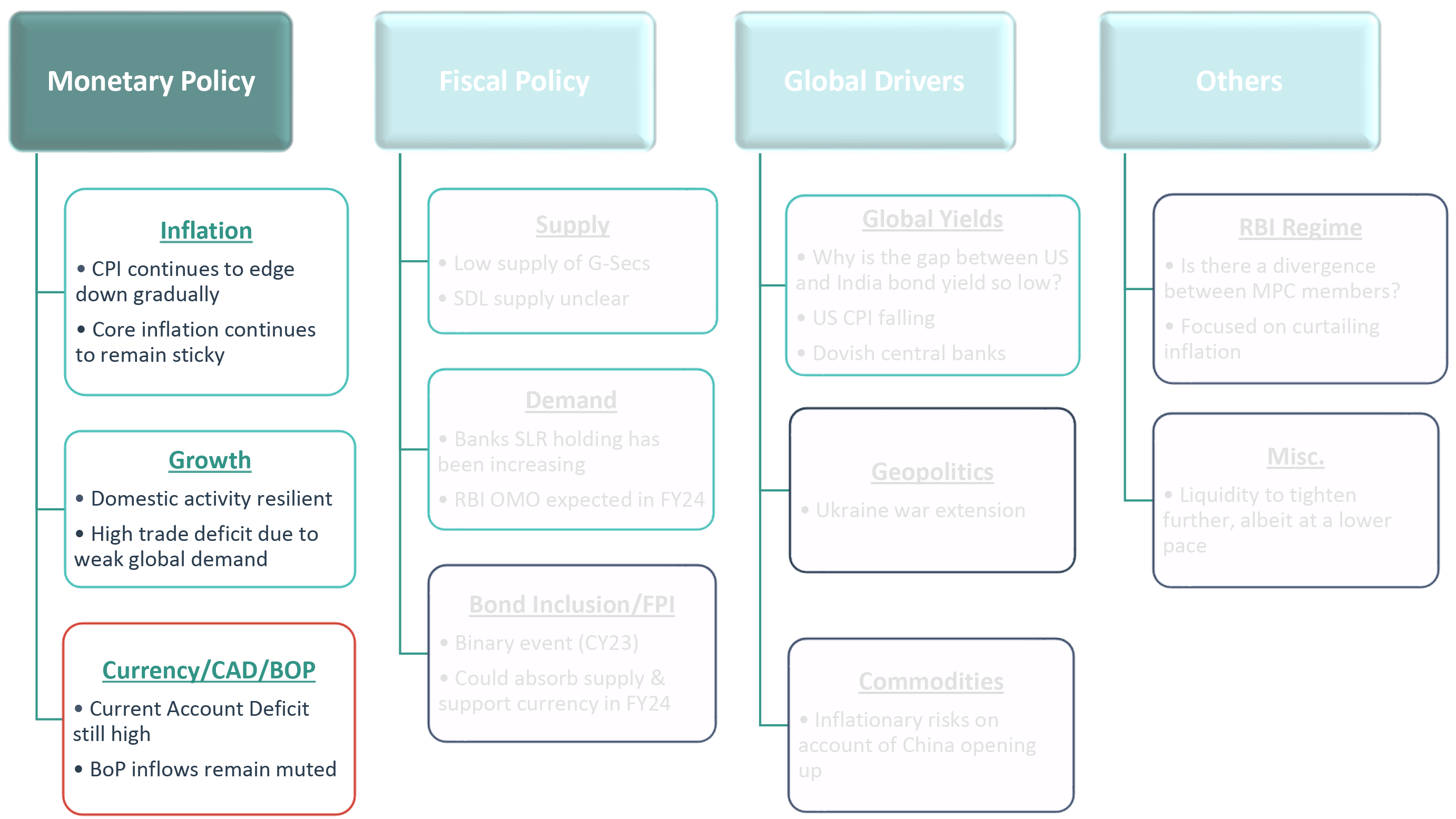

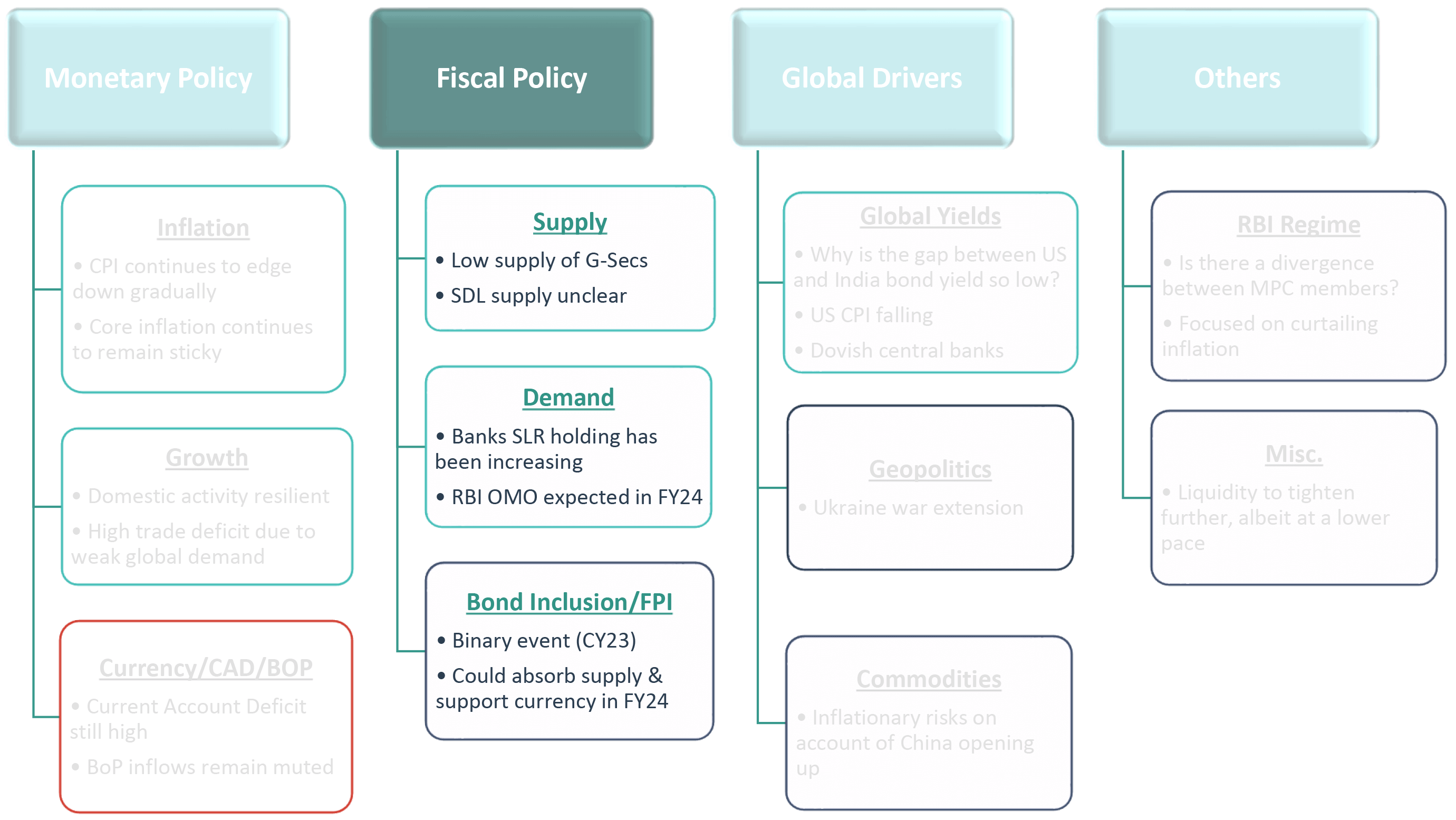

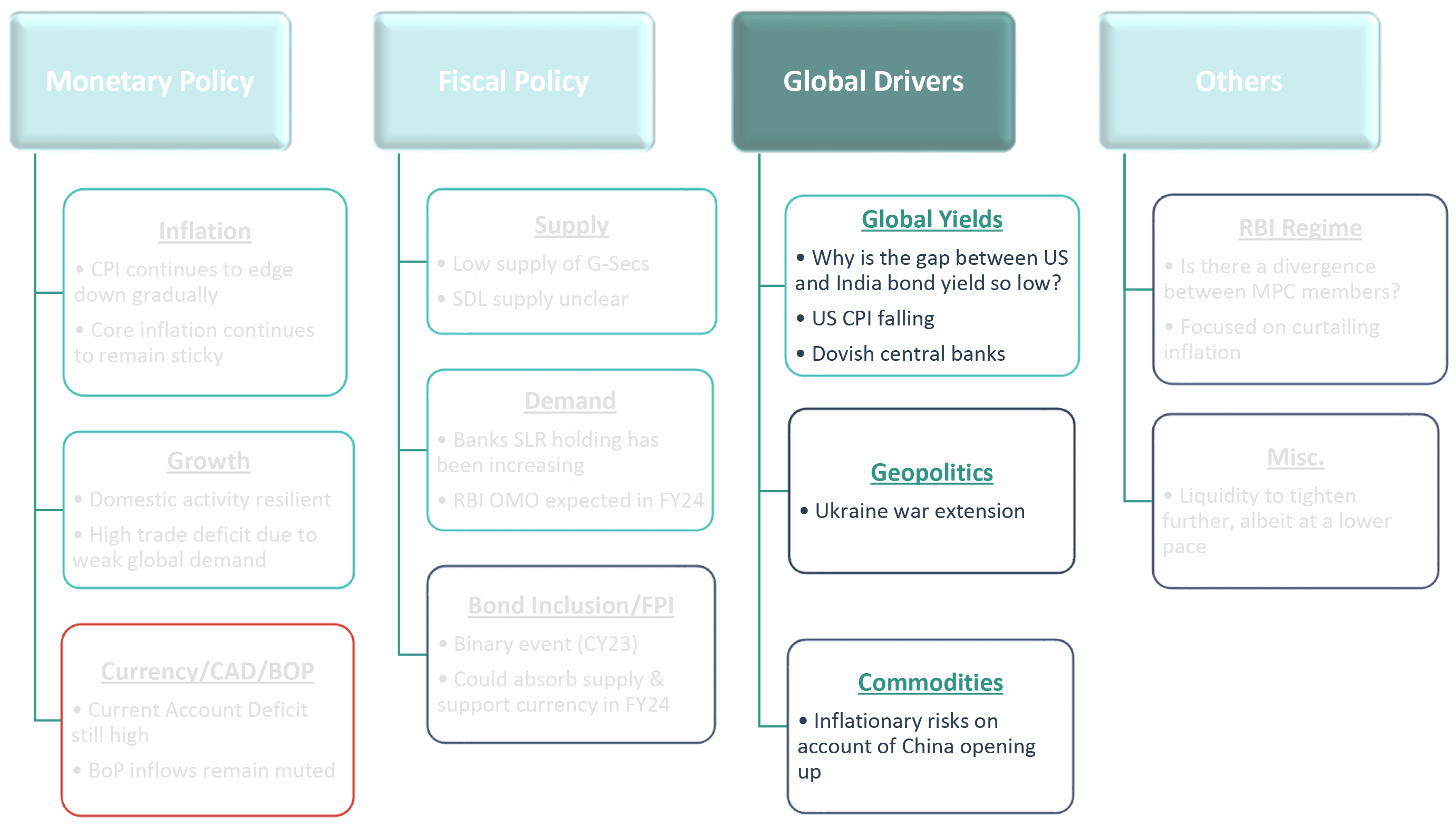

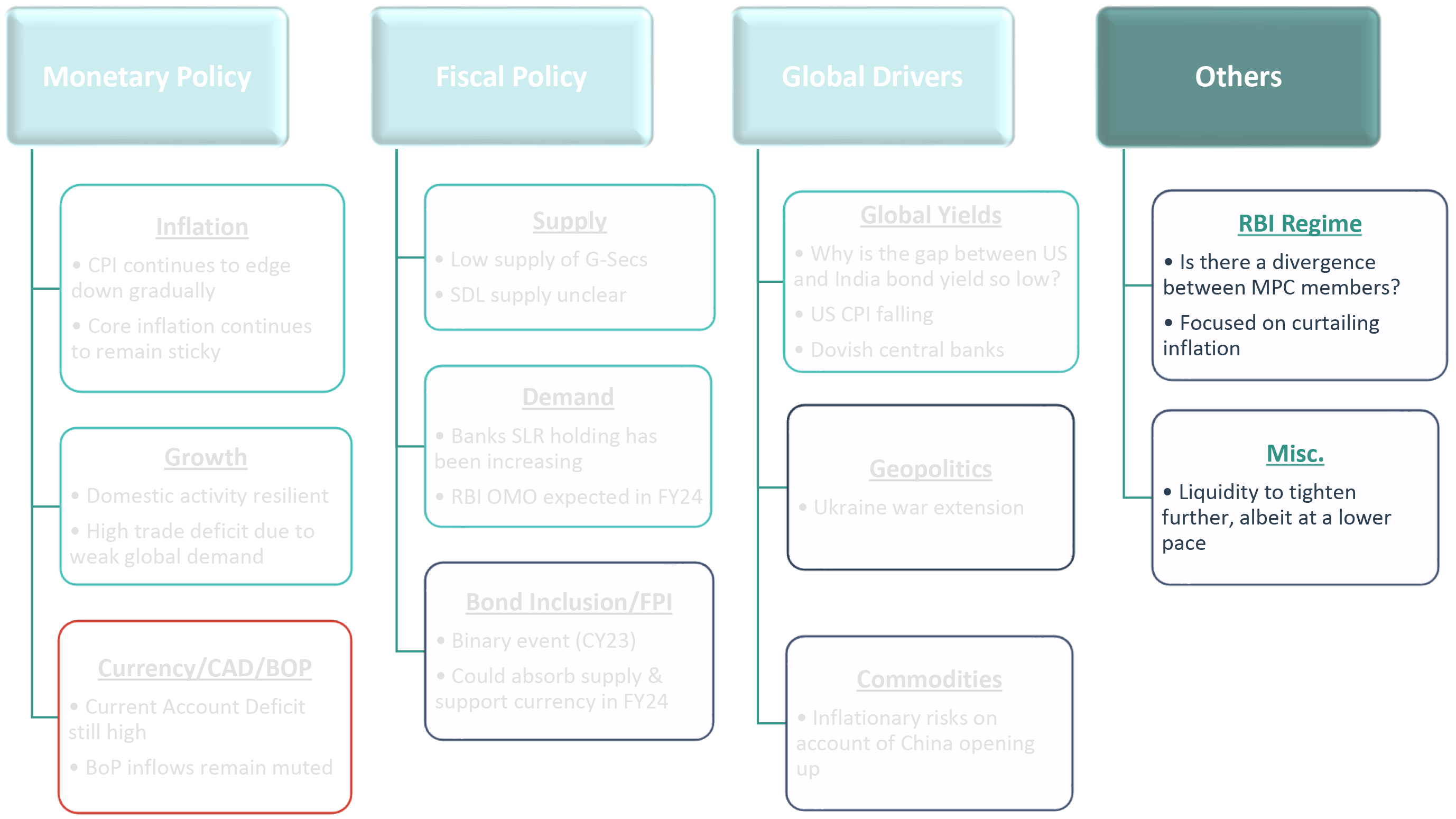

Our Framework

Takeaway:

Most of the parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

Let’s take a look at

Monetary policy

Likely to be less hawkish than in

past…

Leading to short term rates falling

fast!

Our Framework

Takeaway:

Most of the parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

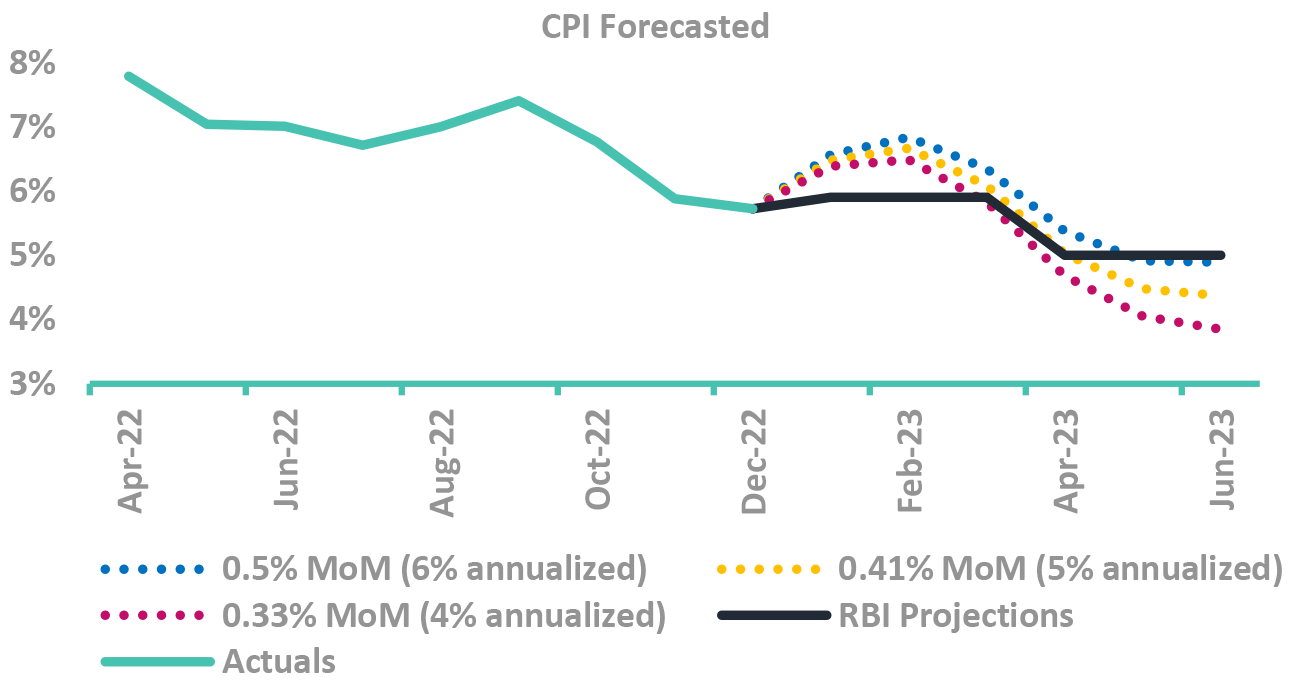

Is inflation really coming down?

Yes, it is.

Is it time for inflation to matter?

Inflation coming lower

-

RBI focus shifted to sticky core CPI from lower headline CPI

- Dec 22 CPI at 5.72% ( ↓ from 5.88% in Nov 22)

- Core continues to remain sticky & elevated at 6.3%

-

RBI’s Q4 target looks achievable

- If inflation grows 0.17% sequentially (2% annualized).

-

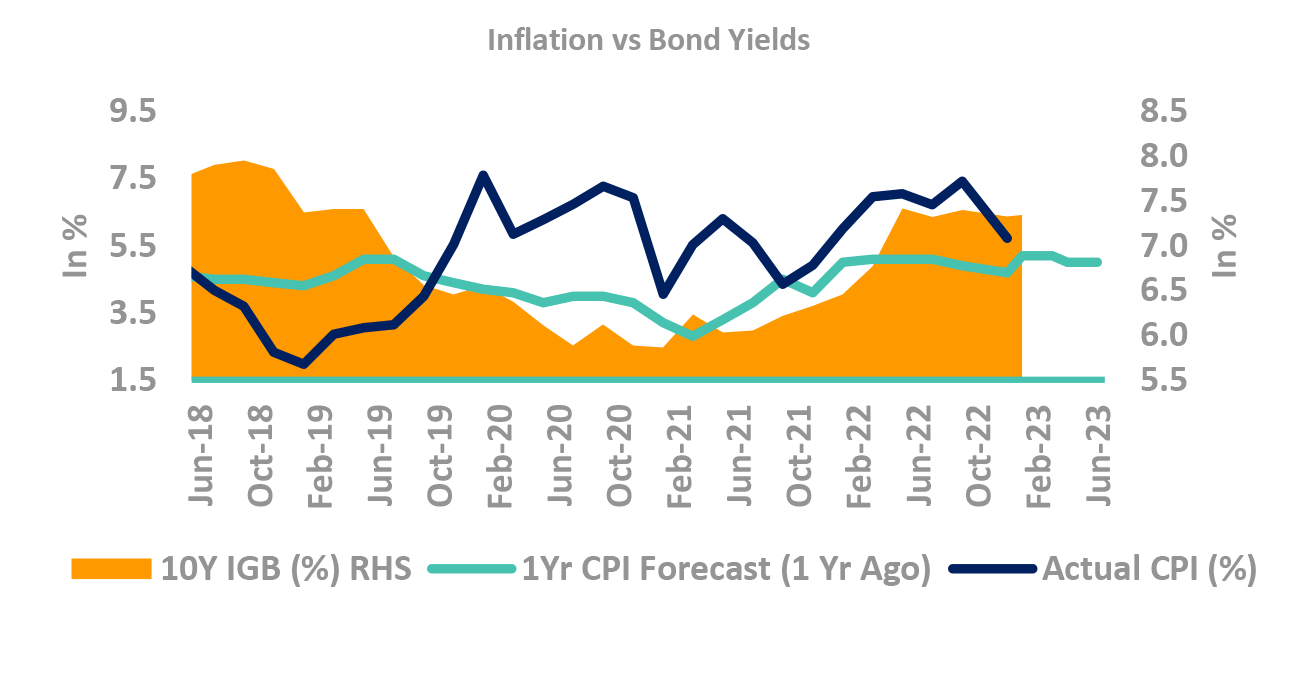

Do yields track inflation projection? No.

- Orange area is 10Y yields, Black line is CPI

-

Can forecasters predict Indian CPI? No.

- Green line is forecasters prediction of CPI 1-Year later

- Black line where inflation actually came.

- Guess the error of margin!

-

CPI projections corelated (not causality) to yields.

- Low predictive power, high current corelation

Takeaway:

Headline inflation has cooled off, though core continues to remain sticky

Source – RBI, CSO, Bloomberg CPI: Consumer Price Inflation; RBI: Reserve Bank of India; IGB: India Government Bond

Growth not a big driver right now

skip the next slide if in hurry

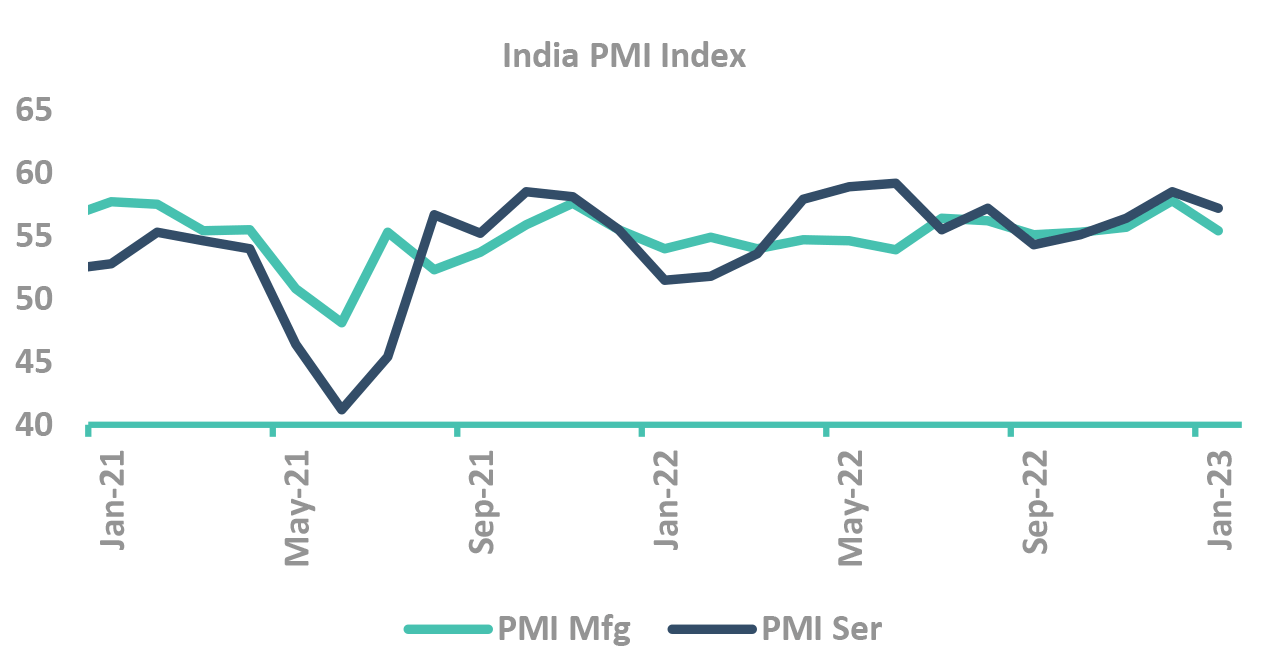

Will global slowdown test domestic resilience?

-

Domestic growth resilient, however seeing impact of global slowdown

- Jan ‘23 Mfg. PMI down to 55.4 from 57.8

- Services PMI down to 57.2 from 58.5

- GST collections picked up

- ✓ Above ₹ 1.5 tn for the third time in current fiscal

- ✓ 2nd highest at ₹ 1.56 trillion for Jan’23

-

Risks of global slowdown are playing out

- Trade deficit remains elevated at USD 23.8bn in Dec’22

- Exports ↓ by 12% YoY due to decline in global demand

-

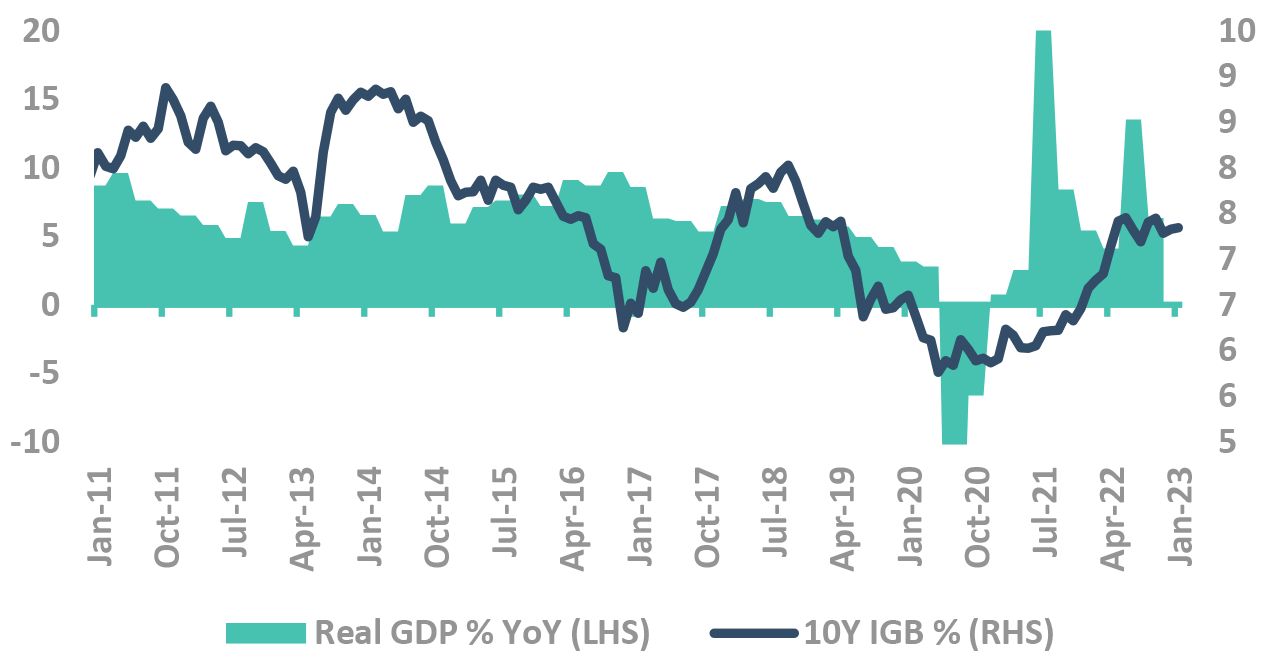

How closely do yields track growth?

- Yields have usually tracked GDP growth, with correlation being stronger when growth slows, barring

- ✓ 2013, when rupee depreciation and debt outflow

- ✓ 2017, during demonetization

- Yields have usually tracked GDP growth, with correlation being stronger when growth slows, barring

-

FY24, growth may not be big driver for yields

- At 6.5% GDP growth, the fall may not be sharp enough to drive yields

Takeaway:

Growth while strong could suffer from global slowdown shocks

Source – Bloomberg GDP: Gross Domestic Product; PMI: Purchasing Managers’ Index; GST: Goods and Service Tax; IGB: India Government Bond; Mfg: Manufacturing

So far we have been mentioning

“When rupee depreciates

RBI hikes”

No matter what the inflation!

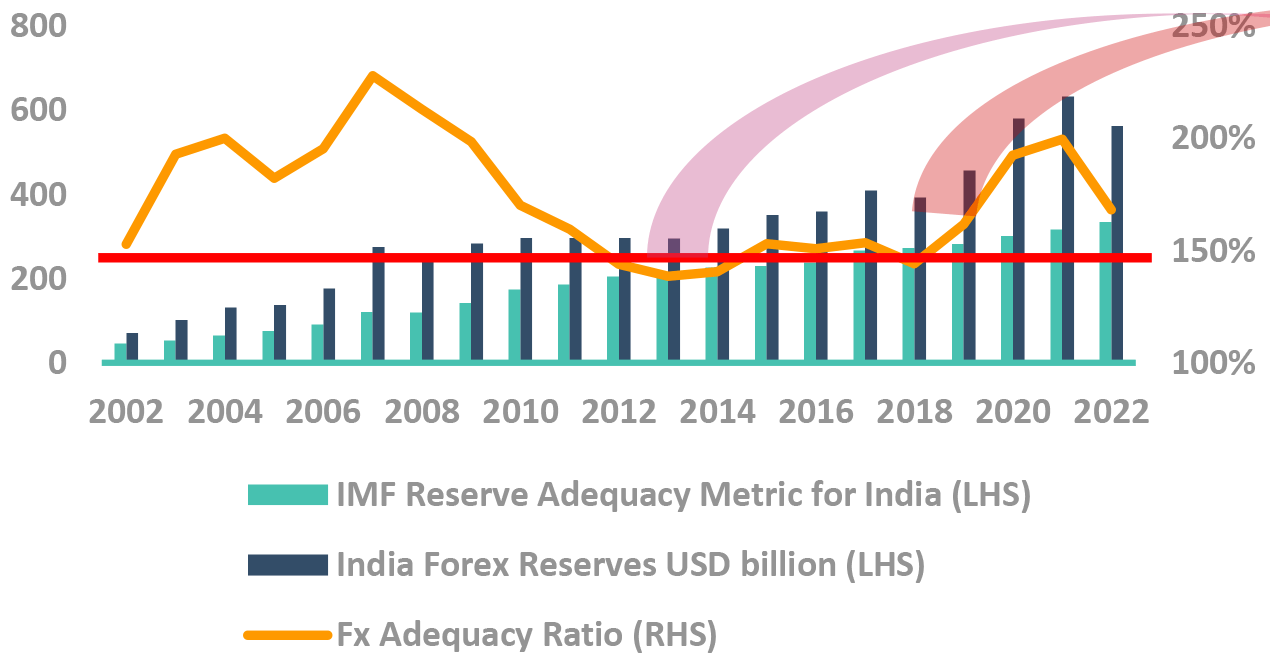

Did you know – when our Fx reserves dip, RBI hikes

-

RBI FX reserves up from lows

- Forex reserves up from USD 524 bn (in Oct 22) to USD 574 bn (in Jan 23)

- Majority of the change in reserves caused by valuation

-

RBI FX Reserve / IMF FX adequacy ratio declined sharply

- Buffer of ~USD 70 bn to reach 2013 and 2018 levels (~150% ratio)

-

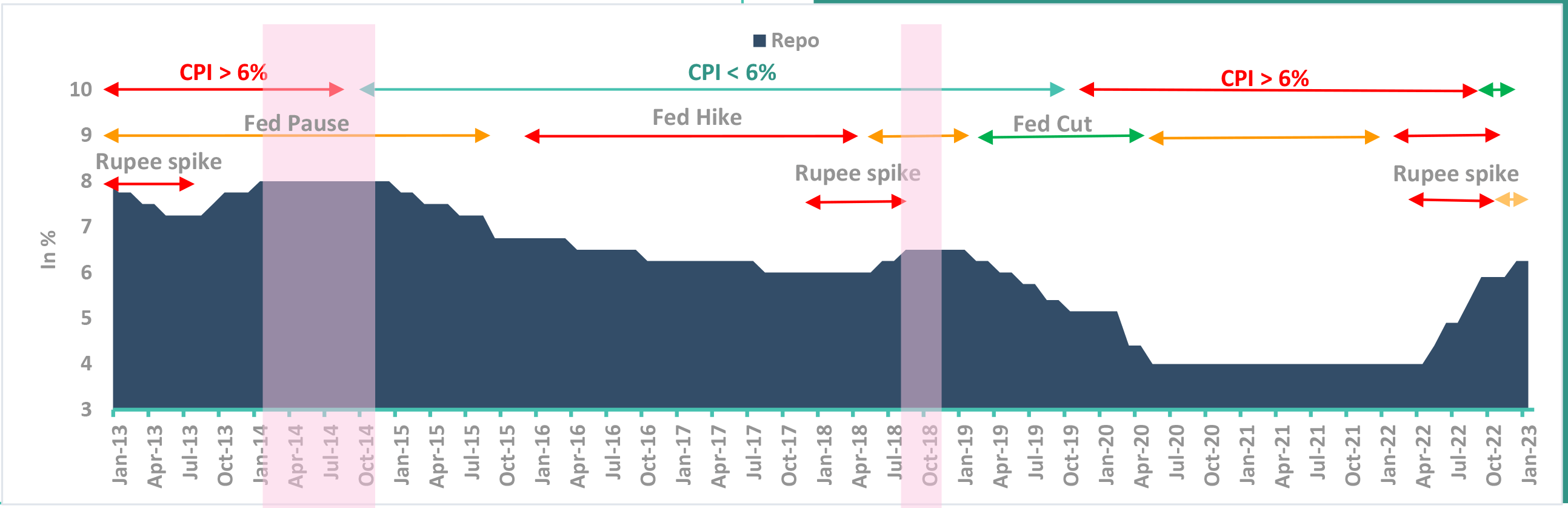

RBI only hiked rates twice in past 10 years, barring now

- Increased rates to control rupee, not inflation

-

RBI has tolerance for inflation, not rupee fall

- In 2018, inflation was within RBI’s target levels

- In 2013, inflation was high for long yet RBI cut

-

When RBI FX reserve fall

- RBI avoids using reserves and does rate hikes to control rupee.

Takeaway:

Foreign exchange reserves have been on an uptrend, albeit absolute levels remain low

Source – Bloomberg RBI: Reserve Bank of India; IMF: International Monetary Fund; US FED: US Federal Reserve; FX: Forex; CPI: Consumer Price Inflation

But question now is not hikes,

But what will make RBI

Pause the rates!

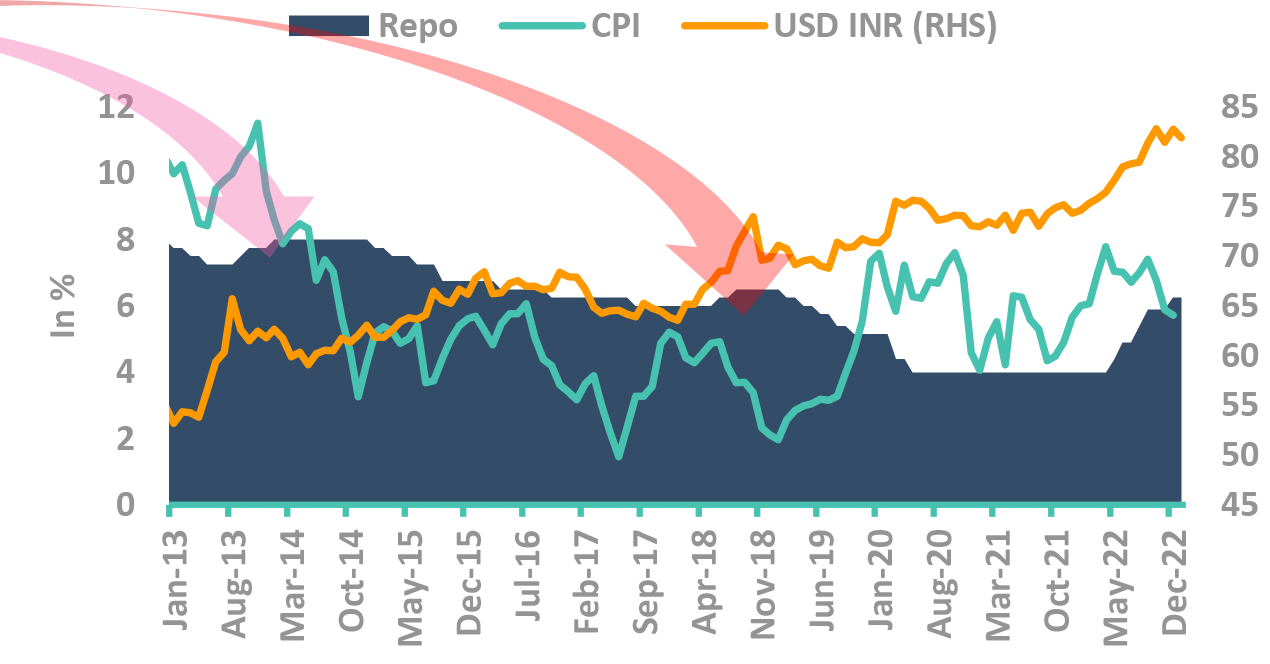

What drives pauses: Series of hygiene factors

The checklist for pause:

-

When the US Fed starts pausing

- Reduces risk of capital outflows

-

When inflation is within comfort

- Reduces risk of inflationary policy

- Barring 2014, when RBI did not have 6% CPI target

- But CPI was falling in 2014

-

When BoP (and currency) is stable

- Reduces inflationary / external risks

How is the checklist now?

- ↔

US FED has indicated lower ongoing hikes

- US yields much lower, expecting rate cuts in CY23

- RBI talking in Fed’s voice

- ✓

Inflation moderating to comfort zone

- RBI shifting stance to core CPI seems to be driven by currency, rather than inflation fears

- х

BoP (rupee) still remains a concern

- Most economist expect muted BoP of around USD 10bn

- However valuation gains have increased FX reserves

Takeaway:

We expect more rate hikes, yet are closer to pause than earlier.

Source – RBI, Bloomberg RBI: Reserve Bank of India; IMF: International Monetary Fund; US FED: US Federal Reserve; BoP – Balance of Payment

We expect RBI to tone down its

stance

Either 25bp hike, with chances of

future pause.

Or,

a pause, with chances of future

hikes

Let’s turn to Fiscal policy

Generally, it drives the long bond

yields

It is reflected in demand/supply

mismatch

Our Framework

Takeaway:

Most of the parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

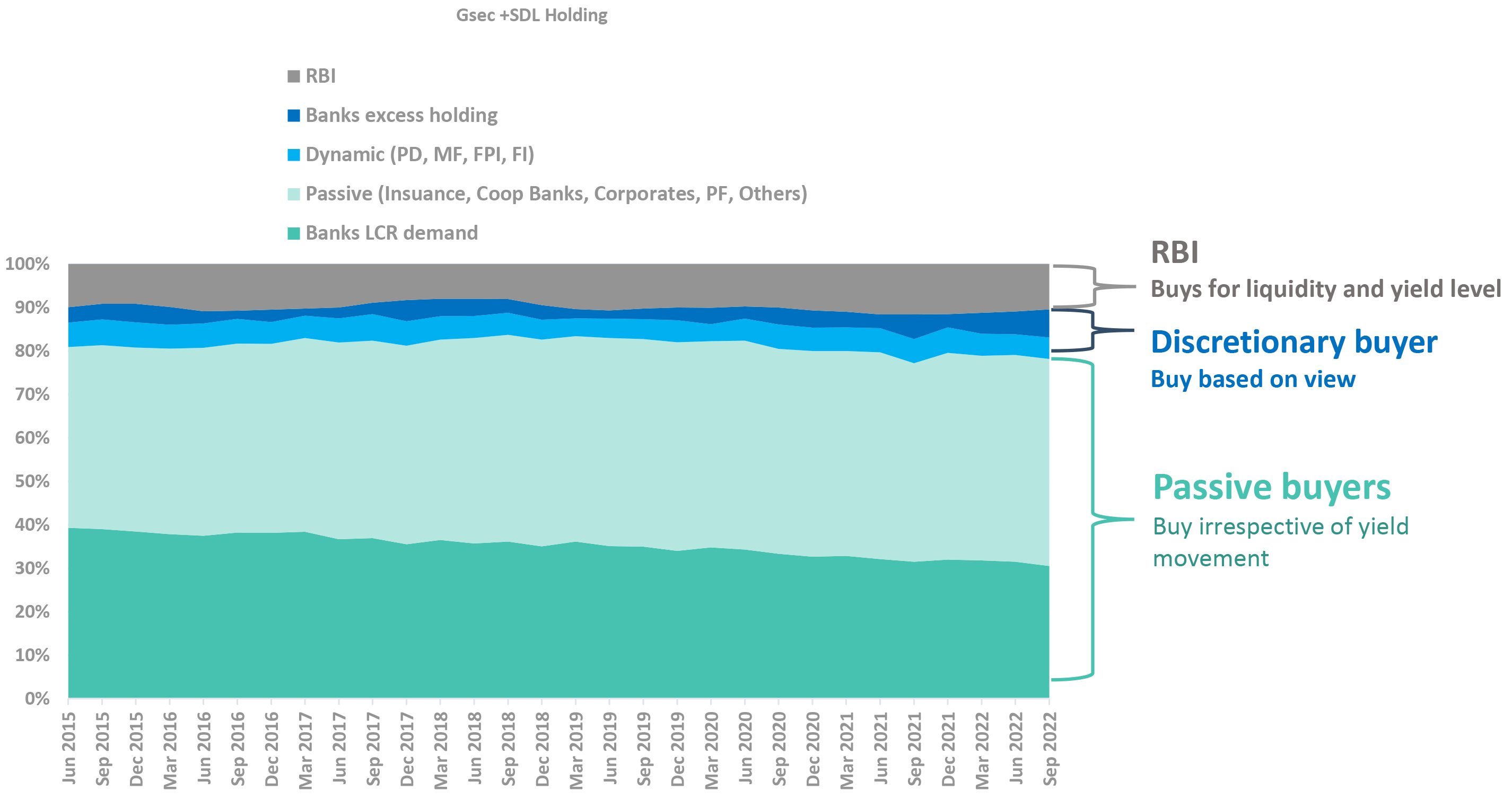

Only small part of bond buyers are

discretionary buyers.

They drive yields.

Supply fluctuations is borne by

these buyers.

Gsec market still driven by lumpy institutions

Takeaway:

Increase in supply impacts the discretionary buying. Banks excess holding and Passive buyers have absorbed the supply so far.

Source – DBIE LCR – Liquidity Coverage Ratio; SDL – State Development Loans; PF – Provident Funds; PD – Primary Dealerships; MF – Mutual Funds; FPI – Foreign Portfolio Investors; FI – Financial Institutions; RBI: Reserve Bank of India; G-Sec: Government Securities; SDL: State Development Loans

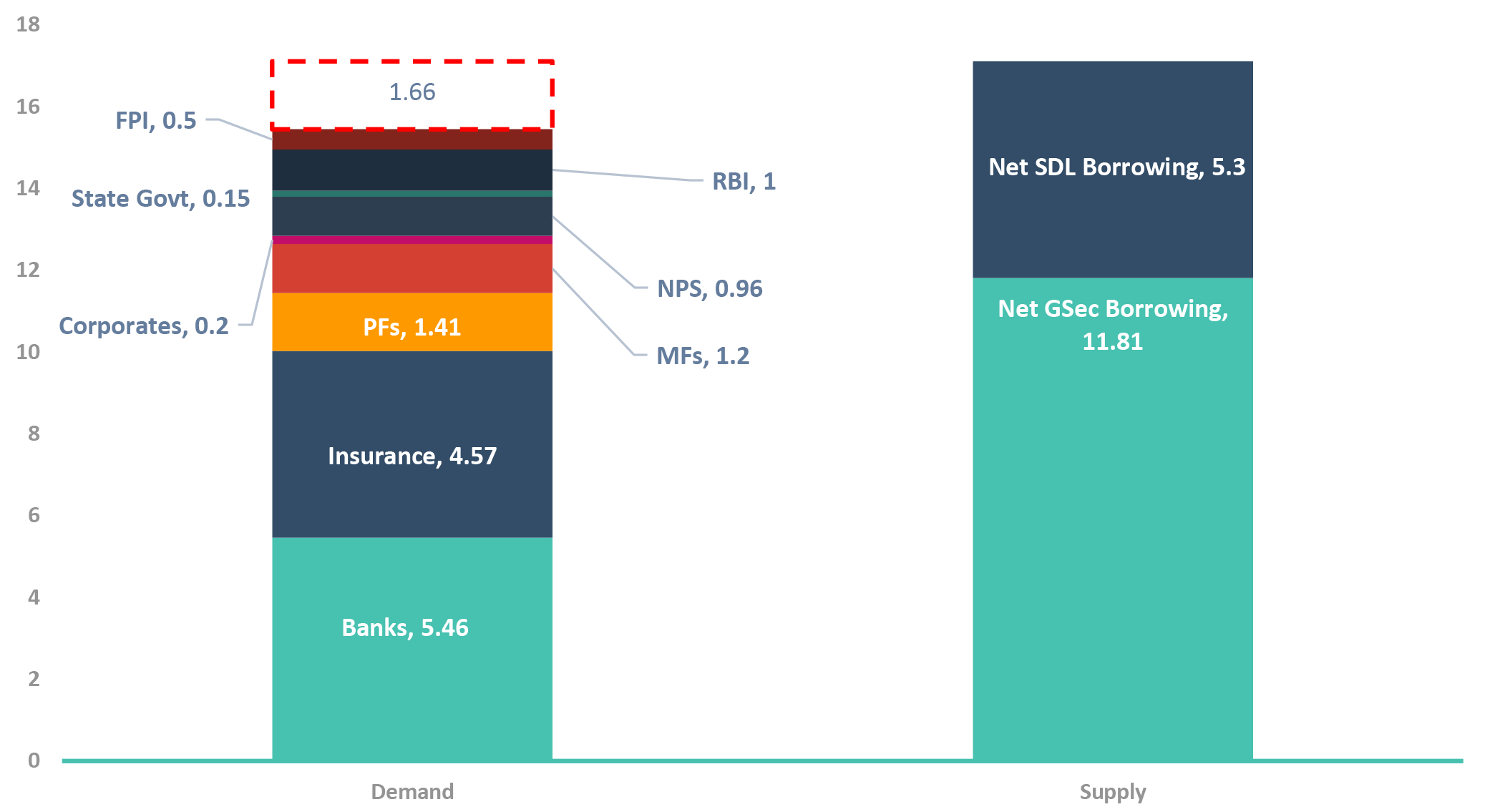

Comfortable supply/demand

dynamics for FY24

Supply is just about ₹ 1.7 lac cr.

more than natural demand

How much is the excess supply

Excess supply can be matched by

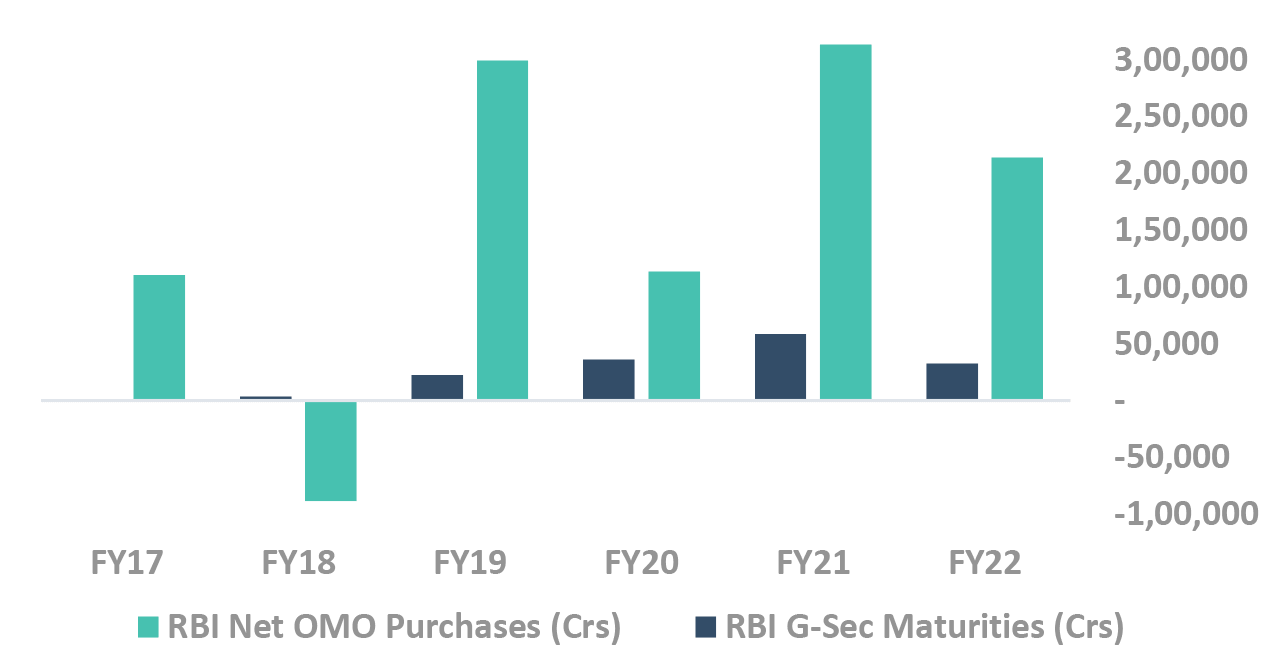

- G-sec supply higher only by 7% over FY23, however demand is expected to rise much more

- Continuing strong demand from Banks and long end investors like EPFO, Insurance and PFs

- Limited room for OMO purchases by RBI as minimal G-sec maturities this year

Takeaway:

Estimated excess supply of INR 1.67 tn not very significant, considering any increase in SLR holdings by banks can substantially reduce the gap

Source – Internal G-Sec: Government Securities; OMO: Open Market Operation; RBI: Reserve Bank of India; FPI: Foreign Portfolio Investment; NPS: National Pension System; MF: Mutual Fund; SDL: State Development Loans; SLR: Statutory Liquidity Ratio; PF: Provident Fund; EPFO: Employees’ Provident Fund Organisation

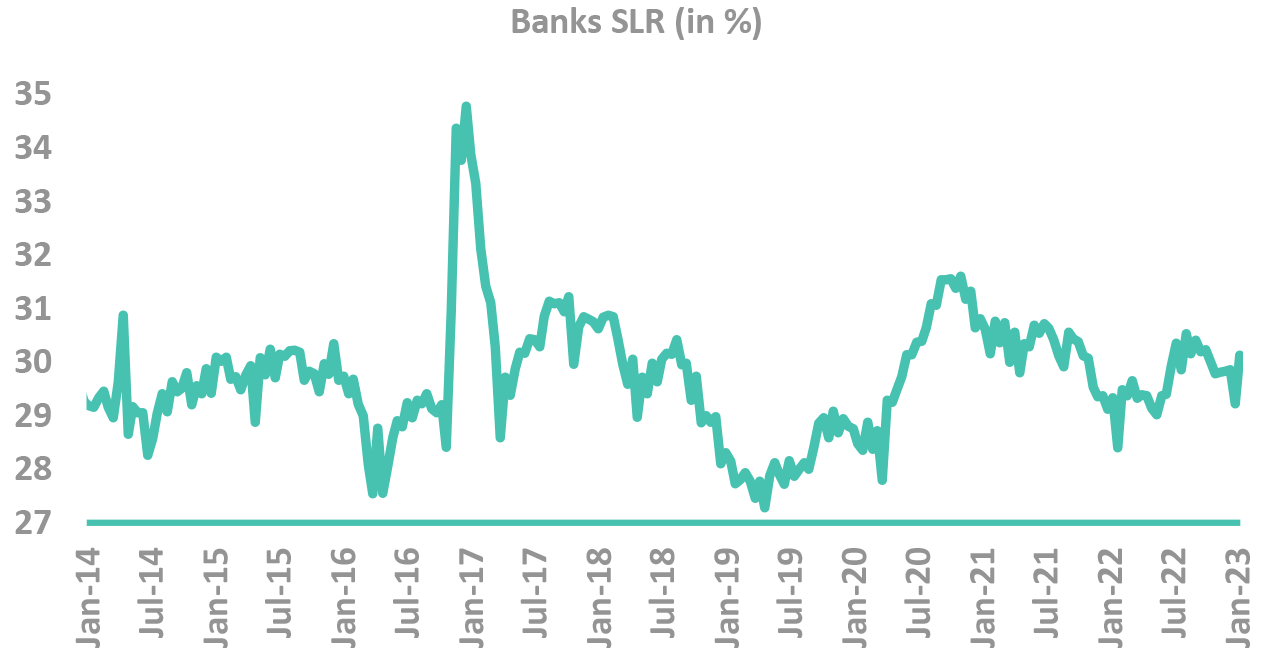

Demand/Supply – Buyers composition needs to change

-

Banks SLR holdings has risen sharply

- Only during the Covid and Demonetization did the levels reach so high

- Then periods' liquidity was in surplus, unlike now

- Part of SLR holding (~1%) is hedges of FRA & TRS, and not naked holdings

-

While the holding ratio may reduce, on absolute levels demand will absorb supply

- SLR holding ratio will trim in FY24, but not substantially

-

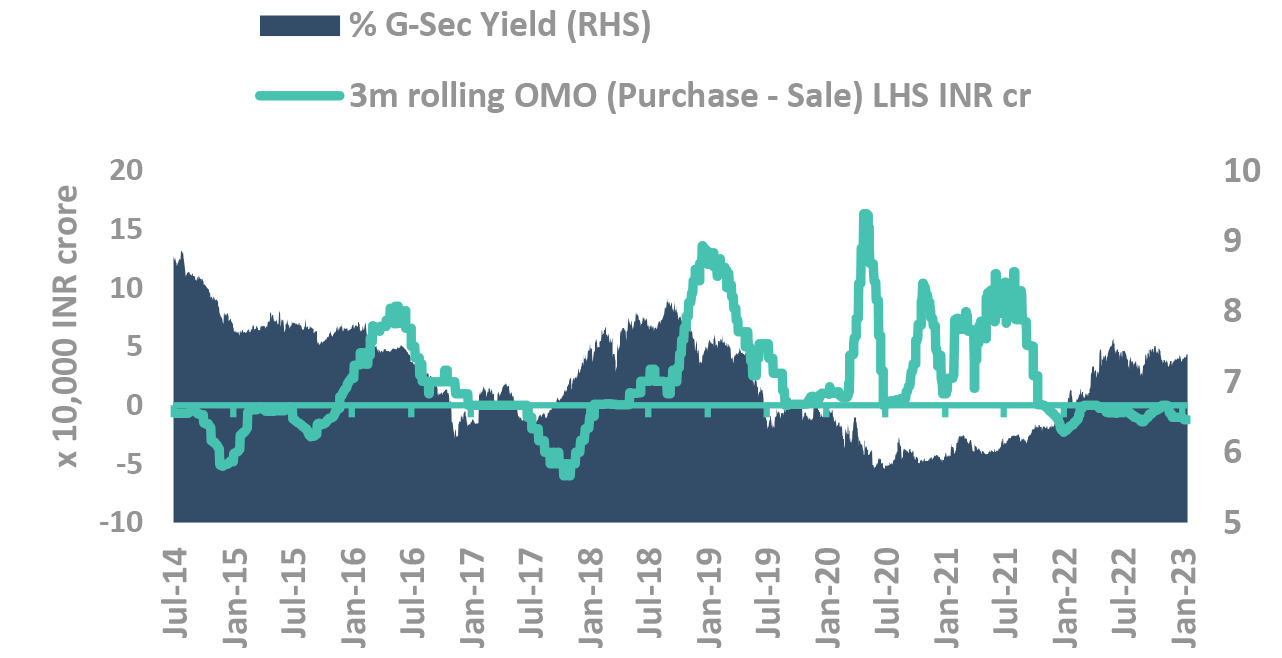

Yields track RBI OMO purchases

- Yields have strong correlation with RBI OMO actions

- Demand/Supply mismatch is usually filled in by RBI

-

RBI OMO expected in FY24 as

- RBI balance sheet rise muted due to less USD inflow

- Gap to be filled by OMO purchase

- Liquidity on path to neutrality due to CIC outflow

-

RBI OMO may be delayed, and not front ended

Takeaway:

Demand – Supply is broadly balanced, but new buyers can provide fillip

Source – Bloomberg, DBIE, Internal OMO – Open Market Operations, SLR – Statutory Liquidity Ratio; G-Sec – Government Securities; RBI: Reserve Bank of India; FRA: Forward Rate Agreement; TRS: Total Return Swap

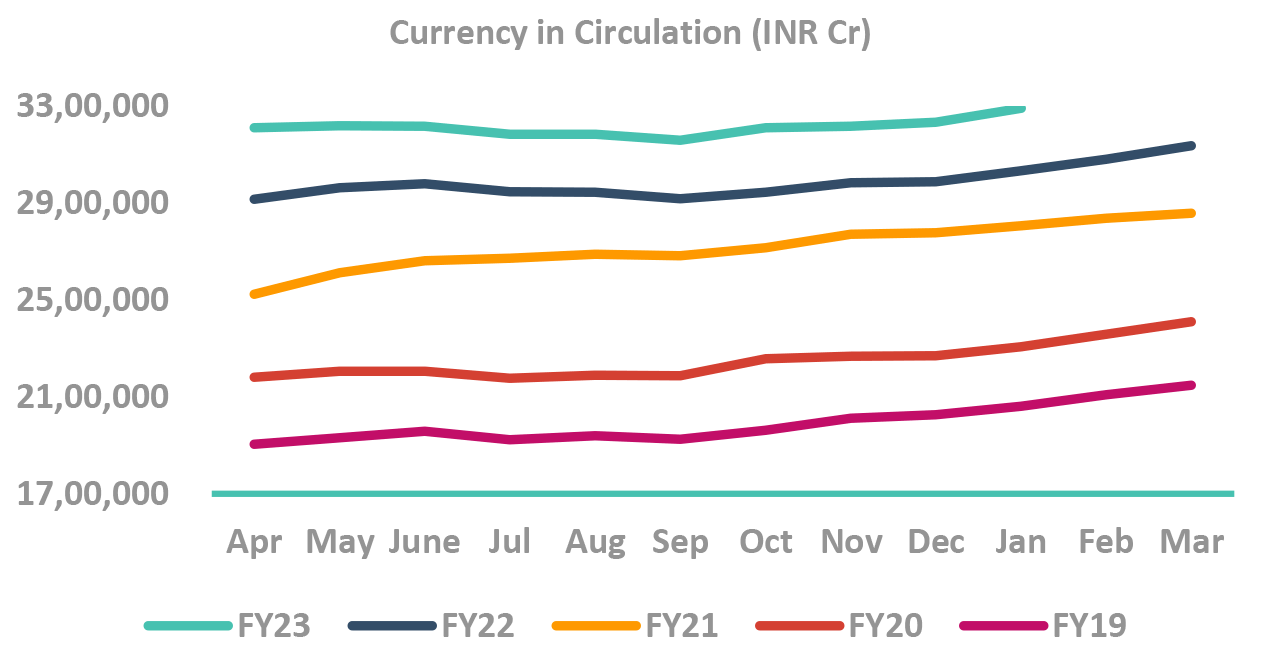

RBI OMO: Delayed but coming in FY24

Liquidity will tighten in next few months. Why?

-

Firstly, Currency in circulation is cyclical

- Jan-May is when CIC increases

- Expect liquidity to tighten by May

-

Secondly, unlikely that the BoP will be large

- Thus, reduces possibility of FX driven liquidity infusion

-

RBI OMO in FY24 likely when liquidity tightens

Reasons why OMO may get delayed, but will occur:

-

RBI will possibly reverse FY23 CRR hike as first step

-

Bond maturities may not reduce RBI balance sheet

- RBI has switched short tenor bonds with Govt

- Natural reduction of balance sheet (& liquidity) is lesser

- Similar to FY17 (post demonetization)

- RBI exhausted its short term G-sec through OMO sale.

Takeaway:

RBI to conduct OMO Purchases when liquidity tightens. Expected to be in FY24

Source – Bloomberg RBI: Reserve Bank of India; CIC: Currency in Circulation; OMO: Open Market Operation; CRR: Cash Reserve Ratio; G-Sec: Government Securities; BoP: Balance of Payment

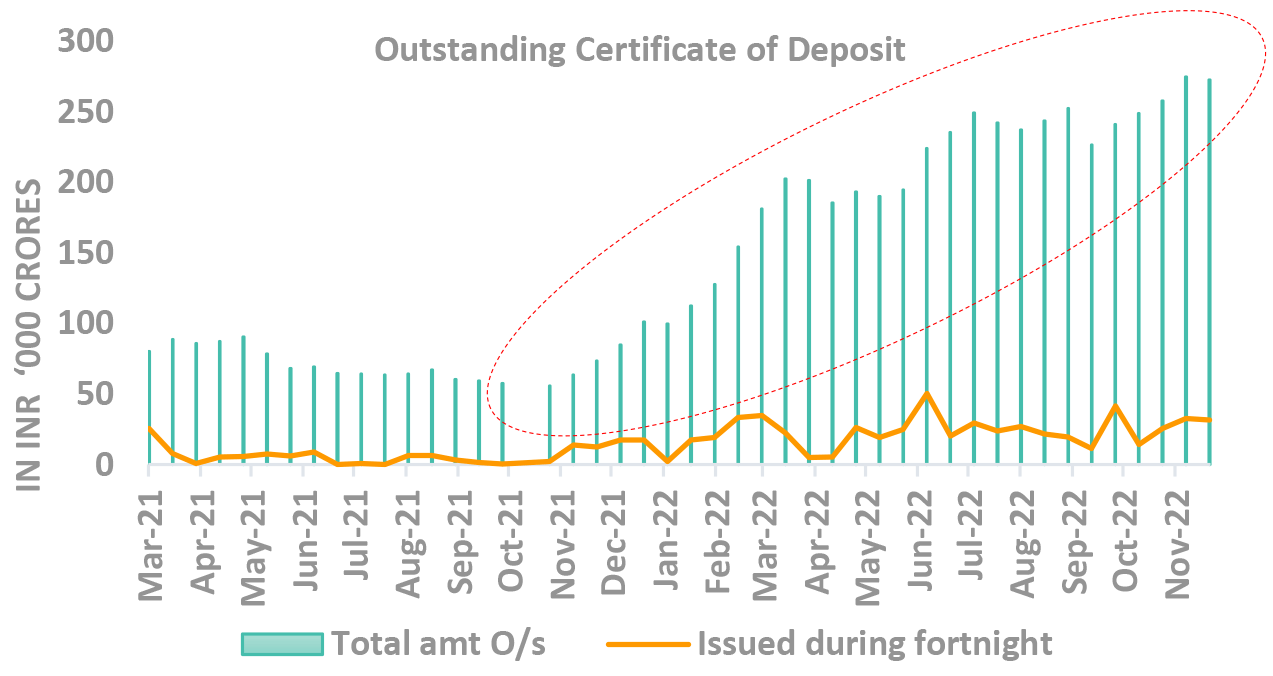

Attractive Spreads in

short tenor (~1 year)

may not last long into next FY

Where are the shorter end rates headed?

-

Pace of credit growth likely to taper

- It is already reduced from earlier highs

- Likely reduction in working capital requirements

- Easing commodity prices

- Lower supply chain bottlenecks

- Capex may get moderated with faltering global growth

Reasons why OMO may get delayed, but will occur:

- Growth of banks’ Certificate of Deposits may taper

- Signaling of future pauses will lead to yield rationalization

- However, tighter liquidity will limit the fall in short term rates

Takeaway:

Short term yields currently high due to supply pressures, any significant uptick from here unlikely

Source – Bloomberg RBI: Reserve Bank of India; CIC: Currency in Circulation; OMO: Open Market Operation; CRR: Cash Reserve Ratio; G-Sec: Government Securities; BoP: Balance of Payment

Are all concerns local?

No

Lets look at the global drivers for

Indian yields

Our Framework

Takeaway:

Most of the parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

Should we be looking closely at

US yields movement?

It will create noise,

not trend.

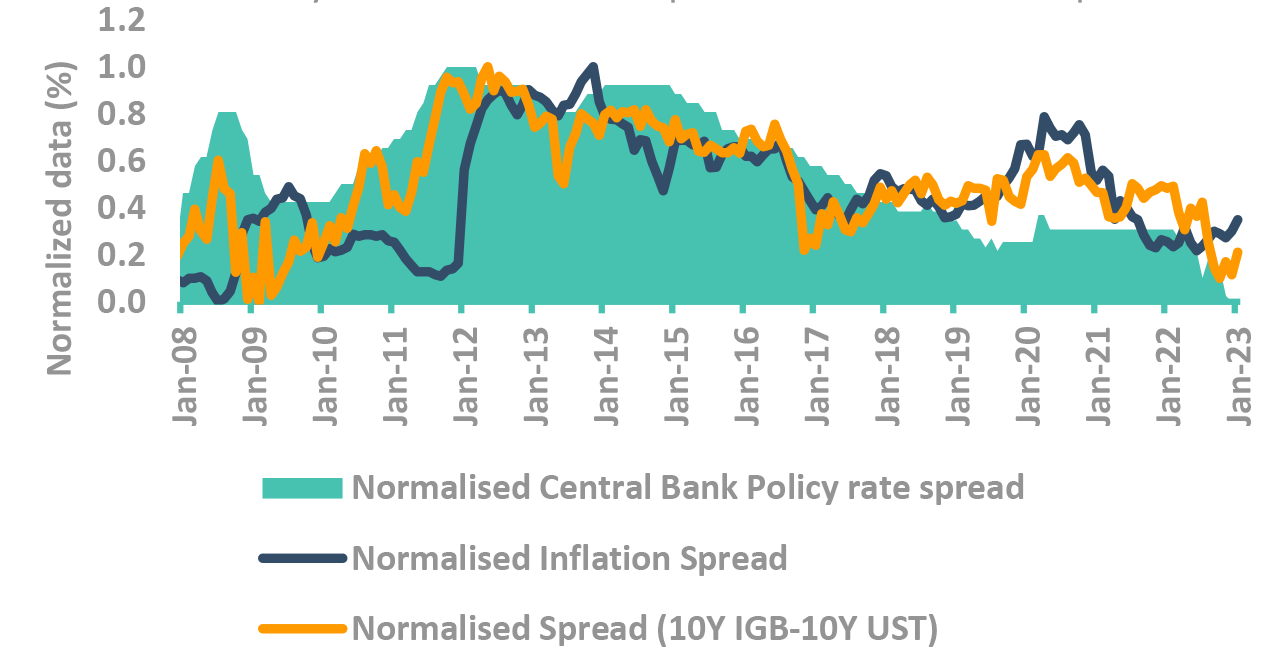

Is India de-coupled from global markets?

-

Fed hiked the rate by 25bps, with terminal rate closer to 5%, with possibility of ongoing increases

- Will be increasingly data dependent

- Disinflationary trends observed, with possibility of ongoing rate hikes

- US December CPI at 6.5% showed signs of cooling off

-

Are spreads of US Treasury and Indian Govt. Bonds low?

- Historical spread of 10 Year US and 10 Year bonds was 5% but has narrowed to 3.8%

- But bond yield spread mimics the inflation and policy rate differential.

- ✓ RBI policy rate is low & has not tracked inflation spread

- ✓ 10Y yields seem to have priced in the inflation spread

-

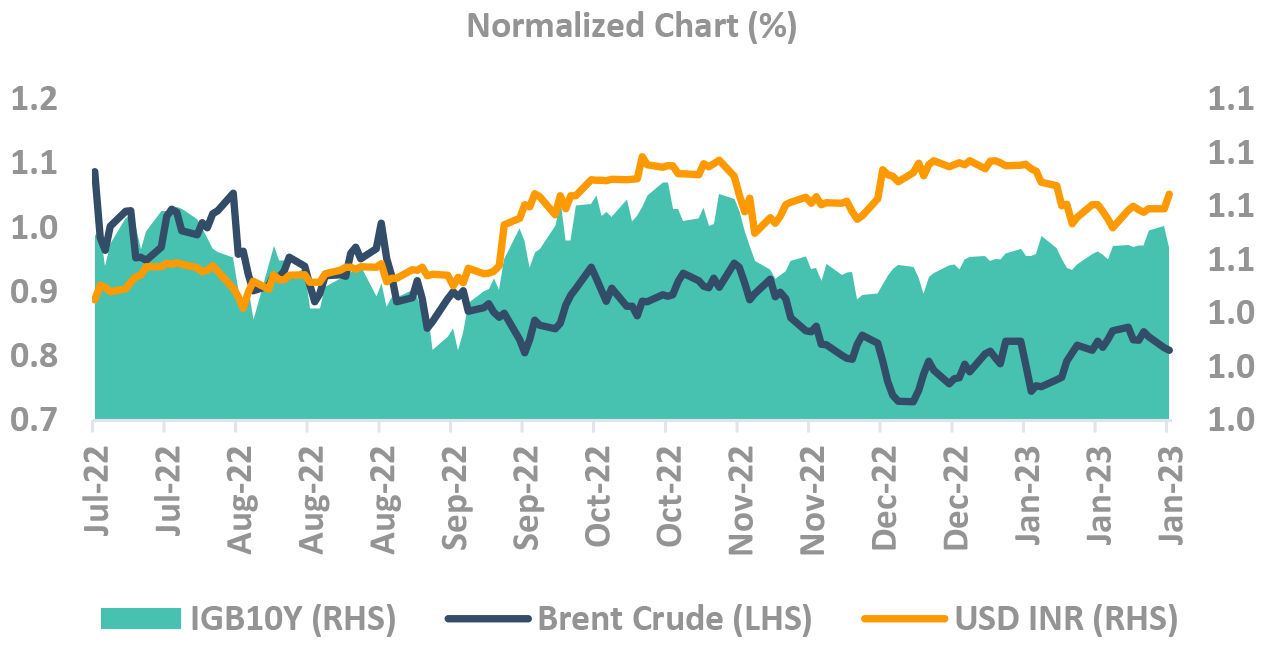

Are rupee risks impacting Indian yields?

-

Rupee has weakened substantially, risks to upside

- Currency tail risks may materialize

- ✓ If Fed tapering impact worsens,

- ✓ Trade deficit remains elevated then tail risks could come to play

- Currency tail risks may materialize

- Oil impact on yields taken a backseat last month

Takeaway:

India bond yields more driven by domestic factors than tracking global yields

Source – Bloomberg, Internal Fed: federal Reserve; CPI: Consumer Price Inflation; RBI: Reserve Bank of India; IGB: India Government Bond

What else

that

can’t be bunched up

Our Framework

Takeaway:

Most of the parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

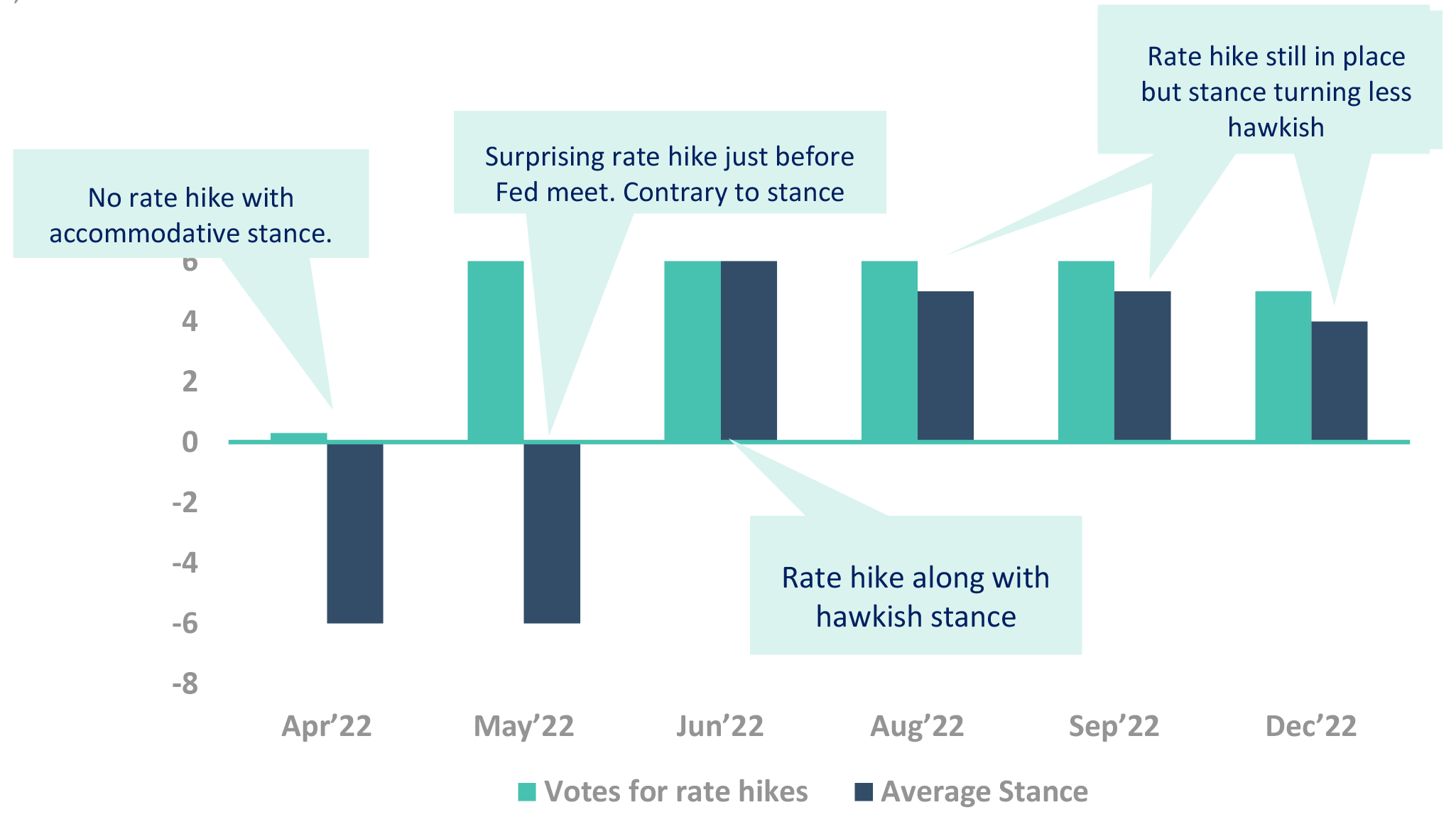

Currently RBI has had Hawkish Tilt

with

Similar underlying Data

RBI regime – Still hawkish, but initial signs of dovishness

RBI has gradually softened:

- The voting pattern for rate hikes moved from 6-0 to 4-2

- MPC committee has gradually made a less hawkish stance

- We expect a more dovish RBI MPC in Feb 23 than on Dec 22

So why hawkish regime? Because at CPI lower than 6%, RBI is still not pausing

- Same input, different result

Takeaway:

Expect continuation of the trend. MPC should change the stance in Feb policy. Possibility of pause, though not our base case

Source – RBI RBI: Reserve Bank of India, MPC: Monetary Policy Committee; CPI: Consumer Price Inflation

Why do we keep reiterating

bond inclusion

Despite it being a

low probability event

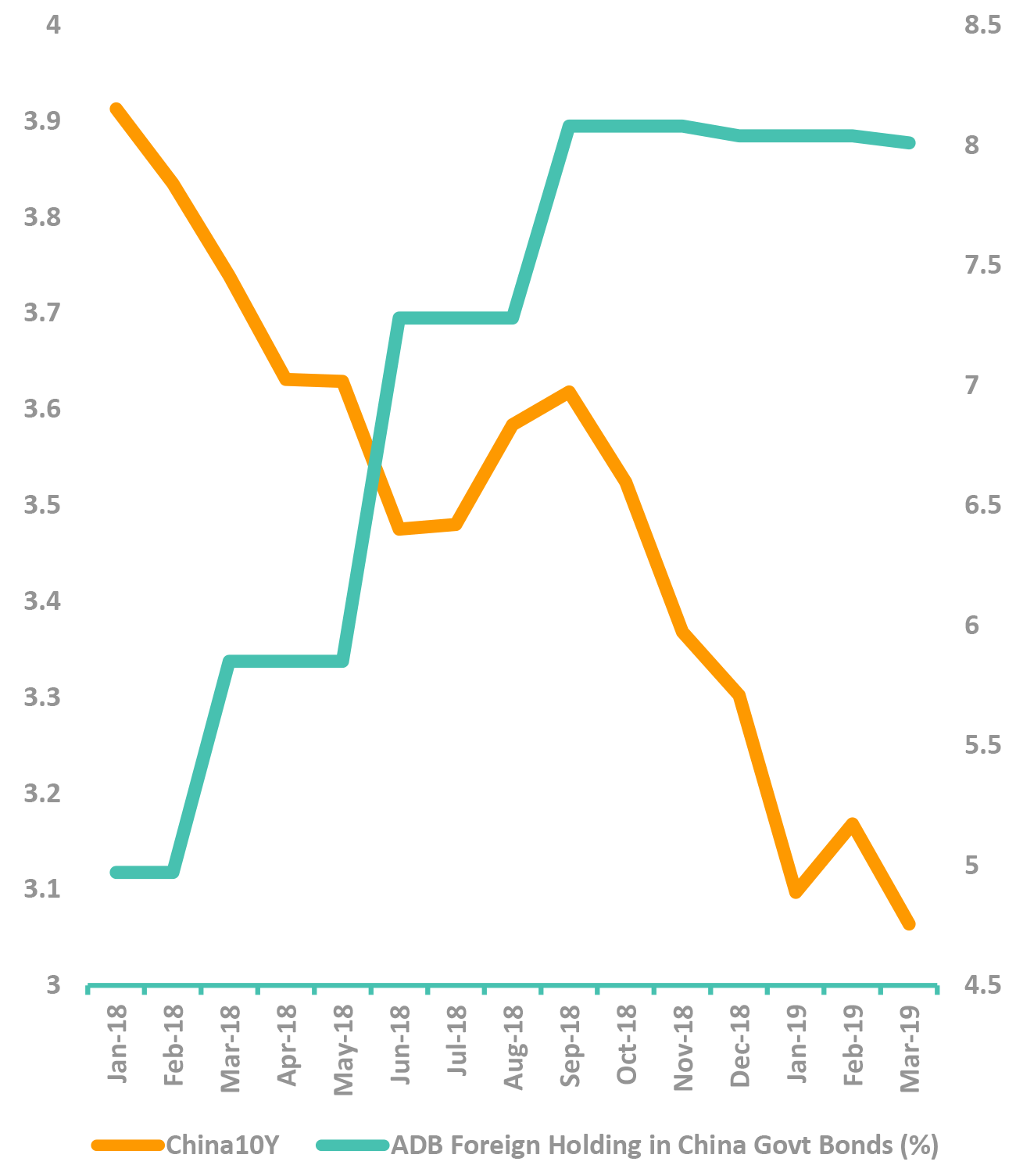

Bond Inclusion Impact – Learnings from China

- In Mar 2018, Bloomberg added China to Index

- Addition over a 20-month period starting 2019

- China 10Y yield fell from 3.9% to 3.1% over that 1 year period

- ✓ While US10Y fell by just 30 bps

- Foreign Holdings of China Govt bonds increased sharply from 5% to 8%

- The inflows in Chinese bonds increased significantly

- Difference in pre and post policy flows significant

- We expect similar move in India

Takeaway:

Bond Inclusion, though unlikely, will be a game changer and ease demand concerns

Source – Bloomberg, Internal ADB: Asian Development Bank

Our View – Time to add duration

-

Risks to yields moving higher greatly diminished

Thus risk/reward gravitates towards a long duration position:

- Favorable Demand-Supply: Announced govt borrowing for FY24 is just 8% more than FY23. Demand expected to grow at faster pace.

- RBI OMOs: In FY24, RBI will finally purchase govt bonds, after a gap of more than 1-year.

- Bond index inclusion chatter: An unlikely event, but with large impact. If risk of yields spiking up is very low, it is prudent to be invested to be able to benefit from such tail events.

- Global central banks: Closer to end of rate hike cycle. Powell was much more benign in Feb policy as compared to Dec policy.

-

Risks to our view

We had mentioned three reasons for yields to be under pressure in this quarter.

- Rupee depreciation: We are confident that the BoP risks are still not behind us, despite rupee stability in recent weeks. However, these risks seem to be overshadowed by the positive drivers.

- Global inflationary pressures: While markets expect inflation to subside, most central banks (including FED) concerned about sustainability of easing inflation. They may wait longer before pausing.

- Liquidity: Liquidity to tighten – even though at a lower pace. There is a risk that RBI might delay its liquidity infusion actions – especially if there is concern on currency.

-

Risk/Reward to buy duration

For long duration investment: With low chances of yields spiking up, we advise to add duration. The event risks also favor long bonds.

For money markets investment: We like the 1-year segment because of its high term premium. The high carry is lucrative. Central banks stance change will lead to fall in yields in this segment.

Fed: Federal Reserve; RBI: Reserve Bank of India; G-Sec: Government Securities; OMO: Open Market Operation

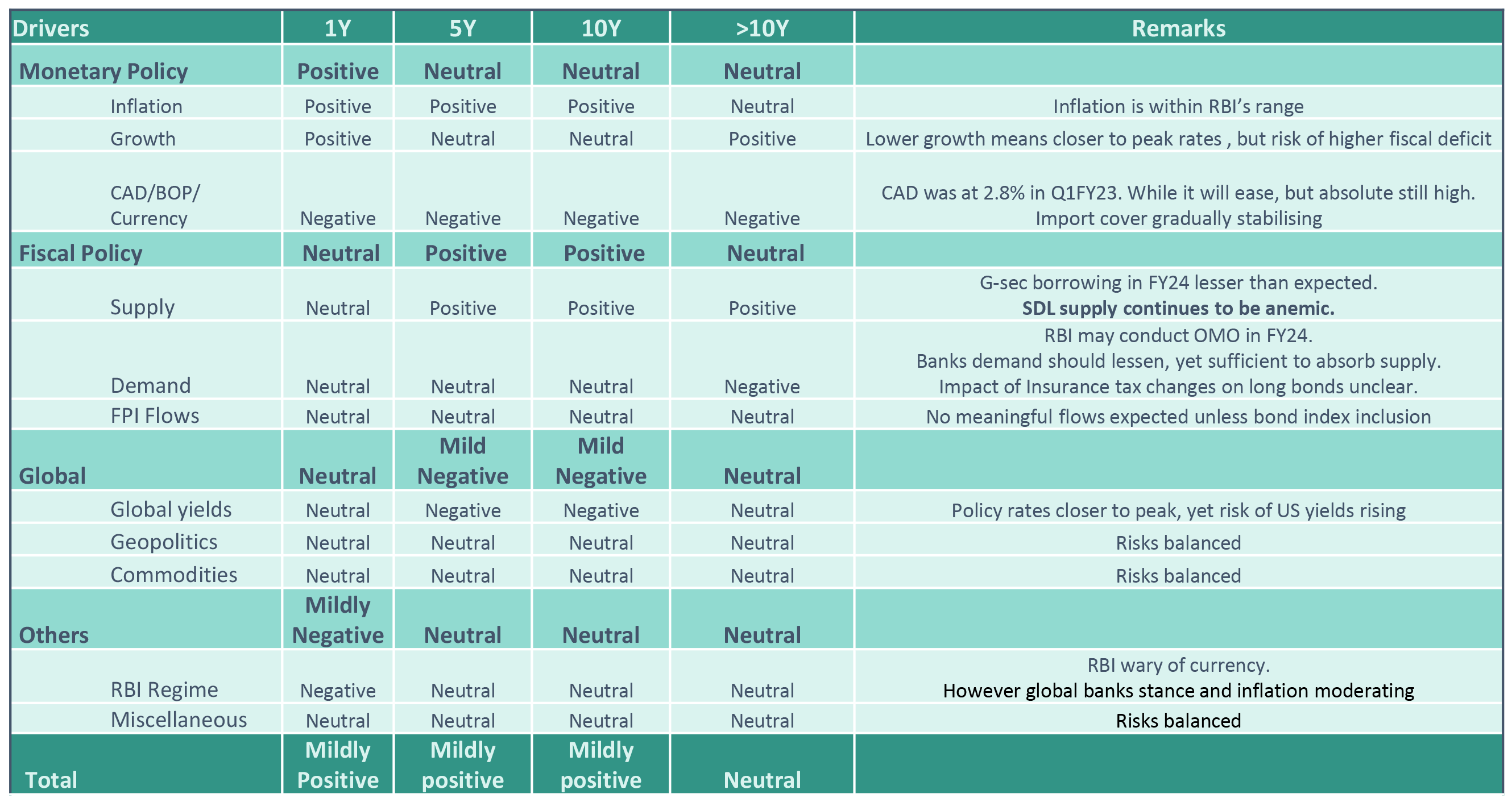

DSP FI Framework checklist : What is our view on yields movement?

Takeaway:

Markets should consolidate – sell-offs will be muted – risk of event led rallies – currency risks not over.

Done with our market view

framework?

Now

Our Portfolio creation framework

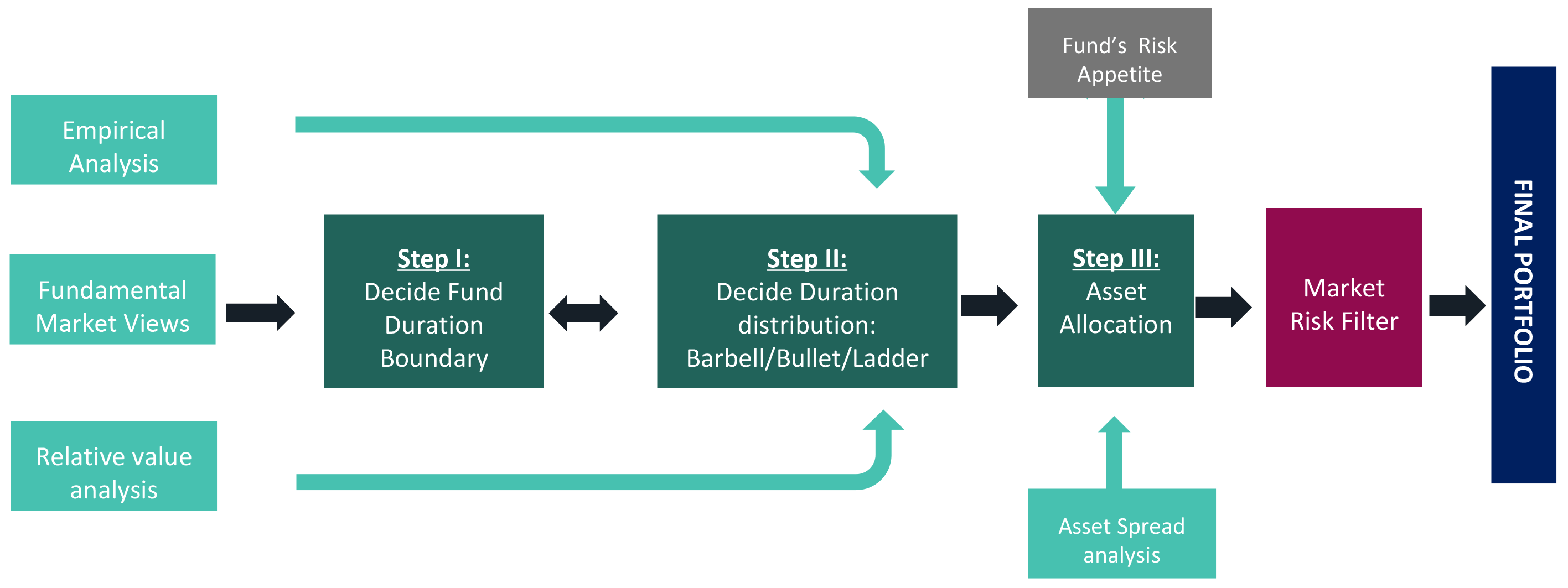

DSP Portfolio Creation: Multi-step process

DSP Fixed Income Funds follow a defined methodology for fund portfolio construction

- We apply market risk filter which can help the Fund Managers not to take extreme risks. Thus, Value at Risk is limited by ensuring the positions are balanced.

Investment approach / framework/ strategy mentioned herein is currently followed & same may change in future depending on market conditions & other factors.

DSP Credit Investment Process – Better Safe, than Sorry!

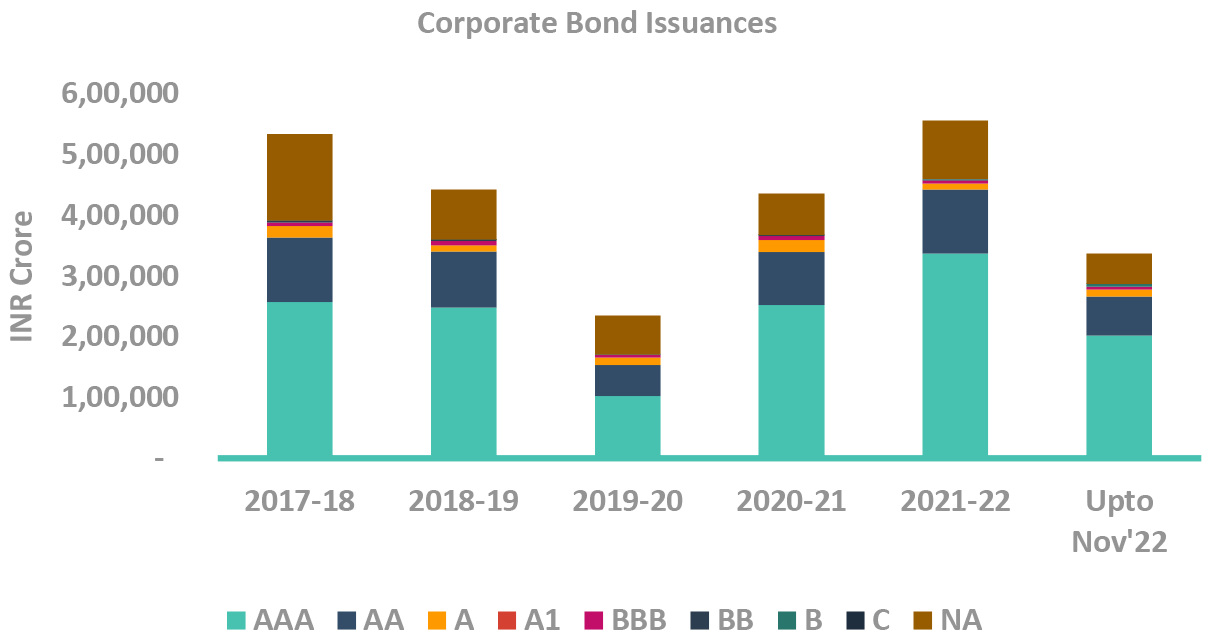

DSP Asset Allocation: Corporate bonds vs. Sovereign Bonds

-

Demand for corporate bond in the long end has been exceeding the supply keeping the spreads low

- The issuance has increased since low of 2020

- The issuances so far (till Nov) in FY23 have increased to ₹ 3.37 tn vs ₹ 3.00 tn till Nov’21

- But with govt. on path to reduce off-balance sheet borrowing, issuances may not increase meaningfully

- The non-discretionary / stable demand from the long-end investors viz. EPFOs, Insurance, NPS have matched the supply of bonds in the longer end keeping the spreads narrow.

- The issuance has increased since low of 2020

-

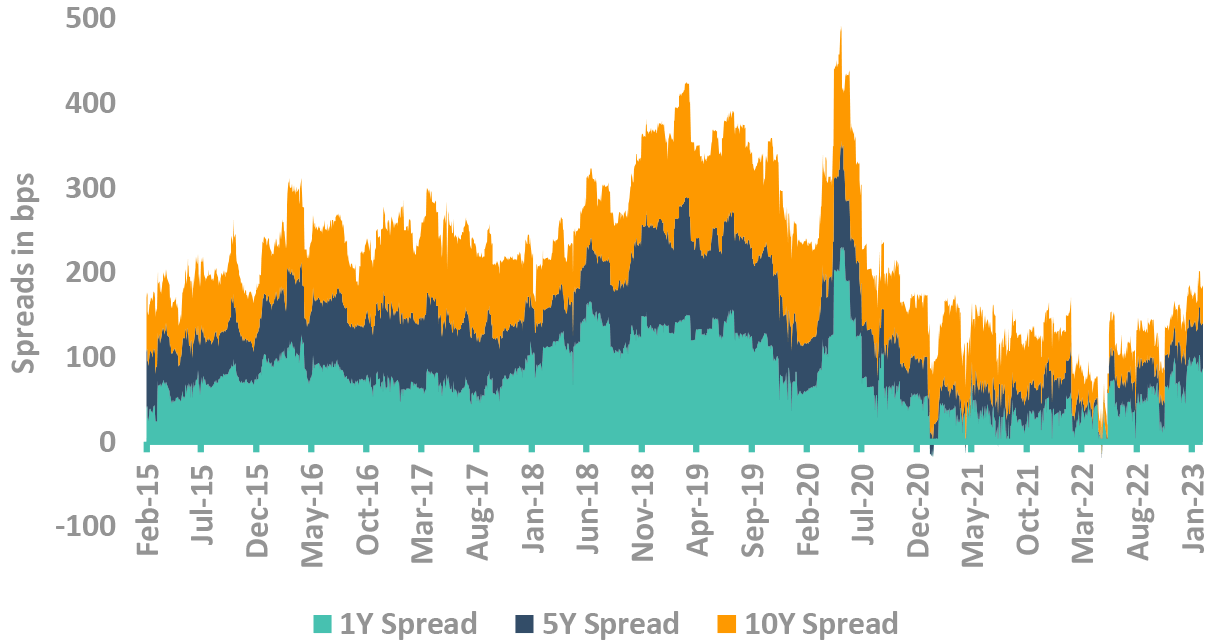

The corporate bond spreads are low

- The short end spreads (1-3Y) are at their median levels, the long end spreads remain narrow as the demand is strong from long end investors

- Steadily increasing allocation to short tenure corporate bonds as spreads have widened.

- Tighter liquidity, and high credit offtake could mean that CD supply from banks will remain elevated.

Takeaway:

In our view, corporate spreads to remain narrow in medium term – may widen in long term. Steadily adding corporate bond allocation in our funds

Source – Bloomberg, CCIL

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.