Summary

A good outcome doesn't always mean a good decision. This story of a friend who trusted luck over logic unpacks outcome bias a dangerous trap investors fall into. Discover why focusing on process, not just results, is key to making better decisions. Before the crash comes.

I have a friend from school who works at an MNC in Gurgaon. This is from around 2018. Every Friday night, his office colleagues would gather at the same bar. Alcohol followed, and by midnight, my intoxicated friend would swagger out of the bar and slip into the driver’s seat of his car to drive back home. It became routine.

As he told us, he knew he’d had too much, but he also knew something else: he always reached home safely. Not once had he been pulled over. Not once had he gotten into an accident. And so, when a few of us school friends, out of worry, tried to talk to him about the obvious danger of drinking and driving, he would wave us off with a grin and say, “Guys, relax. I’ve done this for years. I know what I’m doing.”

To him, the outcome of reaching home without incident justified the decision. Over and over again. Until one day, it didn’t.

He hit a divider late one night and thankfully didn’t hurt anyone, except himself and his car. With a few broken bones, he was bedridden for a few weeks. However, it wasn’t the severity of the crash that haunted him, but the realisation of how long he’d been trusting luck over logic. And just because the outcome had kept turning out fine.

This, my friend, is Outcome Bias, which leads us to judge the quality of a decision based on its result, instead of the thought or process that went into it.

So, as long as the outcome is favourable, we assume the decision was good. When it turns out badly, we blame the decision, even if it made perfect sense at the time.

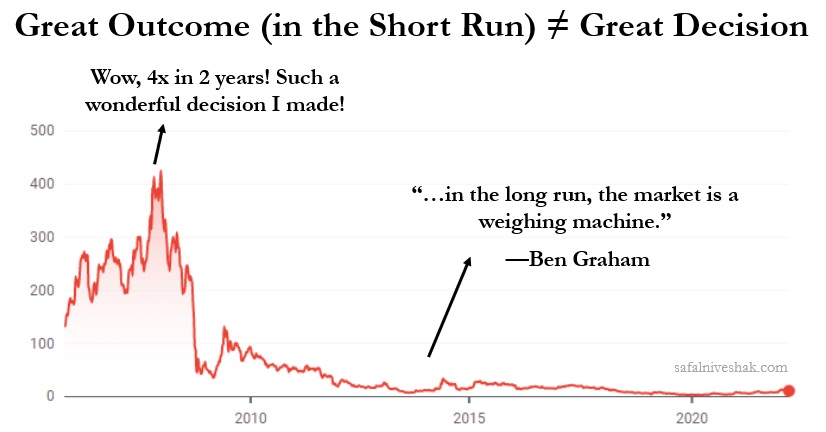

Consider investing. We often believe that a good investment is one that made money. But making money doesn’t always mean you made a good decision. Just as losing money doesn’t necessarily mean the decision was poor.

There’s a deeper truth in investing that many of us forget, which is that you can do everything right and still lose money. And you can do everything wrong and still make a profit. I’ve been there and done that. And this is because the market, like life, doesn’t always reward effort, process, or discipline on schedule. Sometimes, and often in the short run, it’s just the roll of the dice.

Poker champion and author in cognitive-behavioural decision science, Annie Duke, calls this “resulting.” In poker, players constantly make decisions under uncertainty. You could have the odds stacked in your favour and still lose the hand. Or you could play recklessly and win. But if you start assuming that winning equals good strategy, and losing equals bad judgement, you’ll learn all the wrong lessons. That’s resulting, and it’s what outcome bias looks like in real time.

She wrote in her book Thinking in Bets:

You can think about [resulting] as creating too tight a relationship between the quality of the outcome and the quality of the decision. You can’t use outcome quality as a perfect signal of decision quality, not with a small sample size anyway. I mean, certainly, if someone has gotten in 15 car accidents in the last year, I can certainly work backward from the outcome quality to their decision quality. But one accident doesn’t tell me much. In chess, if I lose a game, it’s pretty certain that I made a bad decision somewhere and I can go look for it. That’s a totally reasonable strategy. But it is a very unreasonable strategy in poker. If I lose a hand, I may have played the hand literally perfectly and still lost because there’s this luck element to it. The problem is that we’re all resulters at heart.

Outcome bias leads us to deeply flawed thinking. For instance, you might start believing that putting all your money into one high-risk stock is a smart move because it worked once. Or that avoiding a particular sector was foolish because it later rallied.

But hindsight is a dangerous lens. Just because something worked doesn’t mean it was the right thing to do. On the other hand, just because it didn’t work doesn’t mean it was wrong.

The real problem is that outcome bias not only distorts our view of the past, but that it shapes our future decisions. If a bad decision leads to a good result, we often reinforce it. We do it again. Worse, we up the stakes. It becomes a habit. And like my friend, we trust the pattern until it breaks. When that happens in investing, it may lead to financial ruin.

Outcome bias also leads us to punish good behaviour unfairly. Imagine someone who stuck to their asset allocation plan, avoided chasing hot stocks, and rebalanced regularly, but ended up underperforming in a year when speculative bets did well. That person might feel foolish, even though they followed a sound process.

The irony is that the more disciplined your process, the more often you’ll look wrong in the short term.

This is why many thoughtful investors I know of maintain a decision journal. They don’t just track what they bought or sold but also write down why they made each decision. They also write what assumptions did they make, what risks did they consider, and what was the range of possible outcomes.

Later, they revisit those notes to see if the logic still holds, independent of the result. This way, they learn from the process, not just the money they made or lost on the investment.

You see, one of the hardest parts of investing is separating signal from noise. Outcome bias blurs that line. A one-time win feels like insight. A temporary loss feels like stupidity. But the truth is, short-term outcomes often say very little about the quality of your thinking. It’s because markets are messy and unpredictable, and randomness plays a larger role than we’d like to admit.

Anyway, now for the most important question: What can we do to protect ourselves from outcome bias?

I think the first step, like always, is awareness. Just knowing that this bias exists is powerful. Start by asking: Would I have made this same decision if the outcome had been different? Would I consider this person insightful if their bet hadn’t worked? Questions like these help you step back and see the process more clearly.

The second step is building systems. Whether it’s journaling or creating checklists, systems help anchor you to your own reasoning. They create space between stimulus and reaction. When things go well, you can ask: did I follow my process, or did I just get lucky? When things go wrong, you can say: I did what I thought was right, and I’ll live with that.

The third step is cultivating humility. It’s okay to admit when luck helped. It’s okay to admit when you were wrong for the right reasons. The market doesn’t owe you rewards for good behaviour. But over time, sound decisions compound, even if some of them hurt in the short run.

Finally, surround yourself with people who ask better questions. People who won’t just say “Well done” when something works, but will ask, “How did you think through that?” or “What made you take that call?” These are the conversations that help you grow.

Annie Duke wrote in her book:

You can improve the probability that you will have good outcomes by improving your decision-making, but that is not making your own luck. That is increasing the chances that you have a good outcome. You can’t guarantee that things will turn out well and even though you might have made decisions that increased the probability that you have a good outcome, you cannot guarantee it. You cannot make luck go your way. It’s this idea of incrementally increasing the chances that things go well for you and that hopefully, those things play out over time.

In the end, outcome bias is just another way we fool ourselves. It flatters the ego when things go well and bruises it when they don’t. But investing isn’t about being flattered. It’s about surviving uncertainty with clarity. It’s about building a process you can trust, especially when the results are unclear.

Like my friend, we can all fall into the trap of trusting results over reasoning. But unlike him, we don’t have to wait for a crash to wake up.

This article is authored by Vishal Khandelwal of safalniveshak.com, an initiative to teach investors how to make simple and wise investment decisions.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

All Mutual fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF & procedure to lodge/ redress any complaints visit dspim.com/IEID.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Write a comment