Summary

“The Investor Ask” is a new series that will focus on questions on the minds of our investors, answered by their fund managers. We aim to ask our fund managers your tough questions in good times and in bad times. Each edition will aim to cut through the noise to offer candid, unfiltered answers. No sugar-coating. Just real conversations on how they are managing your money.

In this edition, we ask your questions to Aparna Karnik, the Fund manager behind DSP Value Fund, on her beliefs as a strong proponent of value investing, how she responds to market shocks, what gives her belief despite tough times and more.

1. If your top holdings look just like everyone else’s, isn’t your portfolio just another version of the benchmark?

“We’ve consciously chosen to be different for a reason”

Our largest positions are not the typical institutionally owned names in India. That’s because we have structurally avoided financials, which form the biggest chunk of the benchmark. We don’t own, and have never owned, any banks or lending institutions in the DSP Value Fund.

By avoiding what dominates most indices and peer portfolios, and instead owning names outside them, including select global companies, our portfolio naturally deviates from the benchmark

We accept that our approach can result in divergencies with the benchmark returns but we believe this approach could help generate reasonable, risk-aware returns over time.

2. Why invest in global equities through third-party funds? Shouldn’t you just own those stocks directly if you believe in them?

Third-party funds were a starting point. Today, most of the research is our own

When we started, we started with five global funds to avoid rushing into international stock picking without solid research. But we didn’t stop there. Today, we’re with only two funds, with two already replaced by stocks based on our internal research

The two external funds we still hold are those where we like the stock picking approach and it has a clearly differentiated philosophy that we find unique and additive.

For example, one of the global funds we hold is WCM Heptagon (since February, 2024). What we like about them is their unique investment philosophy where they evaluate corporate culture as an edge that helps them spot potential opportunities early.

3. With SEBI’s cap in place, how are you actually giving me global exposure right now?

"Working within the rules. Thinking beyond the borders."

Right now, around one third of our portfolio is in global stocks. We have been able to manage that because redemptions in some of our other funds freed up limits, which we have then used to allocate internationally.

Of course, we follow SEBI’s restrictions on overseas flows. Right now, inflows into our fund are still modest, so we are able to maintain this global allocation. However, if flows increase significantly, we may need to moderate them to stay within the cap. The global part of our strategy is intentional, and we are doing our best to maintain the global allocation to be a meaningful part of the portfolio.

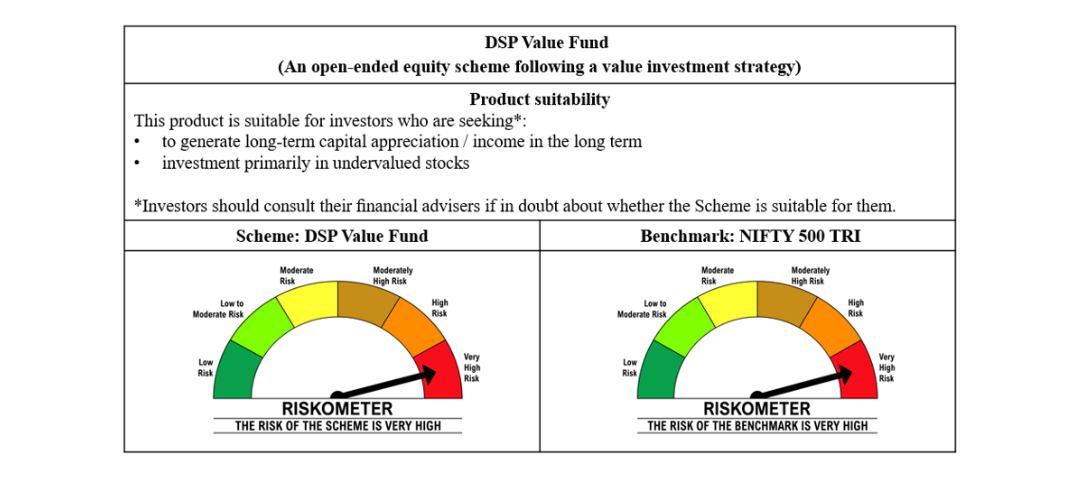

4. You claim a 90% active share but benchmark against a very broad-based index, Nifty 500 TRI. Isn’t that a mismatch?

“The benchmark is context, not a compass.”

We chose the Nifty 500 TRI as our benchmark because it reflects the universe that most of our investors are familiar with and the one against which they evaluate both active and passive options. From an investor’s perspective, it remains a relevant reference point. And as per SEBI regulations, we’re required to declare a benchmark.

While it adds value, our approach to building the portfolio, with its intentional differences from the benchmark it helps us stay aligned with our investment philosophy. That’s because our portfolio is constructed very differently and is designed to deviate meaningfully from the benchmark.

This is a deeply differentiated portfolio with limited overlap with the benchmark. We know that in certain market phases, our performance may diverge significantly. That’s expected because we aren’t trying to mirror the benchmark index.

What matters more to us is that investors understand our strategy clearly before they invest. What we do, what we avoid, and why we might differ from the benchmark index at any given point.

5. Value has trailed more often than not. Momentum, quality, even low volatility has beaten it often. So, what keeps you betting on value?

“Rankings change. Our principles don’t.”

We build portfolios to stand the test of time and to perform well across both up and down-market phases

Our approach is valuation conscious, quality focused, and globally diversified. That could mean we may look out of sync with the market and with peers, especially during frothy rallies.

But over time, the strategy has delivered. Since inception, the fund has generated reasonably better returns with lower drawdowns, especially during volatile periods in Indian markets, where our global allocation and cash positions helped cushion the downside.

Even against a blended benchmark say, 70% Nifty 500 and 30% MSCI ACWI our performance holds up well.

If you are in sync with our strategy, then we believe it can be a valuable long-term, compounder in your portfolio.

6. Why no Banking, Financial Services, and Insurance (BFSI)? Is this a rule you follow or is it something you are willing to relook at?

“Not a hard rule. A conscious, consistent choice.”

We haven’t invested in financials so far, not because of any rigid rule but because of a deliberate preference to avoid leverage. Leverage introduces risks that we’d rather sidestep in this portfolio.

Our universe is wide, with over 500 listed names in India and a large global canvas too. The fund’s size also allows us the flexibility to invest in smaller, underappreciated opportunities. So, the absence of BFSI hasn’t been a constraint. It’s been a conscious way to reduce risk and maintain portfolio differentiation.

7. You’re sitting on 10%+ cash, are you predicting a crash or just unsure where to invest?

“Cash isn’t a forecast. It’s a function of discipline.”

Holding some cash is part of how we manage risk and stay patient. Sometimes it's just a result of portfolio churn, but often it’s deliberate because we’re waiting for opportunities that meet our standards on value and liquidity.

Historically, we’ve carried between 7-15% cash in the portfolio since inception. It’s not a strategy to time the market; it’s about staying flexible. The Indian markets, in many segments, have looked expensive. So, we’d rather wait than chase.

And when volatility shows up, that cash helps us act swiftly. Yes, cash may slightly drag short-term returns, but it positions us well to act when the right ideas appear.

8. What’s your biggest stock holding and what’s a decision you regret?

“No hero bets. Just diversified conviction.”

We have a diversified portfolio with larger domestic and international names in the 2 to 3 percent range. Sometimes, we may to choose several names across a theme or a sector, to get a broad-based exposure so while individual weights may look small, there is still meaningful exposure to the sector or theme

One of the regrets was selling early and missing a large part of the rally in a stock like Polycab because I could not fully appreciate the earnings tailwind and ability of the management to execute

9. Any stocks that look like value, but you still didn’t buy? Why?

“Cheap doesn’t always mean right. Terminal value matters.”

Our approach to value is long term. We prefer holding businesses that can endure and adapt. Some stocks may look cheap but face structural risks.

NTPC, for instance, looked attractive, but with rising renewables and battery tech, we questioned the future of coal-based power. Castrol also seemed undervalued, but the rise of electric vehicles could weaken its core lubricant business.

We avoid companies with uncertain terminal value. Whether the risk comes from technology, regulation, or industry shifts, we prefer to stay cautious rather than chase what only appears to be value.

Editor’s Note: What sets Aparna apart isn’t just her portfolio choices, but the principle behind every decision. Value investing, to her, is less about what’s hot and more about what endures. In a world chasing momentum, she chooses meaning.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. DSP Value Fund is jointly managed by Kaivalya Nadkarni. The statements contained herein are based on fund manager’s views only and may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In this document, DSP Asset Managers Private Limited (“the AMC”) has used information that is publicly available, including information developed in-house. While utmost care has been exercised while preparing this document, neither the AMC nor any person connected warrants the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s), before acting on any information herein, should make his/her/their own assessment and seek appropriate professional advice. Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. The investment approach / framework/ strategy mentioned herein are currently followed by the scheme and the same may change in future depending on market conditions and other factors. The sector(s)/stock(s)/issuer(s) mentioned in this blog do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Portfolio Allocation will be based on the prevailing market conditions and is subject to changes depending on the fund manager’s view of the equity markets. The portfolio details & Holding data is as on 30thth June 2025. It is not possible to invest directly in an index. There is no assurance of any returns/ capital protection/ capital guarantee to the investors in this scheme of DSP Mutual Fund. The portfolio of the Underlying Fund is subject to changes within the provisions of its Offer document. For scheme specific risk factors, asset allocation details, load structure, investment objective and more details, please read the Scheme Information Document and Key Information Memorandum of the scheme available at the Investor Service Centers of the AMC and also available on www.dspim.com.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  FAQs

FAQs Reach us

Reach us

Comments

Total 9

Shimoni Khurana

15-07-2025

Insightful and loved the clarity

Anonymous

15-07-2025

Very insightful

SHIVANGI SHARMA

15-07-2025

Amazing insights!

Sharaya

15-07-2025

Such a transparent communication, loved reading every bit of it, please keep adding more in this series

Hariharan ATHIYAPPAN

15-07-2025

Insightful conversation with Aparna Karnik! Clear communication and transparency are key in investor relations, especially in volatile markets. Great read!

Daryll

15-07-2025

Rarely do you come across fund manager conversations that feel this honest, this intentional. Aparna Karnik’s answers aren’t just strategy notes—they’re a masterclass in clarity, conviction, and calm thinking. No jargon. No flash. Just strong, thought-through decisions that respect the investor’s trust. From skipping financials to questioning ‘cheap’ stocks, this isn’t your typical benchmark-hugging story—it’s value investing with a spine. Looking forward to more editions of The Investor Ask. This is the kind of transparency long-term investors deserve.

Anonymous

16-07-2025

Very refreshing to find a fun manager being this candid and honest about the approach, happy to be an investor in DSP schemes

PS

17-07-2025

As a new investor I always had my doubts, thanks this series is going to be a much needed one !!!

Anonymous

20-07-2025

Quite insightful

Write a comment