Summary

Gold has surged due to record central bank buying, investor demand, and geopolitical tensions. With both the U.S. and China now deleveraging, fears of global currency debasement are rising. This environment could support further gold gains, while silver remains well below its inflation-adjusted peak from 2011.

Gold is flying high. But can it keep defying gravity?

The global demand for gold has been rising since 2022. After Russian central bank assets were frozen in Europe, other central banks scrambled to pick up gold to protect themselves against something like this ever happening to them.

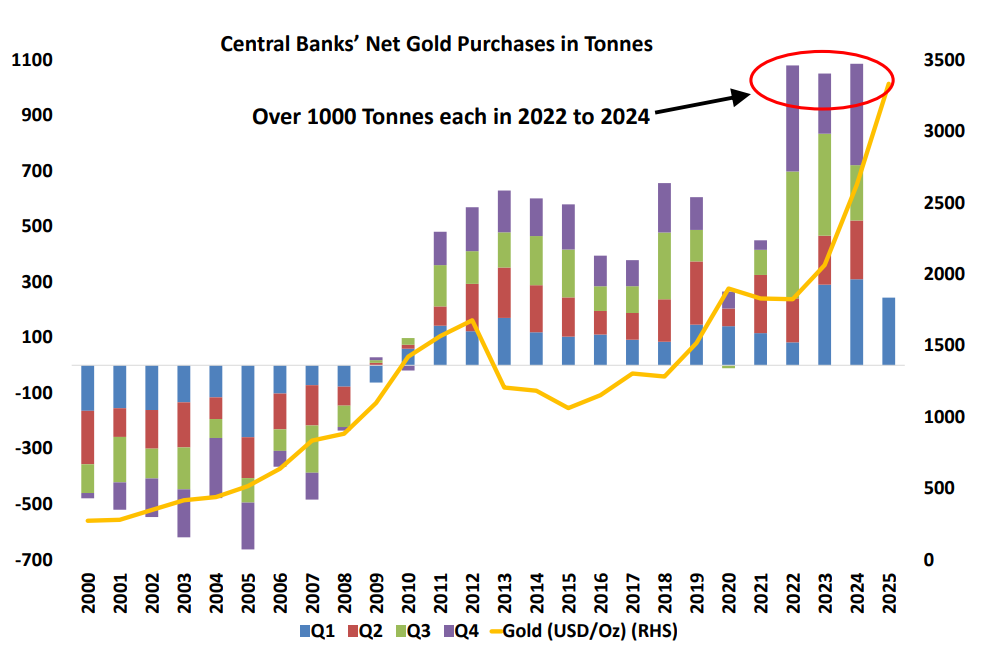

In fact, central banks bought more gold in the last 4 years than in the previous 21 years, as can be seen below.

Source: World Gold Council, DSP, Data As of June 2025

In contrast, silver has yet to reach its inflation-adjusted peak from 2011 and remains significantly lower than that peak.

Source: Bloomberg, DSP, Data As of June 2025.

But what’s noteworthy is that from a geopolitical perspective, there’s definitely a possibility that gold still has a fair bit of headroom left.

Why? Here’s one argument:

US policymakers are now beginning to seriously address their twin deficits: the trade deficit and the fiscal deficit.

The ongoing tariff war, though debatable in its execution, could potentially reduce the US trade deficit by slowing global trade and benefiting from a weaker US dollar.

There is also a growing recognition that the US needs to urgently address its debt problem, whether by borrowing less or servicing its existing debt better: the country’s total federal debt stood at around $36 trillion as of July 2025.

Historically, whenever the largest debtor nation (currently the US) attempts to deleverage (i.e. reduce its debt levels), a major creditor (such as China) offsets it by leveraging up (i.e. taking on more debt).

This time, however, China is also undergoing a deleveraging cycle. This raises serious concerns about global growth, with one likely outcome being a broad currency debasement (which might already be underway).

Such a scenario ought to benefit gold, as well as silver to a lesser extent.

For more actionable insights backed by data and analyses, we invite you to read thelatest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of July 2024 (unless otherwise specified) and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Write a comment