Summary

This article invites HNIs to align their wealth with their values through sustainable investing. It highlights rising ESG trends in India and globally, emphasizing impact-driven strategies, next-gen preferences, and the role of HNWIs in shaping market change. It urges investors to combine purpose with performance for lasting impact.

In today’s information-rich world, relevance and resonance are more important than ever. That’s why we’re launching a new series of thoughtfully curated articles designed exclusively for our most discerning readers. Crafted through in-depth conversations and meticulous research, this series reflects what truly matters to you, especially our High Net-Worth Individual (HNI) audience.

From wealth creation and preservation to fine art, luxury travel, and lifestyle choices that reflect sophistication, our content will align with your evolving interests.

But this isn’t a one-way dialogue. We see this as a shared journey and welcome your voice. Share your thoughts, suggest topics, or tell us what’s missing in today’s content landscape on [email protected].

This is content with purpose for readers who expect more.

Is your wealth aligned with your values?

In the grand tapestry of life, as wealth accumulates, so does the innate desire to give back. Philanthropy becomes not just an act, but a way of life. Titans of the industry, both global and Indian, and across sectors such as IT and e-commerce, have set monumental examples, channeling billions into causes that resonate with their values.

But here's a thought-provoking question: If our hearts and actions are committed to bettering the world, shouldn't our investments mirror this ethos?

ESG - Reshaping the Future of Capital Allocation

Imagine a world where every rupee invested not only yields financial returns but also contributes to a sustainable future. A future where economic growth, social inclusion and environmental protection are more than just bywords. This isn't a distant dream it is the essence of sustainable investing. And it is a tenet that large sections of the society are now committing to, in the hope of building a world more equitable for all.

Globally, sustainable investments have surged, with the U.S. alone accounting for USD 6.5 trillion in assets under management marked as sustainable or ESG (Environmental, Social, Governance) in 2024 representing 12% of the total U.S. assets under professional management 4.

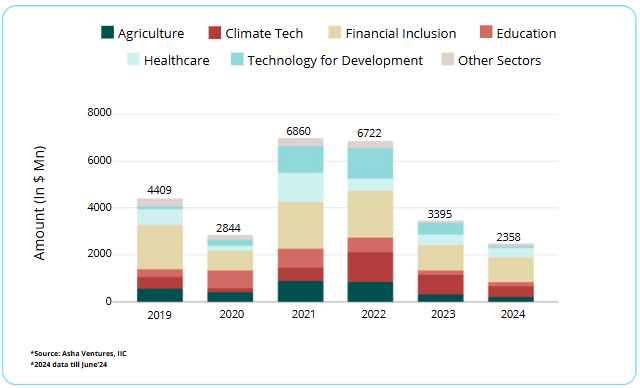

India is keeping pace. While the overall trend has been volatile peaking at USD 6.9 billion in 2021 and USD 6.7 billion in 2022 before a decline in 2023, impact-focused enterprises attracted USD 2.4 billion in just the first half of 20245 . The numbers speak for themselves the demand for sustainable investing is getting stronger.

Exhibit 1 - Sector-wise impact investments in India (Amount in USD million)6

2024 data till June’24

The trend could indicate changing investor priorities, especially, waning impact of the pandemic driven decisions. Agriculture investments have consistently declined. While the sector had a stronger presence in 2019, its share has reduced over the years. This may be due to shifting investor focus toward higher-growth and technology-driven ESG sectors or regulatory/market challenges affecting agricultural investments. Climate Tech and Financial Inclusion remain steady contributors. Unlike other sectors, they have maintained a stable presence, highlighting continued interest in sustainability and financial access.

How are India’s HNWIs and UHNWIs Shaping Market Trends?

India's economic landscape is evolving rapidly. As affluence grows, so does the responsibility to drive meaningful change. High-net-worth individuals (HNWIs) and Ultra-high-net-worth individuals (UHNWIs) hold a distinctive advantage, with the power to steer market trends and capital flows towards sustainable and impactful solutions. Moving beyond traditional philanthropy, impact investing offers more than just donations—it provides measurable returns alongside tangible social and environmental progress.

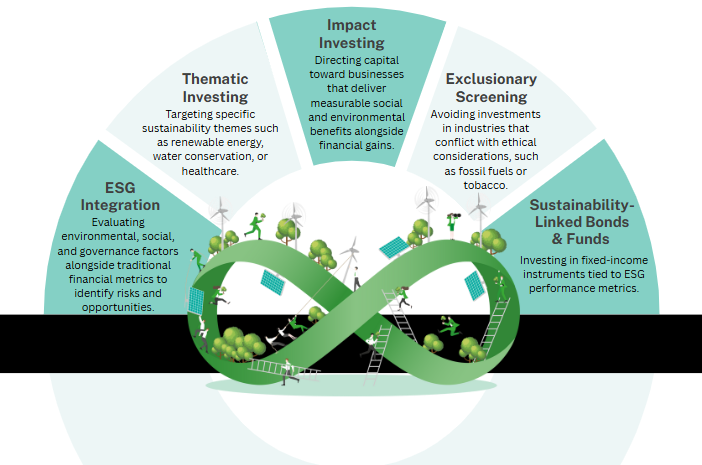

Even as the world aligns with the need of the hour, it is important to understand that sustainable investing is not a one-size-fits-all approach—it offers multiple avenues for investors to align their portfolios with impact-driven growth while ensuring financial returns. Some key strategies that are driving change include:

Future-proofing wealth is also becoming a central focus. Investments in ESG-centric sectors serve as a strategic buffer, mitigating risks from regulatory changes, environmental challenges, and social volatility. Over the next five years, private spending towards philanthropy is forecasted to witness a growth of 10%-12%, powered by family philanthropy from UHNWIs, HNWIs, and the affluent demographic7.

Additionally, next-generation investors and women are increasingly placing sustainability at the heart of their decisions. Reportedly, women are leading philanthropic efforts in 55% of families, while 33% have inter-generational or next-generation members actively anchoring their giving strategies.

This shift in priorities is pushing wealth managers and family offices to adopt impact-driven strategies as part of long-term financial planning. The result is a new wave of investment preferences, with younger investors demanding greater transparency and accountability in their portfolios.

For the discerning Indian investor, this presents a compelling opportunity: to be at the forefront of a movement that seamlessly blends wealth creation with societal betterment.

Beyond Intent: Making Your Money Matter.

For investors who want their wealth to reflect their values, now is the time to act. Aligning your portfolio with sustainability isn't just thoughtful, it's powerful. Here is how to take meaningful steps:

- Choose the right experts: Work with fund managers who specialise in ESG and impact investing. For instance, a leading fund house’s ESG exclusionary strategy offers a solid platform to invest with purpose.

- Diversify with intention: Spread investments across equities, bonds, and sustainable alternatives to reduce risk and stay future-ready. DSP Asset Management provides ESG-focused funds in clean energy and natural resources smart choices for impact and performance.

- Track the impact: Pick funds with clear ESG metrics to ensure your goals both ethical and financial are on track. Top-rated by CRISIL, boutique fund houses stand out for their measurable impact.

A Call to Action: Invest with Purpose

The narrative is clear: As stewards of wealth, we have the power and the obligation to shape a future that reflects our values. Sustainable investing is not merely a trend; it's a testament to the belief that prosperity and purpose can coexist harmoniously.

As you contemplate your next investment move, consider this: By aligning your financial strategies with sustainable initiatives, you're not just securing your future you're contributing to a legacy of positive change.

Invest responsibly. Invest sustainably.

Talk to the DSP team to know more about making sustainable investment choices.

1 https://www.forbes.com/profile/azim-premji/

2 https://fortune.com/article/how-much-does-jeff-bezos-give-to-charity-philanthropy-wife-lauren-sanchez-eva-longoria/

3 https://www.bbc.com/news/articles/cx2p4p4l78zo

4 U.S. Sustainable Investment Assets foundation

5 India Impact Investors Council Report

6 inc42, IIC

7 Bain Dasra Philanthropy Report

Disclaimer

The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). In this note, DSP Asset Managers Private Limited (“the AMC”) has used information that is publicly available, including information developed in-house. While utmost care has been exercised while preparing this document, neither the AMC nor any person connected warrants the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s), before acting on any information herein, should make his/her/their own assessment and seek appropriate professional advice. Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in any scheme of DSP Mutual Fund.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Write a comment