1.04 lakh people have invested in this fund

1.04 lakh people have invested

in this fund as of

Total AUM

₹3,701.59 crores

as of Jan 31, 2026

Age of Fund

12 years 24 days since Feb 06, 2014

Expense Ratio

1.88%

as of Feb 27, 2026

Exit Load

1%

If redeemed between 0 - 1 Months

Ideal holding period

5 Years+

| Large Cap | 30.0% |

| Mid Cap | 3.7% |

| Small Cap | 5.5% |

| Holdings | Weight % |

|---|---|

| HDFC Bank Limited | 2.7 % |

| ICICI Bank Limited | 2.3 % |

| Axis Bank Limited | 1.7 % |

| Bharti Airtel Limited | 1.7 % |

| Tata Consultancy Services Limited | 1.5 % |

| NTPC Limited | 1.5 % |

| Mahindra & Mahindra Limited | 1.5 % |

| SBI Life Insurance Company Limited | 1.3 % |

| Samvardhana Motherson International Limited | 1.2 % |

| State Bank of India | 1.2 % |

| View All Holdings | 16.5 % |

| Credit rating profile | Weight % |

|---|---|

| SOV | 8.2 % |

| AAA | 14.6 % |

| AAA(SO) | 0.8 % |

| AA+ | 4.5 % |

| A1+ | 2.0 % |

| Cash & Equivalent | 1.5 % |

| Instrument break-up | Weight % |

|---|---|

| Bonds & NCDs | 19.1 % |

| Government Securities (Central/State) | 8.2 % |

| Money market instruments | 2.0 % |

| TREPS | 0.8 % |

| Securitized Debt Instruments | 0.8 % |

| Holdings | Weight % |

|---|---|

| 7.32% GOI 2030 | 3.0 % |

| 7.06% GOI 2028 | 1.7 % |

| REC Limited | 1.5 % |

| Bajaj Finance Limited | 1.5 % |

| 7.17% GOI 2030 | 1.4 % |

| LIC Housing Finance Limited | 1.4 % |

| National Bank for Agriculture and Rural Development | 1.4 % |

| HDFC Bank Limited | 1.3 % |

| Torrent Pharmaceuticals Limited | 1.0 % |

| Small Industries Development Bank of India | 1.0 % |

| View All Holdings | 15.1 % |

| Holdings | Weight % |

|---|---|

| NIFTY 26000 Put Feb26 | 0.1 % |

| NIFTY 25500 Put Feb26 | 0.0 % |

| 0.2 % |

| Holdings | Weight % |

|---|---|

| Arbitrage Holdings | 29.1 % |

Yield to Maturity

7.06 %

Modified Duration

2.60 Years

Portfolio Macaulay Duration

2.75 Years

Average Maturity

3.27 Years

Portfolio turnover ratio

4.49 last 12 months

Portfolio turnover ratio - Directional Equity

0.35 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | CRISIL Hybrid 50+50 - Moderate… ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Feb 06, 2014.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Rohit Singhania

Shantanu Godambe

Kaivalya Nadkarni

Preethi R S

The investment objective of the Scheme is to seek capital appreciation by dynamically managing the asset allocation between equity and debt securities.

The Scheme intends to generate long-term capital appreciation by investing in equity and equity related instruments and seeks to generate income through investments in debt securities, arbitrage and other derivative strategies.

However, there can be no assurance that the investment objective of the scheme will be achieved.

An open ended dynamic asset allocation fund

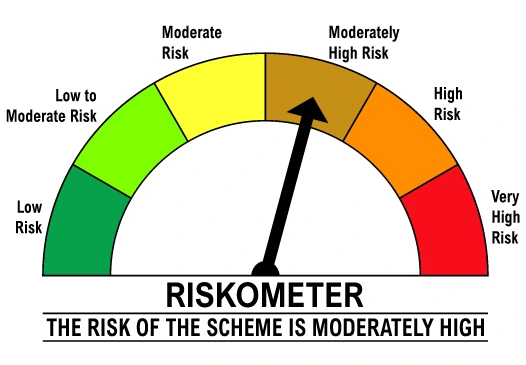

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Transaction timelines

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if money is received before cut-off) | 3:00 PM (business days) | Units added to your folio on T+1 days (if money is received before cut-off). |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Redemption processed on T+1 business days. Money credited to your bank account by T+2 business days. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Switch-out processed on T+2 business days |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NAV of this scheme | 3:00 PM (business days) | Units added on T+1 business days after the switch-out from the source scheme. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NA | NA | Money credited instantly. |

1.04 lakh peoplehave invested in this fund as of