4.41 lakh people have invested in this fund

4.41 lakh people have invested

in this fund as of

Total AUM

₹5,184 crores

as of Jan 31, 2026

Age of Fund

13 years 1 month since Jan 01, 2013

Expense Ratio

0.74%

as of Feb 23, 2026

Exit Load

1%

upto 12 Months

Ideal holding period

10 Years+

| Large Cap | 44.6% |

| Mid Cap | 12.1% |

| Small Cap | 39.2% |

| Holdings | Weight % |

|---|---|

| Larsen & Toubro Limited | 5.2 % |

| NTPC Limited | 4.9 % |

| Apollo Hospitals Enterprise Limited | 3.8 % |

| Multi Commodity Exchange of India Limited | 3.3 % |

| Bharti Airtel Limited | 3.1 % |

| Oil & Natural Gas Corporation Limited | 3.0 % |

| Power Grid Corporation of India Limited | 2.8 % |

| Hindustan Aeronautics Limited | 2.7 % |

| Kirloskar Oil Engines Limited | 2.6 % |

| Coal India Limited | 2.3 % |

| View All Holdings | 33.6 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 2.1 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 2.0 % |

| Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 2.0 % |

| Cash & cash equivalents | 0.1 % |

| 2.1 % |

| Holdings | Weight % |

|---|---|

| Indus Infra Trust | 2.0 % |

| 2.0 % |

Portfolio turnover ratio

0.23 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | BSE India Infrastructure TRI ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Jan 01, 2013.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Direct Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Rohit Singhania

The primary investment objective of the Scheme is to seek to

generate capital appreciation, from a portfolio that is substantially

constituted of equity securities and equity related securities of

corporates, which could benefit from structural changes brought

about by continuing liberalization in economic policies by the

Government and/or from continuing investments in infrastructure, both

by the public and private sector.

There is no assurance that the investment objective of the Scheme will be realized.

An open ended equity scheme following economic reforms and/or Infrastructure development theme

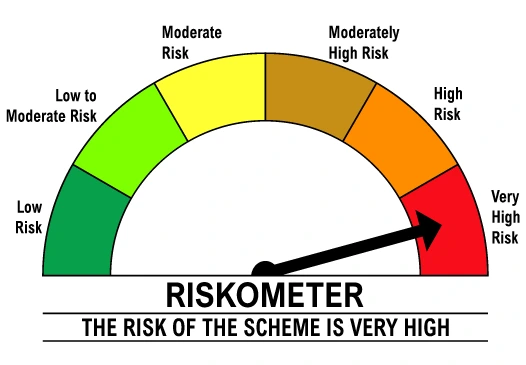

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Transaction timelines

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if money is received before cut-off) | 3:00 PM (business days) | Units added to your folio on T+1 days (if money is received before cut-off). |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Redemption processed on T+1 business days. Money credited to your bank account by T+2 business days. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Switch-out processed on T+2 business days |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NAV of this scheme | 3:00 PM (business days) | Units added on T+1 business days after the switch-out from the source scheme. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NA | NA | Money credited instantly. |

There are two primary ways to invest in the DSP India T.I.G.E.R. Fund. One is directly through the DSP Mutual Fund website. The other is through a market intermediary, such as the zero brokerage mutual fund platform, or from a mutual fund distributor. It is important to note that DSP India T.I.G.E.R. Fund has two variants of the same mutual fund scheme, i.e., the direct variant and the regular variant. You can avail of the direct variant through no brokerage platforms or through the website of the DSP Mutual Fund. You can purchase the regular variant through a mutual fund distributor. If you are purchasing from a no brokerage app, the name of the mutual funds scheme is DSP India T.I.G.E.R. Fund.

Most market experts agree that it is impossible to time the stock market. Additionally, individuals who invest in mutual funds regularly can benefit from 'Rupee Cost Averaging'. It has been observed that in the long run, investments made in mutual funds through SIP yield better returns than investments made sporadically through lump sum investments. This doctrine is called 'Rupee Cost Averaging'. It is best to make regular investments through an SIP in the DSP India T.I.G.E.R. Fund instead of waiting for an opportune time to make a lump sum payment. Most mutual funds apps/platforms allow you to set-up a SIP to your favourite mutual fund scheme within seconds. All you need to set-up a SIP is your bank account details and your mobile to which your bank account is linked for OTP verification.

Thematic Focus: The fund is specifically focused on the infrastructure sector, investing in companies that are involved in or benefit from infrastructure development in India.

Regulatory Compliance: As per SEBI regulations, the fund is required to invest at least 80% of its assets in companies aligned with the infrastructure theme.

Equity Fund Benefits: In case of equity investment by and individual in stock and equity mutual funds, long term capital gains is taxed at a rate of 12.5% with surcharge (in case the income exceeds INR 50 Lakhs) and 4% cess. It is important to note that long term capital gains up to INR 1.25 lakh are completely exempt. The 12.5% rate is applicable only on the gains made beyond INR 1.25 lakh.

Sector Exposure:The fund offers targeted exposure to the infrastructure sector, allowing investors to benefit from the growth potential of infrastructure development in India.

Potential for Long-Term Growth: Given the nature of infrastructure investments, the fund is positioned to potentially deliver growth over the long term, aligning with investors who have a longer investment horizon.

The DSP India T.I.G.E.R. Fund primarily focuses on investing in the infrastructure sector. The fund is benchmarked against the BSE India Infrastructure Total Return Index, reflecting its alignment with this critical sector of the economy. As an equity fund, it is required by SEBI regulations to invest at least 80% of its assets in equity and equity-related securities. This means the majority of the fund's corpus is directed towards companies that are directly involved in or benefit from infrastructure development in India.

The investment strategy is guided by the asset allocation specified in the Scheme Information Document (SID), ensuring compliance with regulatory requirements while aiming to capture the growth potential within the infrastructure sector. By investing in a diversified portfolio of infrastructure-related companies, the fund seeks to capitalize on the ongoing and future growth opportunities in this vital sector, making it a strategic choice for long-term investors.

4.41 lakh peoplehave invested in this fund as of