49.92K people have invested in this fund

49.92K people have invested

in this fund as of

Total AUM

₹893.7 crores

as of Jan 31, 2026

Age of Fund

7 years 4 days since Feb 21, 2019

Expense Ratio

0.18%

as of Feb 23, 2026

Exit Load

Nil

Ideal holding period

10 Years+

| Large Cap | 99.8% |

| Small Cap | 0.0% |

| Holdings | Weight % |

|---|---|

| HDFC Bank Limited | 12.3 % |

| ICICI Bank Limited | 8.4 % |

| Reliance Industries Limited | 8.1 % |

| Infosys Limited | 5.0 % |

| Bharti Airtel Limited | 4.7 % |

| Larsen & Toubro Limited | 4.0 % |

| State Bank of India | 3.9 % |

| Axis Bank Limited | 3.4 % |

| Tata Consultancy Services Limited | 2.8 % |

| ITC Limited | 2.7 % |

| View All Holdings | 55.2 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 0.2 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 0.2 % |

| Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 0.2 % |

| Cash & cash equivalents | 0.0 % |

| 0.2 % |

Portfolio turnover ratio

0.08 last 12 months

Tracking Error

0.04 %

Tracking Error (Abs.)

0.003 %

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returnsas of with investment of₹10,000

| This fund | NIFTY 50 TRI ^ | NIFTY 50 TRI # | Tracking difference | ||||

|---|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | ||

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Date of allotment: Feb 21, 2019.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Direct Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Anil Ghelani, CFA

Diipesh Shah

To invest in companies which are constituents of NIFTY 50 Index (underlying Index) in the same proportion as in the index and seeks to generate returns that are commensurate (before fees and expenses) with the performance of the underlying Index, "subject to tracking error"

There is no assurance that the investment objective of the Scheme will be realized.

An open ended scheme replicating/tracking NIFTY 50 Index.

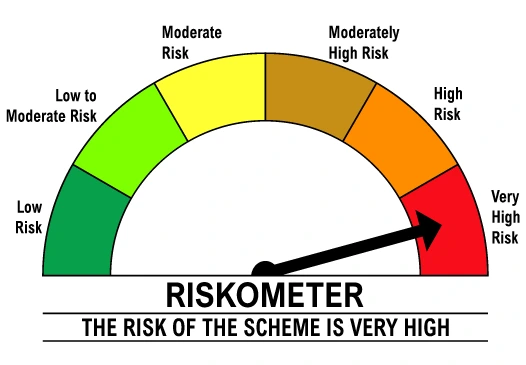

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Transaction timelines

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if money is received before cut-off) | 3:00 PM (business days) | Units added to your folio on T+1 days (if money is received before cut-off). |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Redemption processed on T+1 business days. Money credited to your bank account by T+2 business days. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Switch-out processed on T+2 business days |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NAV of this scheme | 3:00 PM (business days) | Units added on T+1 business days after the switch-out from the source scheme. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NA | NA | Money credited instantly. |

Index funds are passive mutual fund schemes that track a market benchmark index. The Nifty 50 Index Fund tracks the Nifty 50 Index, which includes the 50 largest companies by market capitalization in India. Unlike actively managed mutual funds, index funds don't aim to beat the benchmark; they simply mirror its performance. The Total Expense Ratio (TER) for index funds is lower than that of actively managed funds. They offer benefits and convenience of open-ended mutual fund schemes. Nifty 50 Index Funds provide a straightforward and cost-effective way to invest in Indian equities.

The DSP Nifty 50 Index Fund tracks the Nifty 50 TRI, an index of the 50 largest stocks by market cap. The weight of each stock in the Nifty 50 Index Fund matches its weight in the Nifty 50 Index. For example, if a stock has a 5% weight in the Nifty 50 Index, it will have the same weight in the Nifty 50 Index Fund.

Actively managed equity funds carry unsystematic risks because fund managers may be overweight or underweight on certain stocks compared to the benchmark index. Index funds avoid these risks because they match the weights of the underlying stocks with the index. As a result, index funds have lower risk compared to active funds and are subject to market risks.

Because index funds simply track a market index, they require less effort in fund management and research. Therefore, the Total Expense Ratio (TER) is relatively lower than that of actively managed mutual funds. Lower costs benefit index funds over the long term.

Consider investing in the DSP Nifty 50 Index Fund if you:

Consult with your financial advisor or mutual fund distributor to see if the DSP Nifty 50 Index Fund fits your investment needs.

Click the green INVEST button on the left side of the webpage (Click here). If you're already a DSP Mutual Fund investor, you can start investing right away. New to DSP Mutual Funds? Create a portfolio by filling out the necessary details. If you're new to mutual funds, complete the KYC requirements. Follow the on-screen instructions to get started. You can also invest in the DSP Nifty 50 Index Fund through your mutual fund distributor.

Returns from the Nifty 50 Index Fund can vary widely due to market conditions and economic factors. Historically, equity as an asset class has the potential to deliver relatively better returns compared to other asset classes. Since the Nifty 50 Index Fund invests in the largest companies in India, it tends to be less volatile than funds investing in the broader market, such as midcap or small-cap funds. However, the Nifty 50 Index Fund can be volatile in the short term, so investors should have long-term horizons.

Check the past performance of the DSP Nifty 50 Index Fund by visiting the performance section. View both lump sum and SIP returns and see how the fund has performed against its benchmark index (Nifty 50 TRI) over the last 1, 3, 5 years, and since inception. Always evaluate an equity index fund's performance over long periods.

Your investment amount depends on:

The ideal investment duration in a Nifty 50 Index Fund depends on your financial goals and risk tolerance. Since this is an equity-oriented Index scheme, plan to stay invested for at least 5 years. Over a long period, investments can recover from market corrections and can possibly benefit from the power of compounding.

49.92K peoplehave invested in this fund as of