8.58 lakh people have invested in this fund

8.58 lakh people have invested

in this fund as of

Total AUM

₹19,047.03 crores

as of Jan 31, 2026

Age of Fund

19 years 3 months since Nov 14, 2006

Exit Load

1%

upto 12 Months

Ideal holding period

10 Years+

| Large Cap | 14.2% |

| Mid Cap | 67.5% |

| Small Cap | 14.2% |

| Holdings | Weight % |

|---|---|

| Coforge Limited | 4.3 % |

| IPCA Laboratories Limited | 3.3 % |

| Coromandel International Limited | 2.7 % |

| Jindal Steel Limited | 2.6 % |

| Fortis Healthcare Limited | 2.6 % |

| Voltas Limited | 2.5 % |

| Max Financial Services Limited | 2.5 % |

| AU Small Finance Bank Limited | 2.5 % |

| Schaeffler India Limited | 2.4 % |

| The Federal Bank Limited | 2.4 % |

| View All Holdings | 27.8 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 4.1 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 4.0 % |

| Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 4.0 % |

| Cash & cash equivalents | 0.1 % |

| 4.1 % |

Portfolio turnover ratio

0.24 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | Nifty Midcap 150 TRI ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Nov 14, 2006.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Institutional Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Vinit Sambre

Abhishek Ghosh

The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities of mid-cap companies. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction.

There is no assurance that the investment objective of the Scheme will be realized

An open ended equity scheme predominantly investing in mid cap stocks

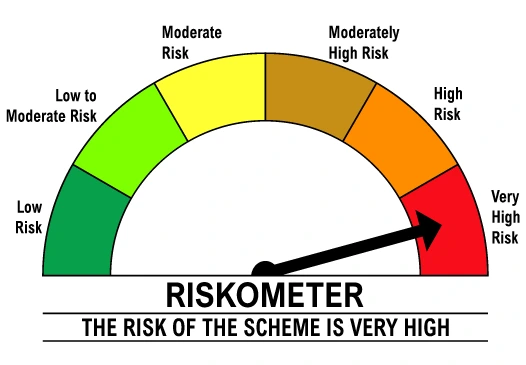

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Transaction timelines

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if money is received before cut-off) | 3:00 PM (business days) | Units added to your folio on T+1 days (if money is received before cut-off). |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Redemption processed on T+1 business days. Money credited to your bank account by T+2 business days. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Switch-out processed on T+2 business days |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NAV of this scheme | 3:00 PM (business days) | Units added on T+1 business days after the switch-out from the source scheme. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NA | NA | Money credited instantly. |

Mid Cap funds invest in mid-sized companies that have the potential to become big. SEBI defines companies ranked 101st to 250th companies by market capitalization as midcap companies. As per SEBI?s, mandate midcap funds should invest minimum 65% of their assets in midcap companies. The balance 35% in midcap funds can be invested in large cap, small cap or other asset classes.

Mid-sized companies like these can offer more growth potential than larger companies but at lower risk levels than smaller-sized companies. Midcap companies can be market leaders in certain industry sectors or sub-sectors / niches. They can also be challengers to large caps in certain sectors. These businesses tend to be less capital intensive, more nimble and innovative than large caps. At the same time, they tend to be more stable than small caps due to their size and balance sheet strengths.

Mid-sized companies are often under-researched compared to large caps, leading to more inefficiency in price discovery.. This provides opportunities to fund managers of identifying stocks that are trading at significant discounts to their fair values and benefits of valuation re-rating in the future. This can create significant alphas for investors.

From a risk / return perspective, midcap funds are somewhere between large caps and small caps. They offer greater growth potential than large caps and are less volatile than small caps.

Long term investors & are willing to remain invested for at least 5 years.

SIP investors who are disciplined to continue SIP for longer tenure.

Investors who are prepared for higher volatility in the quest for higher returns.

Experienced investors who can take advantage for market corrections as good opportunities to invest more.

Investors can tactically allocate 10-15% or even higher of their overall portfolio to midcap funds depending on their risk appetite.

It's important for investors to understand the associated risks, and align their investment goals with the risk / return characteristics of mid-cap funds.

When investors redeem their mid-cap fund units, they may incur capital gains or losses. There are two types of capital gains: short-term and long-term depending on the investment holding period.

Short-term capital gains: If the holding period of mid-cap fund units is less than 1 year, gains (if any) are considered to be short-term capital gains. Short-term capital gains in equity funds are taxed at 15%.

Long-term capital gains in excess of Rs 1 lakh in a financial year are taxed at 10%.

Income Distribution cum capital withdrawals (IDCW) or dividends are taxed as per the income tax rate of the investor.

Click on the green INVEST button on the left-hand side of the webpage (Click here). If you are an existing DSP Mutual Fund, you can start investing straight away. If you are new to DSP Mutual Funds, you will have to create a portfolio by filling out the necessary details. If you are new to Mutual Funds, you will have to fulfil KYC requirements. Follow the on-screen instructions to get started. You can also invest in DSP Midcap Fund through your mutual fund distributor.

The recommended duration for staying invested in DSP mid-cap mutual funds is typically around five years or longer. This time frame allows you to capitalize on the growth potential and / or valuation re-rating of mid-sized companies while mitigating the impact of short-term market fluctuations. However, the ideal holding period can vary based on individual financial goals and risk tolerance. Patience is paramount, as mid-cap stocks may require time to realize their growth potential. Over longer investment tenures investors can benefit from the power of compounding. Investors should be prepared for market volatility and maintain a goal-oriented approach throughout their investment journey.

Midcap funds invest minimum 65% of their assets in 101st to 250th companies by market capitalization segments across industry sectors. Different midcap funds have different investment styles and strategies. DSP Midcap Fund uses bottom up approach to select stocks focusing on High ROE and earnings growth. The fund tends to avoid companies with corporate governance issues, capital misallocation, are sensitive to changing regulations, in highly cyclical industries, with red flags in related party transactions and with complex organizational structures. In addition to quantitative factors, DSP Midcap Fund uses the following qualitative factors to select stocks:-

Mid-cap funds generally have a higher level of risk compared to large-cap funds. The risk stems from the fact that mid-sized companies, while often having significant growth potential, may also be more vulnerable to economic downturns due to their smaller size. Furthermore, the valuations of midcap companies tend to run up faster than large caps, and hence they can experience deeper price corrections in volatile markets. Investors considering mid-cap mutual funds should carefully assess their risk tolerance, investment goals, and time horizon to make informed investment decisions.

Returns from mid-cap investments can vary widely and are influenced by market conditions, economic factors, the investment strategy of the fund manager and the investment horizon. Mid-cap stocks generally offer the potential for higher returns compared to large caps due to their growth prospects, but they also come with increased volatility and risk, in other words, they may underperform in the short term. Therefore, investors should have longer investment horizons in midcap fund compared to large cap funds.

Investors can check the past performance of DSP Midcap Fund by clicking on the performance section. One can check both lump sum and SIP returns. We have shown how DSP Midcap Fund has performed versus its benchmark index (Nifty Midcap 150 TRI) and its additional benchmark (Nifty 50 TRI) over last 1, 3, 5 years and since inception. One should always evaluate an equity fund?s performance over long investment periods.

Investors can invest in the DSP Midcap fund if they:

8.58 lakh peoplehave invested in this fund as of