81.74K people have invested in this fund

81.74K people have invested

in this fund as of

Total AUM

₹2,602.2 crores

as of Jan 31, 2026

Age of Fund

7 years 1 month since Jan 09, 2019

Expense Ratio

0.12%

as of Feb 23, 2026

Exit Load

Nil

Ideal holding period

3 Days+

| Credit rating profile | Weight % |

|---|---|

| SOVEREIGN | 4.2 % |

| A1+ | 28.8 % |

| Cash & Equivalent | 67.0 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 68.1 % |

| Money market instruments | 33.0 % |

| Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 68.1 % |

| Hero Fincorp Limited | 9.6 % |

| Motilal Oswal Financial Services Limited | 7.7 % |

| Union Bank of India | 3.8 % |

| Credila Financial Services Private Limited | 3.8 % |

| Indian Bank | 3.8 % |

| 364 DAYS T-BILL 2026 | 1.7 % |

| 364 DAYS T-BILL 2026 | 1.3 % |

| 182 DAYS T-BILL 2026 | 1.2 % |

| Cash & cash equivalents | -1.1 % |

| 100.0 % |

Yield to Maturity

5.45 %

Modified Duration

0.00 Years

Portfolio Macaulay Duration

0.00 Years

Average Maturity

0.01 Years

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returnsas of with investment of₹10,000

| This fund | CRISIL Liquid Overnight Index ^ | CRISIL 1 Year T-Bill I… # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Date of allotment: Jan 09, 2019.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Karan Mundhra

Shalini Vasanta

Shantanu Godambe

The primary objective of the scheme is to seek to generate returns commensurate with low risk and providing high level of liquidity, through investments made primarily in overnight securities having maturity of 1 business day.

There is no assurance that the investment objective of the Scheme will be realized.

An Open Ended Debt Scheme Investing in Overnight Securities.

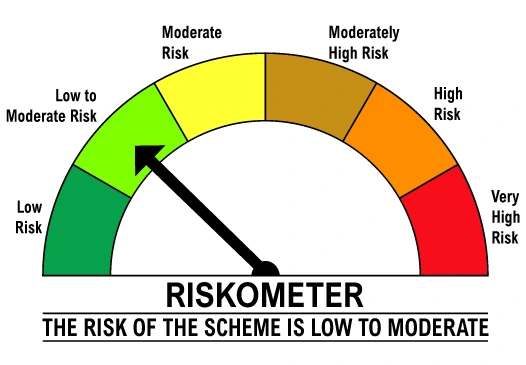

A relatively low interest rate risk and relatively low credit risk.

Level of Risk in the fund

Potential Risk Class Matrix : A-I

A-I is the potential risk class matrix of DSP Overnight Fund based on interest rate & credit risk.

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| Not Applicable | Long term | Not Applicable |

| Not Applicable | Short term | Applicable Rate |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Transaction timelines

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Previous day's NAV (if money is received before cut-off) | 1:30 PM (business days) | Units added to your folio on T+1 days (if money is received before cut-off). |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 7:00 PM (business days) | Redemption processed on T+1 business days. Money credited to your bank account by T+1 business days. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 7:00 PM (business days) | Switch-out processed on T+1 business days |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NAV of this scheme | 1:30 PM (business days) | Units added on T+1 business days after the switch-out from the source scheme. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NA | NA | Money credited instantly. |

81.74K peoplehave invested in this fund as of