28.39K people have invested in this fund

28.39K people have invested

in this fund as of

Total AUM

₹6,662.57 crores

as of Nov 30, 2025

Age of Fund

7 years 11 months since Jan 25, 2018

Expense Ratio

1.0%

as of Dec 29, 2025

Exit Load

Nil - If the units …Ideal holding period

6 months+

| Credit rating profile | Weight % |

|---|---|

| SOV | 0.4 % |

| AAA | 7.8 % |

| AA+ | 1.6 % |

| A1+ | 8.0 % |

| Cash & Equivalent | 1.1 % |

| Instrument break-up | Weight % |

|---|---|

| Bonds & NCDs | 9.4 % |

| Mutual-funds | 9.4 % |

| Money market instruments | 8.4 % |

| TREPS | 1.4 % |

| Holdings | Weight % |

|---|---|

| DSP Savings Fund - Direct Plan - Growth | 9.4 % |

| National Bank for Agriculture and Rural Development | 1.6 % |

| TREPS / Reverse Repo Investments | 1.4 % |

| Bajaj Housing Finance Limited | 1.2 % |

| Small Industries Development Bank of India | 1.1 % |

| National Bank for Agriculture and Rural Development | 0.8 % |

| Mahindra & Mahindra Financial Services Limited | 0.8 % |

| Cholamandalam Investment and Finance Company Limited | 0.8 % |

| REC Limited | 0.8 % |

| Cholamandalam Investment and Finance Company Limited | 0.8 % |

| View All Holdings | 18.6 % |

| Holdings | Weight % |

|---|---|

| Arbitrage Holdings | 71.8 % |

Yield to Maturity

6.38 %

Modified Duration

0.54 Years

Portfolio Macaulay Duration

0.57 Years

Average Maturity

0.58 Years

Portfolio turnover ratio

10.53 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | NIFTY 50 Arbitrage Index ^ | CRISIL 1 Year T-Bill I… # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Jan 25, 2018.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Kaivalya Nadkarni

Karan Mundhra

The investment objective of the Scheme is to generate income through arbitrage opportunities between cash and derivative market and arbitrage opportunities within the derivative market. Investments may also be made in debt & money market instruments.

There is no assurance that the investment objective of the scheme will be realized.

An open ended scheme investing in arbitrage opportunities

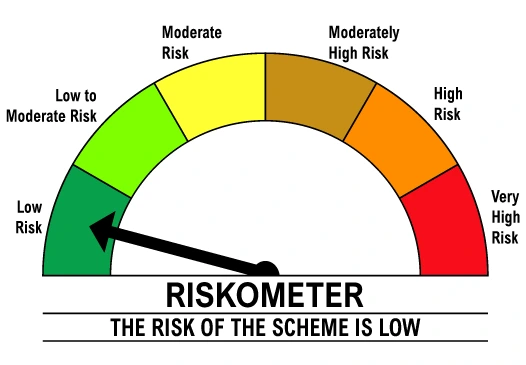

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund’s taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Arbitrage funds are suitable for parking your idle funds for short or medium investment tenures at low risk for tax efficient returns. To invest in the DSP Arbitrage Fund, Click on the green INVEST button on the left-hand side of the webpage (Click here). If you are an existing DSP Mutual Fund investor, you can start investing immediately. If you are new to DSP Mutual Funds, you will have to create a portfolio by filling out the necessary details. If you are new to Mutual Funds, you will have to fulfill KYC requirements. Follow the on-screen instructions to get started. You can also invest in DSP Arbitrage Fund through your mutual fund distributor.

The average return of arbitrage funds depends on market conditions, market volatility and futures premium. Returns of arbitrage funds usually are related to short term interest rates in the economy. Investors can check the past performance of the DSP Arbitrage Fund by clicking on the (performance) section of the DSP website. One can check both lump sum and SIP returns. We have shown how the DSP Arbitrage Fund has performed versus its benchmark index (NIFTY 50 Arbitrage Index) and its additional benchmark (CRISIL 1 Year T-bill Index) over the last 1, 3, and 5 years and since its inception.

- Short-term capital gains: If the holding period of arbitrage fund units is less than 1 year, gains (if any) are considered to be short-term capital gains. Short-term capital gains in equity funds are taxed at 20%.

- Long-term capital gains: If the holding period of arbitrage fund units is more than 1 year, gains (if any) are considered to be long-term capital gains. Long-term capital gains in excess of Rs 1.25 lakh in a financial year are taxed at 12.5%. Income Distribution cum capital withdrawals (IDCW) or dividends from arbitrage funds are taxed as per the income tax rate of the investor. Income Distribution cum capital withdrawals (IDCW) or dividends from arbitrage funds are taxed as per the income tax rate of the investor.

Arbitrage funds have low risk. It is suitable for parking your idle funds for few months to a year or longer. However, there is no guarantee of capital safety or assured returns in arbitrage funds. Investors should know that arbitrage returns depends on market conditions and market volatility. In extreme market conditions, arbitrage spreads can turn negative and these funds can give negative/low returns in the short term. Therefore, investors should be prepared to remain invested to minimum 3 ? 4 months.

The recommended duration for staying invested in the DSP Arbitrage fund is typically around 6 months to 2 years. This time frame aligns with the short to medium-term nature of these funds, which aim to capitalize on short-term market inefficiencies. Arbitrage funds are suitable for parking your short to medium funds to get tax efficient returns with minimal risk.

Arbitrage funds invest at least 65% of their assets in equity and equity related securities. The balance portion of the assets under management is invested in debt and money market instruments. In the equity portion of the portfolio, positions are taken only in stocks which are part of the Futures and Options (F&O) segment because the equity portion is fully hedged through futures. Hedging implies taking opposite positions in the same underlying assets. For example, if you buy shares worth Rs 1 crore in Stock A, you will sell futures of Stock A worth Rs 1 crores to create a fully hedged position. DSP Arbitrage Funds consider the following factors for selecting securities for the fully hedged equity part of the fund portfolio:-

For the debt portion of the portfolio the fund invests in debt mutual fund units, G-Secs / T-Bills, and debt and money market instruments of up to 1 year maturity and of highest credit quality.

Arbitrage funds are not high risk. Arbitrage funds are considered to be low risk funds since arbitrage by definition is risk free profits. However, these funds may be volatile in the short term and may even give negative returns in extreme market conditions.

28.39K peoplehave invested in this fund as of