42.37K people have invested in this fund

42.37K people have invested

in this fund as of

Total AUM

₹1,292.05 crores

as of Dec 31, 2025

Age of Fund

13 years 1 month since Jan 01, 2013

Expense Ratio

0.57%

as of Feb 02, 2026

Exit Load

Nil

Ideal holding period

3 Years+

| Credit rating profile | Weight % |

|---|---|

| SOVEREIGN | 87.0 % |

| Cash & Equivalent | 13.0 % |

| Instrument break-up | Weight % |

|---|---|

| Government Securities (Central/State) | 87.0 % |

| TREPS | 12.6 % |

| Holdings | Weight % |

|---|---|

| 6.90% GOI 2065 | 28.9 % |

| 7.24% GOI 2055 | 20.2 % |

| 6.68% GOI 2040 | 14.8 % |

| TREPS / Reverse Repo Investments | 12.6 % |

| 7.30% GOI 2053 | 11.7 % |

| 7.09% GOI 2054 | 8.6 % |

| 6.80% GOI 2060 | 2.9 % |

| Cash & cash equivalents | 0.4 % |

| 100.0 % |

Yield to Maturity

7.15 %

Modified Duration

9.87 Years

Portfolio Macaulay Duration

10.23 Years

Average Maturity

26.17 Years

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returnsas of with investment of₹10,000

| This fund | Crisil Dynamic Gilt Index ^ | CRISIL 10 Year Gilt In… # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Date of allotment: Jan 01, 2013.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Direct Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Shantanu Godambe

Sandeep Yadav

The primary objective of the Scheme is to generate income through investment in securities issued by Central and/or State Government of various maturities.

There is no assurance that the investment objective of the Schemes will be realized.

An open ended debt scheme investing in government securities across maturity.

A relatively high interest rate risk and relatively low credit risk.

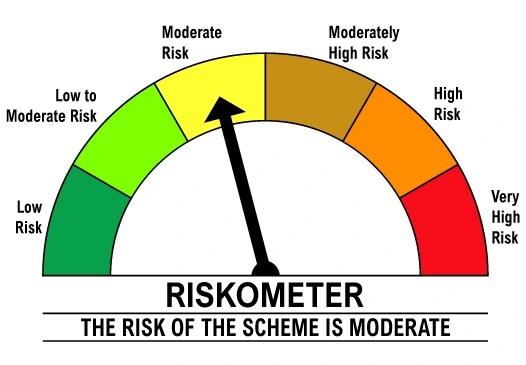

Level of Risk in the fund

Potential Risk Class Matrix : A-III

A-III is the potential risk class matrix of DSP Gilt Fund based on interest rate & credit risk.

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| Not Applicable | Long term | Not Applicable |

| Not Applicable | Short term | Applicable Rate |

Mutual fund taxation is based on the fund’s taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

42.37K peoplehave invested in this fund as of