96.25 lakh people have invested in this fund

Investment in this kind of strategy assumes that you understand downside risks associated with equity investments in the short to medium term. Invest in this solution only if you have the patience to weather the volatility while aiming at creating wealth over long-term

Risk factor:

Very High Risk

50%

Share

Risk factor:

Very High Risk

25%

Share

Risk factor:

Very High Risk

15%

Share

Risk factor:

Very High Risk

10%

Share

Risk

Sudden & unexpected downsides

Goal of Investment

Create wealth over long term

Ideal holding period

Over 5 years

10 years

5 years

3 years

1 year

Rohit Singhania

Nilesh Aiya

Vinit Sambre

Abhishek Ghosh

Shantanu Godambe

Sandeep Yadav

Shalini Vasanta

Karan Mundhra

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Solution Description

Investment in this kind of strategy assumes that you understand downside risks associated with equity investments in the short to medium term. Invest in this solution only if you have the patience to weather the volatility while aiming at creating wealth over long-term

₹ 1,000 Lumpsum

₹ 1,000 SIP - 12 instalments

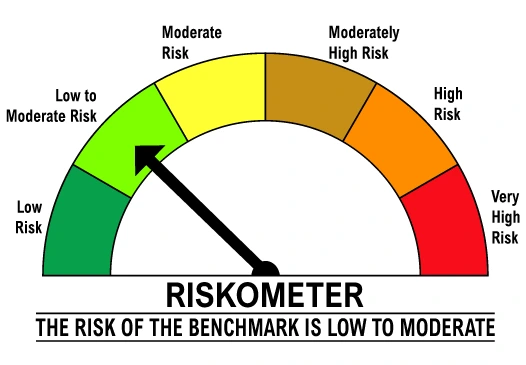

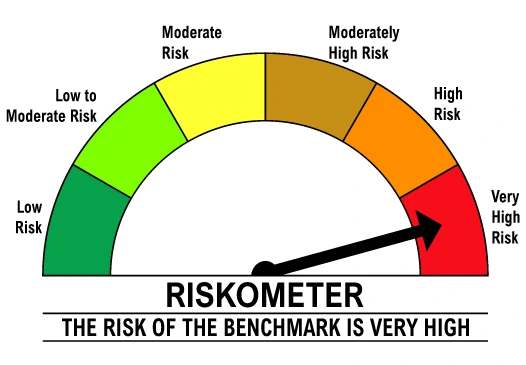

Benchmark of DSP Large & Mid Cap Fund (Ex DSP Equity Opportunities Fund)

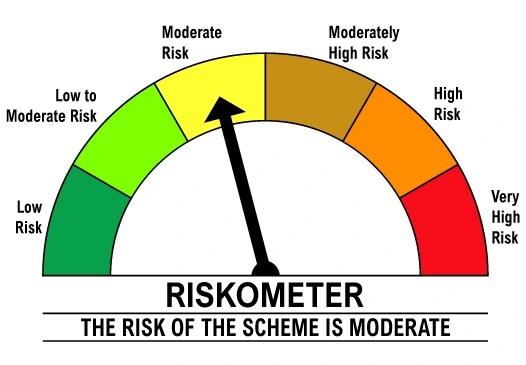

Benchmark of DSP Mid Cap Fund

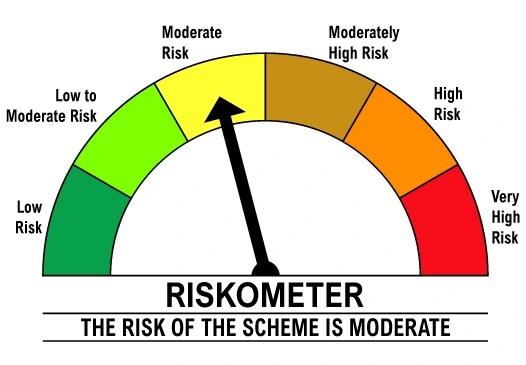

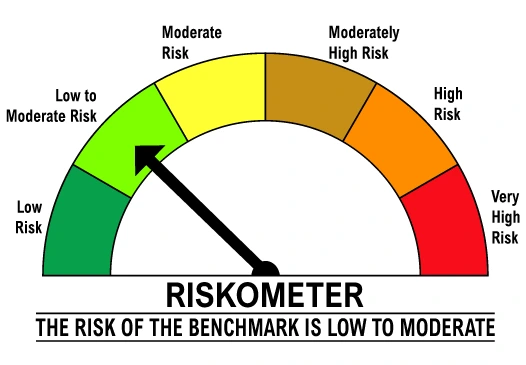

Benchmark of DSP Banking & PSU Debt Fund

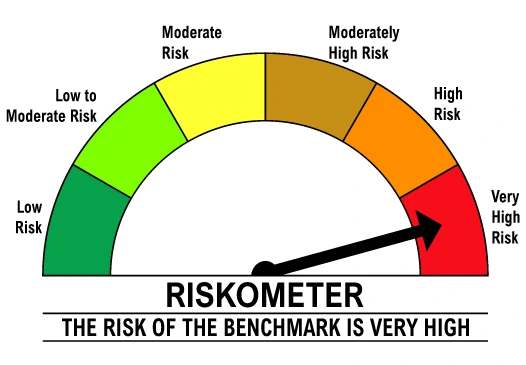

Benchmark of DSP Ultra Short Fund