Total AUM

₹369.02 crores as of Jan 31, 2026

Age of Fund

7 years 11 months since Mar 14, 2018

Expense Ratio

0.3%

as of Feb 26, 2026

Exit Load

Nil

Goal of Investment

Cash Management

Ideal holding period

3 Days+

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 100.0 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 99.5 % |

| Top Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 99.5 % |

| Cash & cash equivalents | 0.6 % |

| 100.0 % |

Debt Index Replication Factor (DIRF)

99.47 %

Tracking Error

0.01 %

Tracking Error (Abs.)

0.001 %

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | NIFTY_1D_Rate_Index ^ | CRISIL 1 Year T-Bill Index # | Tracking difference | ||||

|---|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | ||

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

Date of allotment: Mar 14, 2018.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Standard Benchmark

Anil Ghelani, CFA

Diipesh Shah

The investment objective of the Scheme is to seek to provide current income, commensurate with relatively low risk while providing a high level of liquidity, primarily through a portfolio of Tri Party REPO, Repo in Government Securities, Reverse Repos and similar other overnight instruments.

There is no assurance that the investment objective of the Scheme will be realized.

An open ended scheme investing in Tri Party REPO, Repo in Government Securities, Reverse Repo and similar other overnight instruments.

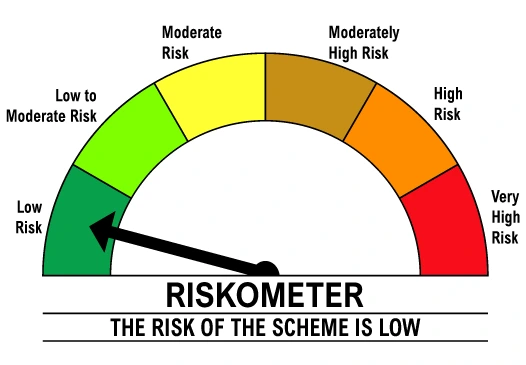

A relatively low interest rate risk and relatively low credit risk.

Level of Risk in the Scheme

Potential Risk Class Matrix : A-I

A-I is the potential risk class matrix of DSP NIFTY 1D Rate Liquid ETF based on interest rate & credit risk.

Other Information

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| Not Applicable | Long term | Not Applicable |

| Not Applicable | Short term | Applicable Rate |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

NSE Disclaimer:

It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE'

BSE Disclaimer:

It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer clause of the BSE Limited