1.99 lakh people have invested in this fund

1.99 lakh people have invested

in this fund as of

Total AUM

₹3,178.53 crores

as of Nov 30, 2025

Age of Fund

7 years 28 days since Nov 30, 2018

Expense Ratio

1.92%

as of Dec 26, 2025

Exit Load

0.5%

If redeemed between 0 - 1 Months

Ideal holding period

10 Years+

| Large Cap | 22.0% |

| Mid Cap | 16.1% |

| Small Cap | 41.7% |

| Holdings | Weight % |

|---|---|

| Sun Pharmaceutical Industries Limited | 8.9 % |

| Cipla Limited | 8.6 % |

| IPCA Laboratories Limited | 7.8 % |

| Laurus Labs Limited | 6.2 % |

| Cohance Lifesciences Limited | 5.3 % |

| Gland Pharma Limited | 5.1 % |

| Sai Life Sciences Limited | 5.0 % |

| Apollo Hospitals Enterprise Limited | 4.5 % |

| Alembic Pharmaceuticals Limited | 4.1 % |

| Pfizer Limited | 3.1 % |

| View All Holdings | 58.5 % |

| Holdings | Weight % |

|---|---|

| Globus Medical Inc | 6.9 % |

| Illumina Inc | 5.9 % |

| Intuitive Surgical Inc | 3.0 % |

| Abbott Laboratories | 1.2 % |

| 0.8 % | |

| Grail Inc | 0.3 % |

| 18.1 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 2.1 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 2.1 % |

| Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 2.1 % |

| Cash & cash equivalents | 0.0 % |

| 2.1 % |

Portfolio turnover ratio

0.08 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | BSE HEALTHCARE (TRI) ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Nov 30, 2018.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Chirag Dagli

The primary investment objective of the scheme is to seek to generate consistent returns by predominantly investing in equity and equity related securities of pharmaceutical and healthcare companies.

There is no assurance that the investment objective of the Scheme will be realized

An open ended equity scheme investing in healthcare and pharmaceutical sector

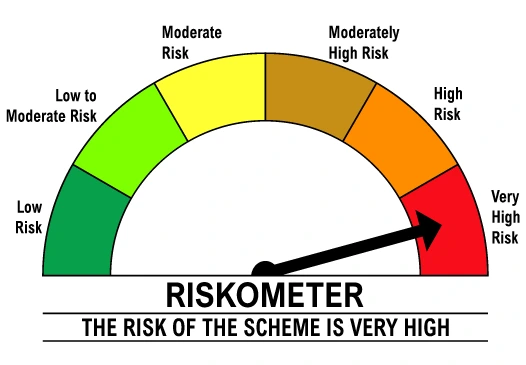

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund’s taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

The DSP Healthcare Fund is a Sectoral/thematic mutual fund scheme that invests in companies within the healthcare theme. This healthcare theme includes industries such as pharmaceuticals, biotechnology, medical devices, healthcare services, and more.. To invest in the DSP Healthcare Fund, Click on the INVEST button on the webpage (Click here). If you are an existing DSP Mutual Fund investor, you can start investing immediately. If you are new to DSP Mutual Fund, you will need to create a portfolio by filling out the necessary details If you are new to mutual funds, you will have to comply with and fulfil the KYC requirements. You can also invest in DSP Healthcare Fund through your mutual fund distributor.

Returns of the DSP Healthcare Fund depend on market conditions, sector performance, the performance of individual companies in the underlying portfolio, the investment horizon, and other factors. Sectors within the healthcare theme, such as pharmaceuticals, are considered conservative. Historical trends from developed markets like the US show that medical costs rise with growth in per capita income (Source: American Medical Association) Since India's per capita income is expected to grow significantly in the coming decades, the long-term outlook for the healthcare theme is promising (Source: Deloitte).

Investors can check the past performance of the DSP Healthcare Fund by clicking on the (performance) section. You can view both lump-sum and SIP returns. We have displayed how the DSP Healthcare Fund has performed versus its benchmark index (BSE Healthcare TRI) and its additional benchmark (NIFTY 50 TRI) over the last 1, 3, and 5 years, as well as since its inception. Equity fund performance should always be evaluated over long investment periods.

The expense ratio is the percentage of the fund's assets used to cover expenses like administration, management, marketing, etc. Essentially, it is a percentage of your investment that goes toward the fund?s operating expenses and management fees. The expense ratio of the DSP Healthcare Fund can be seen on the TER page

Most mutual funds have two plans: direct and regular. In the case of the DSP Healthcare Fund, the expense ratio is higher for its regular plan and lower for its direct plan. Direct plans have a lower expense ratio, whereas regular plans have a higher expense ratio. Regular plans have a higher expense ratio because they are distributed/sold through an intermediary, i.e., a mutual fund distributor. A higher expense ratio for regular plans ensures that the mutual fund distributor also receives compensation for distributing/selling the mutual fund scheme.

Healthcare funds are equity-oriented schemes, and the risk profile of these investments is higher than traditional fixed-income investments; there is no guarantee of capital safety or assured returns in equity funds. Furthermore, being thematic funds, healthcare funds invest in just healthcare sectors and sub industries within the sector compared to diversified equity funds implying higher risk. Investors should consider other risk factors like regulatory risks (both local and foreign), clinical trial risks, geopolitical factors, technological disruptions etc. The healthcare sector is known for stability and resilience of earnings, as demand for healthcare services remains relatively consistent, investors should be aware of the risk factors and make informed investment decisions. Investors are advised to consult their financial advisors or mutual fund distributors to understand whether the DSP Healthcare Fund is suitable for their long-term investment needs.

1.99 lakh peoplehave invested in this fund as of