DSP S&P BSE Liquid Rate ETF

An open-ended scheme replicating/ tracking S&P BSE Liquid Rate Index. A relatively low interest rate risk and relatively low credit risk.

Why consider investing in DSP S&P BSE Liquid Rate ETF?

Easy access to liquid money

If you trade on stock markets actively, DSP S&P BSE Liquid Rate ETF can help you utilize idle money in your broker account efficiently and make you potentially earn higher returns than your savings bank account.

Hassle-free money movement

Investing in DSP S&P BSE Liquid Rate ETF helps you in avoiding extra steps in transactions to move money between your trading & bank account.

Income compounding

You stand a chance to enjoy the benefits of compounded returns since no IDCW is paid out.

No Interest rate & credit risk

It invests in low-risk securities like Tri-Party REPO, Repo in Government Securities, Reverse Repo and similar other overnight instruments.

No hassle of fractional units or small bank transactions

DSP S&P BSE Liquid Rate ETF only has growth option & accordingly there are no fractional units created or payout made due to Income Distribution Cum Capital Withdrawal (IDCW).

Where exactly does it invest?

The DSP S&P BSE Liquid Rate ETF is an open ended scheme replicating/ tracking S&P BSE Liquid Rate Index. A relatively low interest rate risk and relatively low credit risk.

Who should invest?

If you want to park money for a very short period of time & may need to withdraw suddenly.

If you want to avoid cash being flushed out to bank accounts from demat accounts.

If you are a retail trader or an investor.

If you are a Portfolio Management Services (PMS) provider.

If you manage institutional money for a firm which invests directly in equities.

If you want to avoid hassle of calculating return due to IDCW getting credited to demat/bank accounts.

Know this before you invest

This is a debt ETF. While investing in this ETF scheme carries Low Risk, it also means you are likely to earn low returns.

What do you need to invest?

01

A trading account

You need a trading account with a broker/ sub-broker

02

A demat account

You also need a Demat account for holding the ETF units

Frequently asked questions

What is an ETF?

Exchange Traded Funds, or ETFs, are a type of funds/schemes that track an index, sector, commodities or other assets, but which can be purchased or sold on the stock exchange like any regular stock. They combine the features and potential benefits of stocks or bonds and mutual funds. Like individual stocks, ETFs can be traded throughout the day at real time prices that change based on supply and demand.

What are the benefits of an ETF?

- Simplicity - Buying / Selling ETFs is as simple as buying / selling any other stock on the exchange.

- Realtime trading - ETFs allow investors to take benefit of intraday movements in the market, which is not possible with open-ended Funds.

- Low cost - The cost of investing in ETFs is generally lower than an active fund invested in the same market of assets.

- Seamless trading - Existing investors insulated from bearing transaction costs of other investors coming in or going out.

- Transparency - Holdings published daily, so investor always knows exactly what is owned.

Who is the fund manager for the fund?

Mr. Anil Ghelani and Mr. Diipesh Shah will be the fund managers of the Scheme.

Disclaimers

During the NFO period, you can invest as low as Rs. 5,000/- and in multiples of Re.1/-. Note that unit allotment (if you invest during the NFO period) units will be issued at a premium approximately equal to the difference between face value and Allotment Price during the NFO and at NAV based prices on an on-going basis

On Continuous basis –

Directly with Fund:

Large investors can directly purchase/redeem in blocks from the Fund in creation of unit size on any business day however, with effect from May 01, 2023, Large Investors can directly purchase / redeem in blocks from the fund in “Creation unit size” subject to the value of such transaction is greater than threshold of INR 25 Cr. (Twenty-Five crores) and such other threshold as prescribed by SEBI from time to time.

On the Exchange :

The units of the Scheme can be purchased and sold in minimum lot of 1 unit and in multiples thereof.

The comparison with savings account (and other traditional saving instruments) has been given for the purpose of the general information only. Investments in mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike traditional saving instruments, there is no capital protection guarantee or assurance of any return in mutual fund investment. Traditional savings instruments are comparatively low risk products. Investment in mutual funds carries high risk as compared to the traditional saving instruments and any investment decision needs to be taken only after consulting a tax consultant or financial advisor.

There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned Scheme.

| Scheme Name and Type | Product Suitability | Scheme Riskometer | Benchmark^ Riskometer |

|

DSP S&P BSE Liquid Rate ETF: An open ended scheme replicating/tracking S&P BSE Liquid Rate Index. A relatively low interest rate risk and relatively low credit risk. |

This scheme is suitable for investors who are seeking*

* Investors should consult their financial advisers if in doubt about whether the Scheme is suitable for them. |

Scheme Riskometer

|

Benchmark^ Riskometer

|

|

^Benchmark: S&P BSE Liquid Rate Index |

|||

|

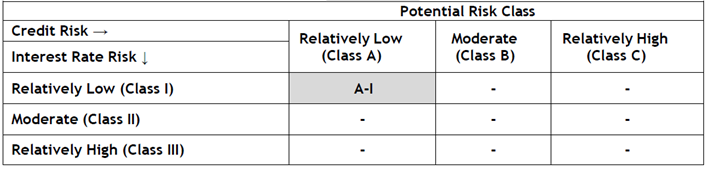

Potential Risk Class Matrix: The potential risk class matrix of DSP S&P BSE Liquid Rate ETF based on interest rate risk and credit risk is as follows:

|

|||

The product labelling assigned during the New Fund Offer (‘NFO’) is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.

For scheme information document, click here.

For index disclaimer, click here.

For product PPT, click here.

BSE Disclaimer

It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer clause of the BSE Limited.

NSE Disclaimer

It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the ‘Disclaimer Clause of NSE’.