A.C.E. PROTECTION

Markets don’t care about your plans in December 2020. But we do. That’s why this fund focuses on safeguarding your capital from downside.

Allocates to protect

6% of scheme allocation gets allocated towards protecting the downside if markets are lower in December 2020# as compared to December 2017.

Coverage through appreciation

If the value of investments in December 2020 is lower than your invested capital, the capital allocated towards protection starts to appreciate and minimizes the loss.

It limits risks, not dreams

With 94% of money invested in stocks, your portfolio doesn’t lose out on the chance to get the returns it deserves.

A.C.E. PROCESS

Where the process comes first, success comes right behind. We follow a scientific process that aims to bring out the best from your investment.

Prosperity with sector diversity

Mirrors the NIFTY 500 index for sector allocation. Aligning to a broad-based market index like NIFTY 500 is aimed to ensure investments get benefit from all economic reforms.

Stocks up potential

With an in-depth, multi-layered process adopted by our 16-member strong analyst team, only the top stocks get recommended by the analysts to the fund manager.

Zero-bias allocation

Your investment is distributed equally in all the top stocks identified within each sector by the analysts. No favoritism.

A.C.E. DISCIPLINE

With protection and process in place, discipline is what helps us get you closer to your goals.

Selected stocks treated equally

The fund rebalances portfolio every quarter, ensuring it books profits in top stocks that have run up and buys more of the top stocks that have corrected.

Our analysts stay alert

Analysts keep track of all the stocks in the portfolio at all times. They appropriately intervene whenever performance indicators change or new stocks enter their list.

NIFTY 500, nothing else

Adheres to sector allocation as per NIFTY 500 index at all times. No deviations. Any change in the sector allocation of NIFTY 500 is reflected in the fund.

So what do you get when you invest?

High conviction multi-cap portfolio

The fund will invest in 45-55 high conviction stocks across market-caps. A close ended fund means you will stay invested till January 2021 and get a chance to reap benefits of compounding.

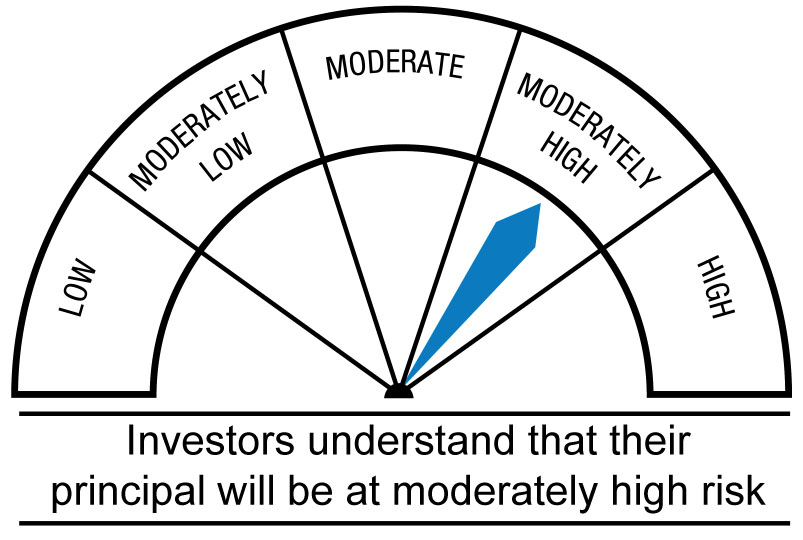

Downside protection with a 3-year lock-in

The 3-year investment horizon for the principal amount allows us to buy protection with an aim to minimize losses in case of a market downturn, if any in December 2020.

True to label process driven investing

Your money is invested and managed with a consistent philosophy. No deviations from the core principles of process, discipline and protection.

DSP BlackRock A.C.E. Fund (Analyst’s Conviction Equalized) Series 1 (Multi Cap Fund - A close ended equity scheme investing across large cap, mid cap and small cap stocks)

- Capital appreciation with a long term investment horizon

- Investing predominantly in equity & equity related securities